- Australia

- /

- Professional Services

- /

- ASX:C79

ASX Growth Stocks With High Insider Confidence

Reviewed by Simply Wall St

In the midst of a mixed performance on the ASX, with investors awaiting crucial CPI data and geopolitical developments, attention is drawn to growth companies that demonstrate resilience through high insider ownership. In volatile market conditions, such as those highlighted by recent sector fluctuations and geopolitical uncertainties, stocks with significant insider confidence can indicate strong internal belief in a company's potential for sustained growth.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 89.9% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 96.3% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

Underneath we present a selection of stocks filtered out by our screen.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technologies across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of A$953.70 million.

Operations: Chrysos Corporation Limited generates revenue primarily through its mining services segment, amounting to A$66.11 million.

Insider Ownership: 15%

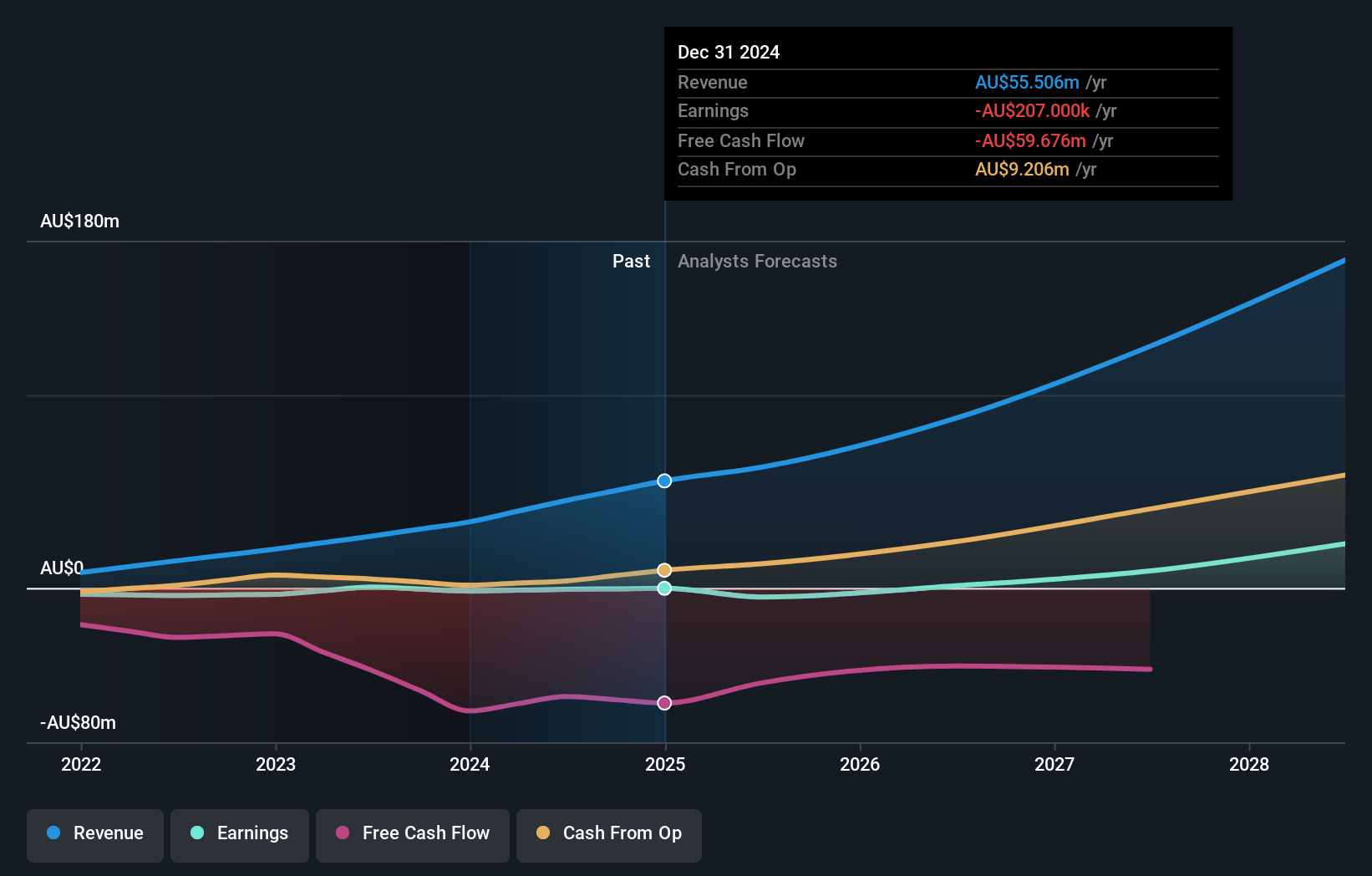

Chrysos is poised for significant growth, with revenue forecasted to increase by 26.4% annually, outpacing the Australian market. Despite a current net loss of A$8.22 million for 2025, insider buying indicates confidence in future profitability within three years. Recent board appointment of Ms. Elisha Civil enhances financial governance as the company expands globally with its PhotonAssay technology. Revenue guidance for 2026 suggests a substantial increase to A$80-90 million, reflecting strong growth potential amidst high insider ownership dynamics.

