- Australia

- /

- Commercial Services

- /

- ASX:BXB

Brambles (ASX:BXB) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Brambles (ASX:BXB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Brambles

Brambles' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Brambles has grown EPS by 12% per year. That growth rate is fairly good, assuming the company can keep it up.

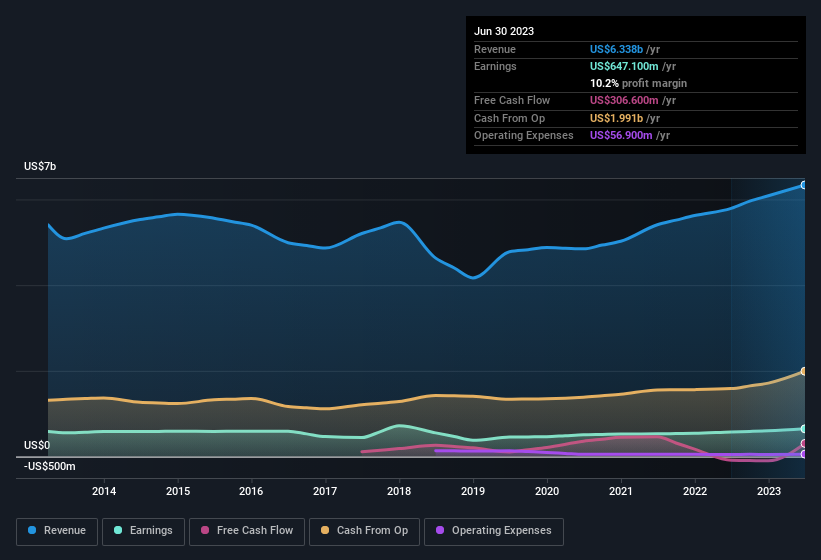

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Brambles' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Brambles achieved similar EBIT margins to last year, revenue grew by a solid 9.4% to US$6.3b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Brambles.

Are Brambles Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Brambles insiders spent US$279k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Independent Non-Executive Chairman John Mullen who made the biggest single purchase, worth AU$150k, paying AU$13.14 per share.

Should You Add Brambles To Your Watchlist?

One positive for Brambles is that it is growing EPS. That's nice to see. It's not easy for business to grow EPS, but Brambles has shown the strengths to do just that. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. You still need to take note of risks, for example - Brambles has 2 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Brambles, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Brambles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BXB

Outstanding track record average dividend payer.