- Australia

- /

- Commercial Services

- /

- ASX:BXB

Brambles’ Rising ROCE and Push for Employee Ownership Could Be a Game Changer for ASX:BXB

Reviewed by Sasha Jovanovic

- Earlier this week, Brambles reported that its return on capital employed (ROCE) has risen to 19%, considerably exceeding the Commercial Services industry average of 12%. The company also introduced a new ASX quotation to encourage greater employee ownership through its incentive plan, deepening workforce engagement in Brambles' long-term strategy.

- The combination of higher capital reinvestment returns and initiatives targeting employee alignment highlights a dual focus on both operational performance and internal culture, both of which support Brambles' positioning as a sustainable logistics leader.

- We will now explore how Brambles’ accelerating ROCE and employee ownership efforts impact its broader investment narrative and long-term outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Brambles Investment Narrative Recap

To be invested in Brambles, you need to share the belief that advanced supply chain solutions and disciplined capital allocation can deliver sustainable earnings growth, despite variable pallet volumes in key geographies. The recent surge in ROCE and expanded employee ownership are constructive for internal alignment, but do not materially shift the short-term catalyst, which remains the successful scaling of digital asset tracking technologies. The key near-term risk continues to be cost inflation and asset efficiency in the U.S., which could impact margins if not contained.

Among the latest company developments, the board's recent approval of a sizeable share buyback program, targeting up to 10% of issued shares for US$400 million, is most relevant given current investor focus on capital returns and earnings resilience. This capital management initiative sits alongside operational improvements, reinforcing Brambles’ multi-pronged approach to unlock shareholder value as the market weighs the impact of pallet volume uncertainty and cost inflation.

However, despite improved capital returns, investors should also consider the possibility that persistently elevated input costs may still weigh on profit margins if...

Read the full narrative on Brambles (it's free!)

Brambles' outlook anticipates $7.8 billion in revenue and $1.1 billion in earnings by 2028. This represents a 4.5% annual revenue growth rate and a $235.8 million increase in earnings from the current $864.2 million.

Uncover how Brambles' forecasts yield a A$25.07 fair value, in line with its current price.

Exploring Other Perspectives

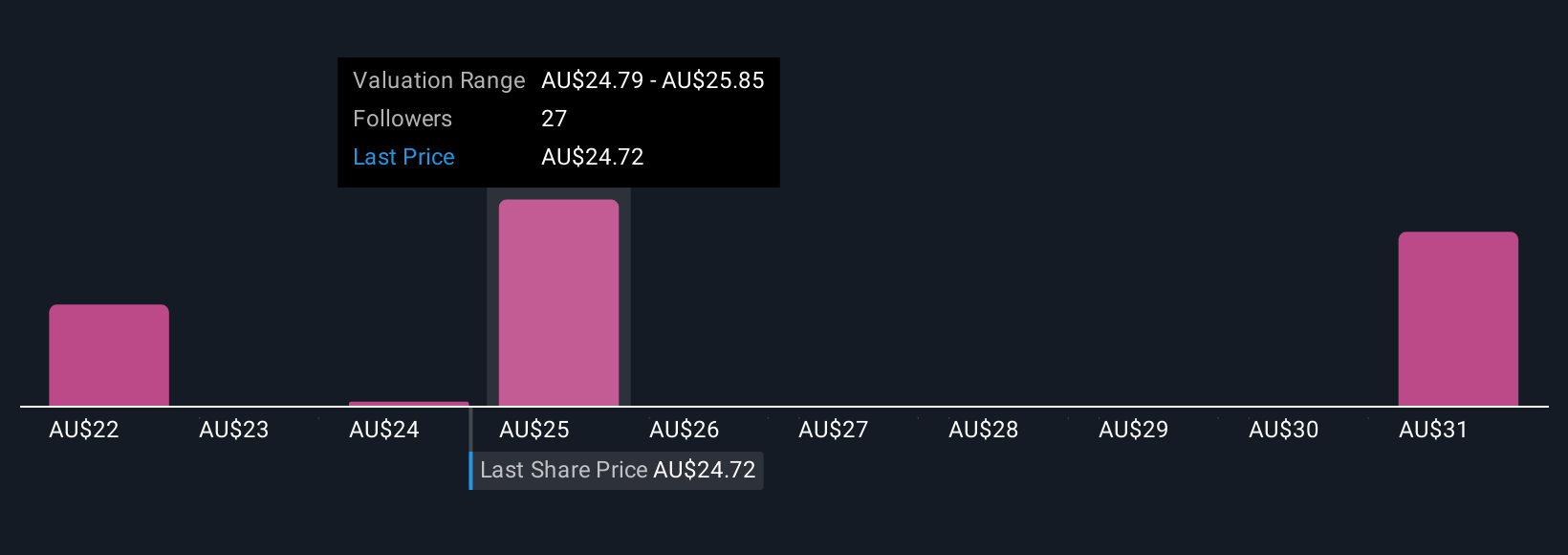

Seven members of the Simply Wall St Community have set fair value estimates for Brambles ranging from A$21.58 to A$32.08 per share. While you weigh these divergent valuations, remember that the company’s ability to offset cost inflation remains a crucial factor for its long-term performance.

Explore 7 other fair value estimates on Brambles - why the stock might be worth 13% less than the current price!

Build Your Own Brambles Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brambles research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brambles research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brambles' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brambles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BXB

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)