- Get an in-depth perspective on Chrysos' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Chrysos' current price could be inflated.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various regions including Australia, Asia, the Americas, Africa, and Europe, with a market cap of A$1.08 billion.

Operations: The company's revenue is derived from its Advisory segment, generating A$24.77 million, and its Software segment, contributing A$73.96 million.

Insider Ownership: 12%

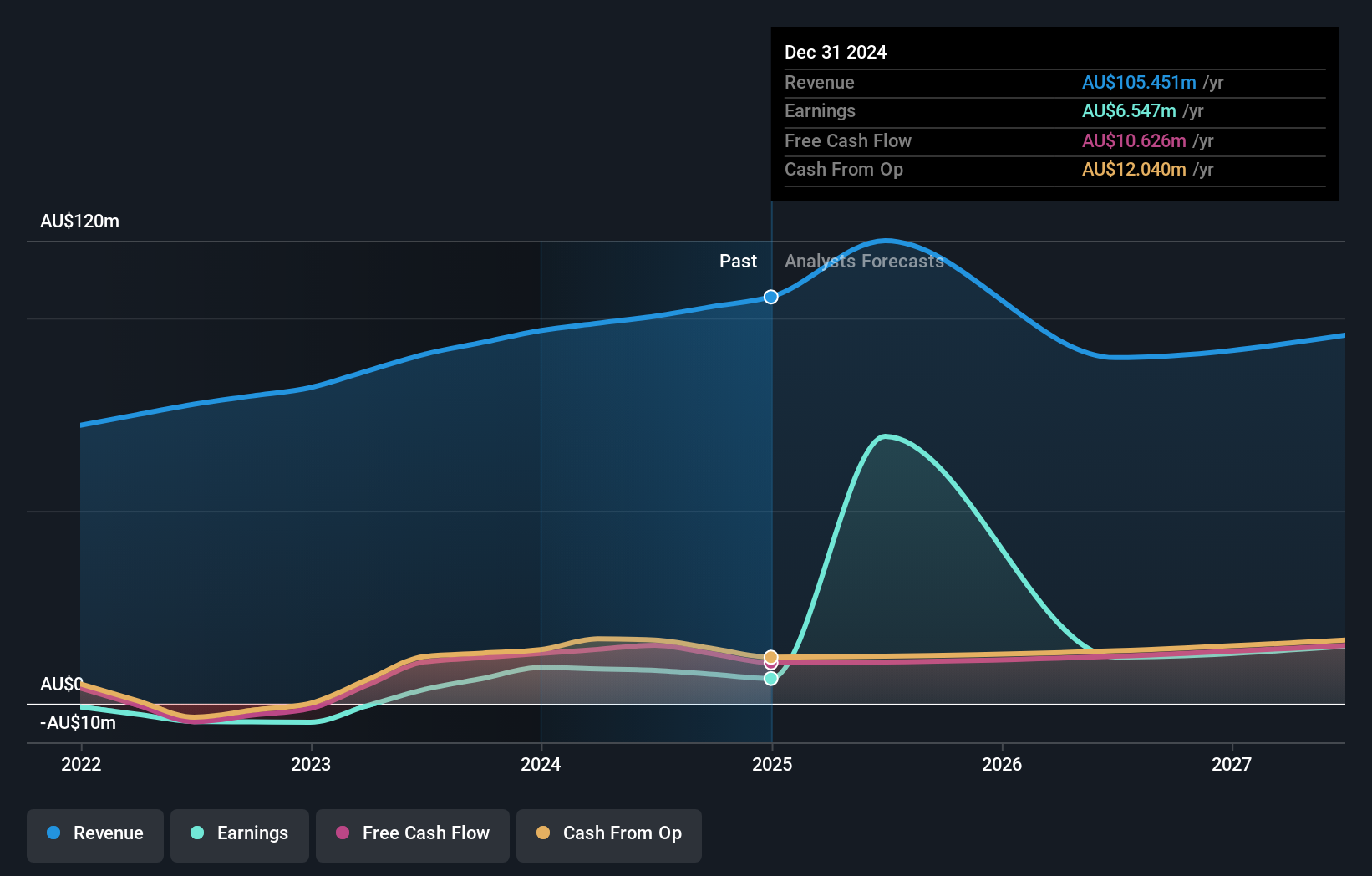

RPMGlobal Holdings is experiencing robust earnings growth, with forecasts predicting a 55.02% annual increase, significantly surpassing the Australian market's average. Despite a recent dip in profit margins to 0.01%, the company's net income for FY2025 surged to A$47.46 million from A$8.66 million previously, showcasing strong financial performance amid high insider ownership dynamics. Additionally, Caterpillar Inc.'s acquisition proposal at A$1.1 billion underscores confidence in RPMGlobal's strategic value and future potential within the industry landscape.

- Click to explore a detailed breakdown of our findings in RPMGlobal Holdings' earnings growth report.

- According our valuation report, there's an indication that RPMGlobal Holdings' share price might be on the expensive side.

Universal Store Holdings (ASX:UNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Universal Store Holdings Limited operates in the retail sector, focusing on fashion in Australia, with a market capitalization of A$698.16 million.

Operations: The company's revenue is primarily derived from its US & PS segment, contributing A$306.41 million, followed by the CTC segment with A$40.06 million.

Insider Ownership: 12.7%

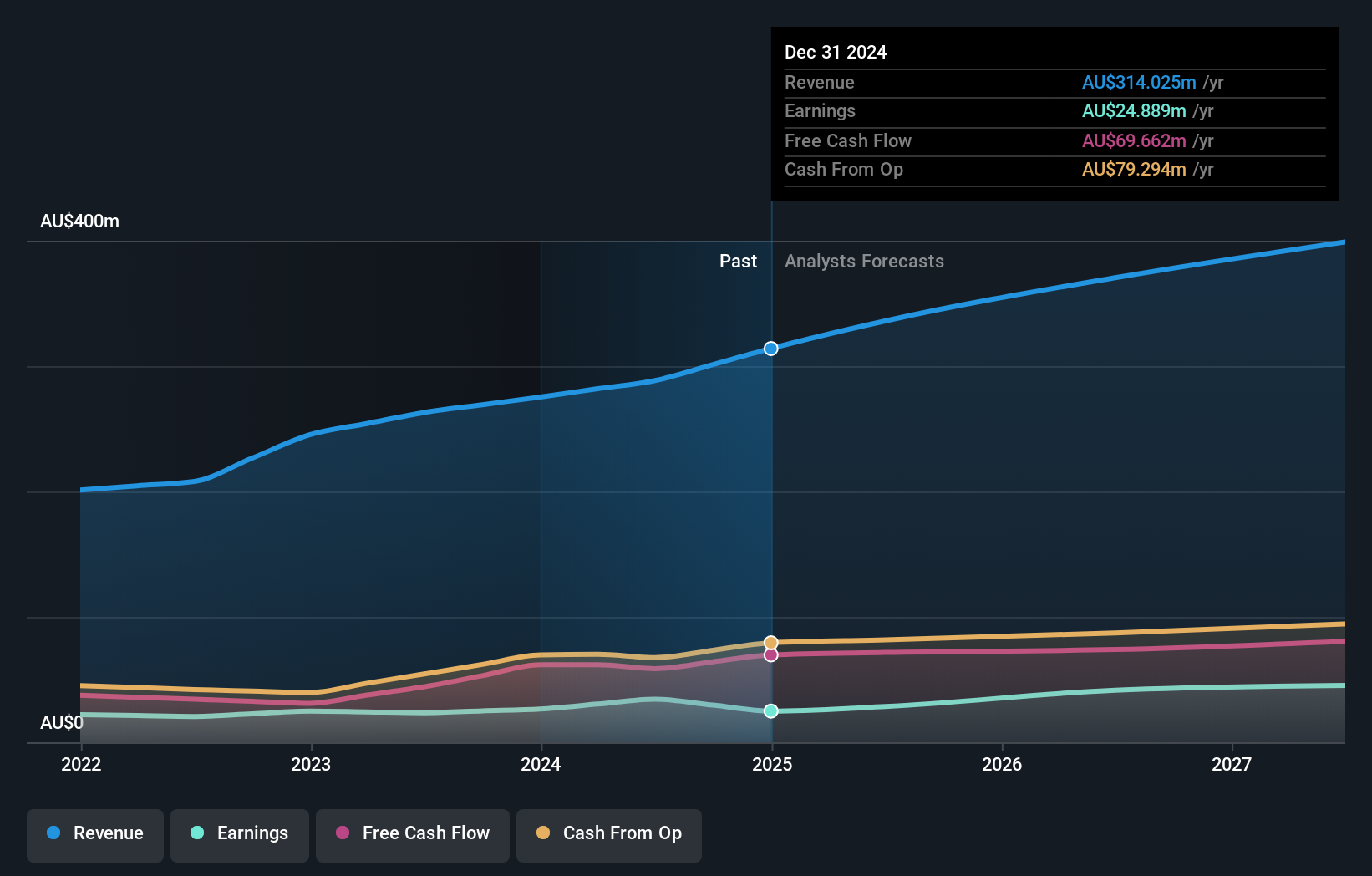

Universal Store Holdings has seen its sales grow to A$333.27 million, up from A$288.52 million, despite a decrease in net income to A$23.26 million. Earnings are forecasted to grow at 16.34% annually, outpacing the Australian market's average growth rate of 14.3%. Insider activity shows more shares bought than sold recently, indicating confidence in the company’s future prospects as it expands with plans for new store openings and recent additions to major stock indices.

- Take a closer look at Universal Store Holdings' potential here in our earnings growth report.

- Our valuation report unveils the possibility Universal Store Holdings' shares may be trading at a premium.

Next Steps

- Click through to start exploring the rest of the 93 Fast Growing ASX Companies With High Insider Ownership now.

- Curious About Other Options? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

Chrysos

Engages in the development and supply of mining technologies in Europe, the Middle east, Africa, the Asia pacific, and the Americas.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives