- Australia

- /

- Commercial Services

- /

- ASX:BXB

Brambles (ASX:BXB) Valuation in Focus as Returns and Capital Investment Strengthen

Reviewed by Kshitija Bhandaru

Brambles (ASX:BXB) is drawing fresh attention after recent figures showed the company has significantly improved its returns on capital employed, reaching 19%. At the same time, Brambles has increased its overall capital investment by 21% in the past five years.

See our latest analysis for Brambles.

Brambles’ latest moves have not gone unnoticed in the market. The share price has climbed 27.8% year to date, and its stellar one-year total shareholder return of 33% points to strengthening momentum as operational improvements and capital investment translate to investor confidence over both the short and long term.

If you’re keen to see what else is making waves, now is the moment to expand your horizons and discover fast growing stocks with high insider ownership

With such strong fundamentals and momentum, the key question now is whether Brambles' current valuation leaves room for further upside or if the market has already factored in all of the company's future growth prospects.

Most Popular Narrative: 13% Overvalued

Brambles’ narrative fair value of $21.90 sits well below its recent close at $24.82, hinting at a valuation premium. Let’s unpack what’s driving this viewpoint from one of the most followed voices in the community.

“Brambles is a dominant global player in its niche, with scale advantages that are hard to replicate. Its presence in essential industries gives it relatively stable, recession-resistant revenues.”

The most buzzed-about forecast hinges on a bold set of revenue growth and profit margin assumptions. Will the company’s famed stability and market dominance really justify a price this high, or are there surprises in the outlook? Only the full narrative reveals what underpins this valuation call.

Result: Fair Value of $21.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected cost increases or currency swings could quickly undermine growth expectations and challenge the prevailing view of Brambles’ stability.

Find out about the key risks to this Brambles narrative.

Another View: DCF Model Suggests Undervaluation

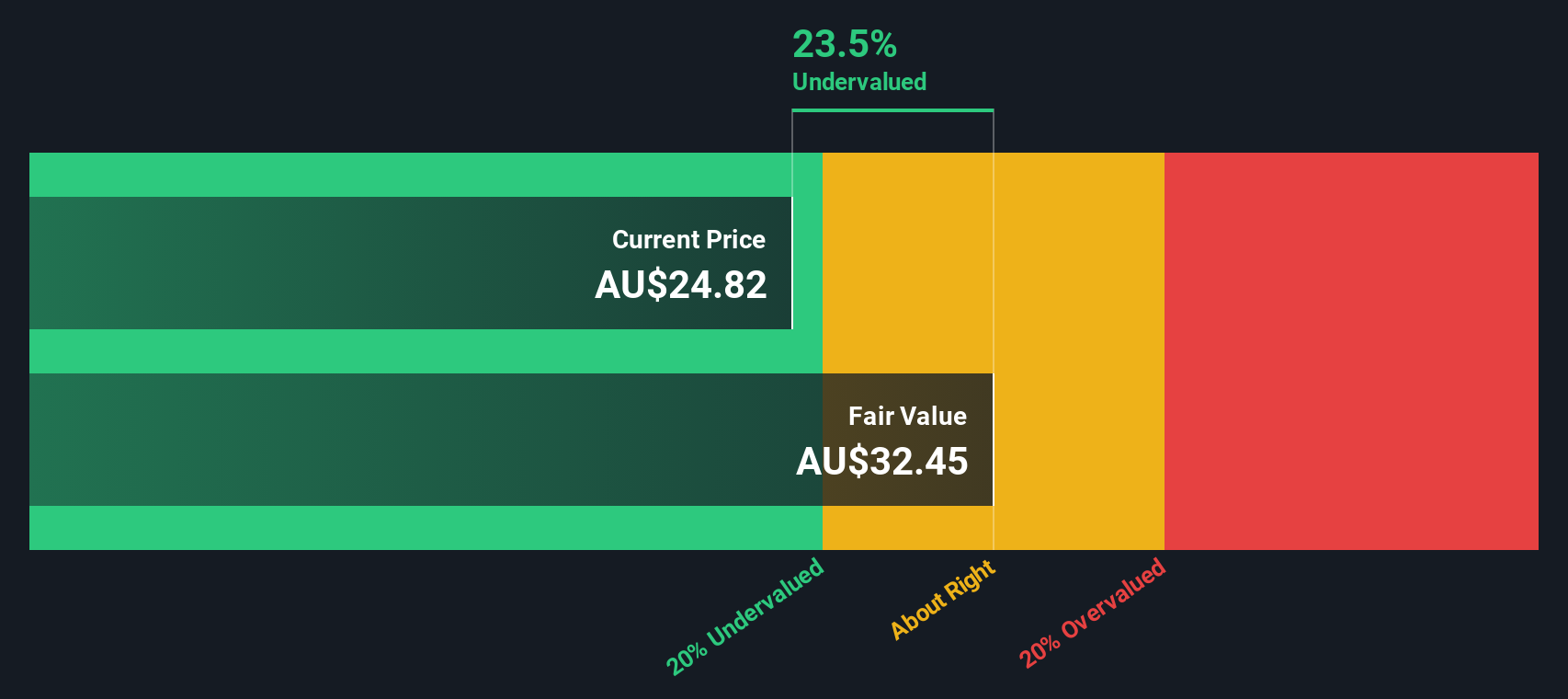

Looking at Brambles from another angle, our DCF model estimates a fair value of A$32 per share. This is about 22% above where the stock is trading now and suggests the market may be underpricing future cash flows. So, is the premium in the narrative-based view missing something in Brambles' fundamentals, or is the DCF being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brambles for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brambles Narrative

If the story so far does not match your view or you would prefer to analyze the numbers yourself, you are free to craft and share your own perspective. It takes less than three minutes. Do it your way

A great starting point for your Brambles research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Put yourself ahead of the curve by tapping into compelling market opportunities. Don't let the next big winner pass you by. See what else is shaping up right now:

- Uncover stocks with robust yields when you check out these 18 dividend stocks with yields > 3%. This resource is ideal for investors seeking steady income and solid fundamentals.

- Position yourself for tomorrow’s breakthroughs by seeing which companies stand out in these 25 AI penny stocks, where artificial intelligence is driving rapid growth.

- Take advantage of potential bargains in the market with these 888 undervalued stocks based on cash flows, featuring companies that show strong fundamentals and room to rise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brambles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BXB

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.