- Australia

- /

- Commercial Services

- /

- ASX:CDD

Cardno (ASX:CDD) shareholder returns have been solid, earning 236% in 5 years

This week we saw the Cardno Limited (ASX:CDD) share price climb by 10%. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Cardno

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that Cardno has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 8.0% per year is viewed as evidence that Cardno is shrinking. This has probably encouraged some shareholders to sell down the stock.

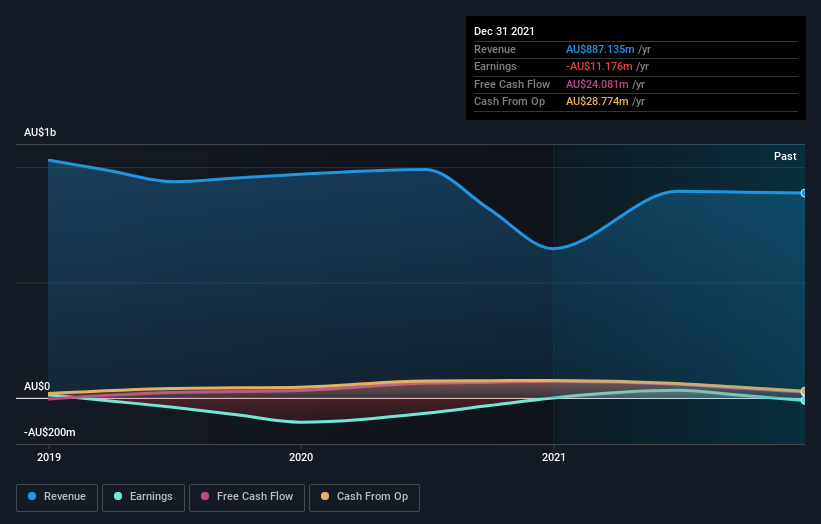

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Cardno's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Cardno's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Cardno shareholders, and that cash payout contributed to why its TSR of 236%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Cardno shareholders have received a total shareholder return of 224% over the last year. That's better than the annualised return of 27% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Cardno you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CDD

Cardno

A professional environmental services company, engages in the development and improvement of social infrastructure for communities in Ecuador and Peru.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives