- Australia

- /

- Commercial Services

- /

- ASX:CWY

What Cleanaway Waste Management Limited's (ASX:CWY) P/S Is Not Telling You

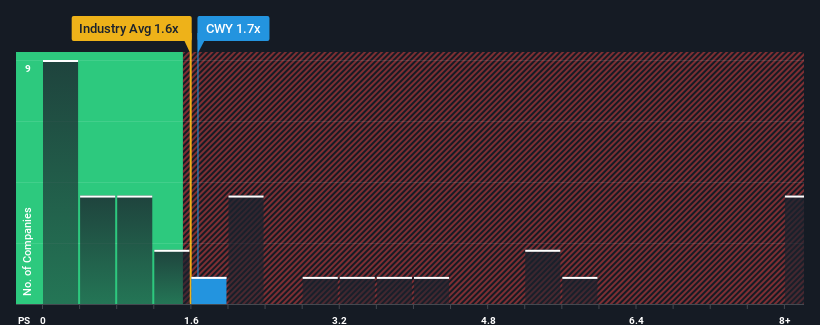

It's not a stretch to say that Cleanaway Waste Management Limited's (ASX:CWY) price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" for companies in the Commercial Services industry in Australia, where the median P/S ratio is around 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Cleanaway Waste Management

How Has Cleanaway Waste Management Performed Recently?

Recent times have been advantageous for Cleanaway Waste Management as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cleanaway Waste Management will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Cleanaway Waste Management would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Pleasingly, revenue has also lifted 53% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.0% per annum during the coming three years according to the twelve analysts following the company. That's shaping up to be materially lower than the 8.9% per year growth forecast for the broader industry.

With this information, we find it interesting that Cleanaway Waste Management is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Cleanaway Waste Management's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Cleanaway Waste Management, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CWY

Cleanaway Waste Management

Provides waste management, industrial, and environmental services in Australia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives