- Australia

- /

- Professional Services

- /

- ASX:ALQ

With EPS Growth And More, ALS (ASX:ALQ) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in ALS (ASX:ALQ). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for ALS

How Fast Is ALS Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that ALS has grown EPS by 53% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

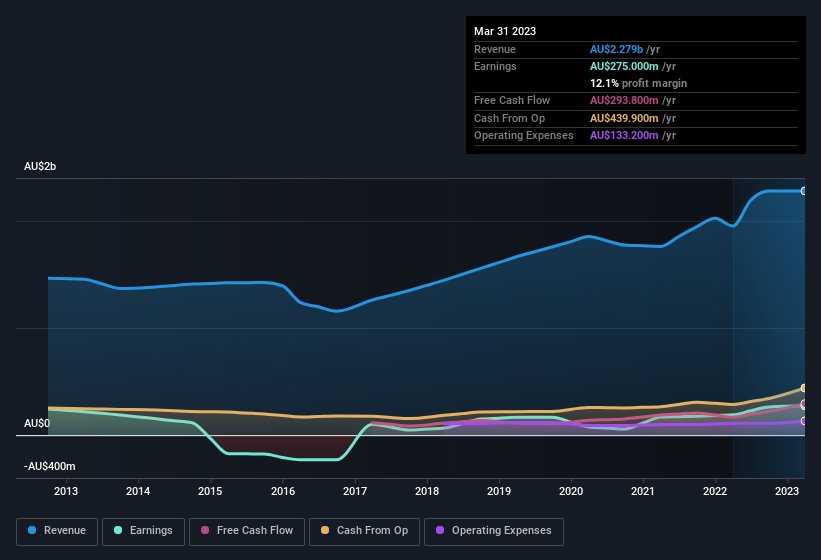

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for ALS remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 17% to AU$2.3b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for ALS?

Are ALS Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see ALS insiders walking the walk, by spending AU$634k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was Independent Chairman Bruce Phillips who made the biggest single purchase, worth AU$584k, paying AU$11.68 per share.

The good news, alongside the insider buying, for ALS bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at AU$104m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Malcolm Deane, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like ALS with market caps between AU$3.1b and AU$10.0b is about AU$3.4m.

The ALS CEO received total compensation of just AU$1.3m in the year to March 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is ALS Worth Keeping An Eye On?

ALS' earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe ALS deserves timely attention. We don't want to rain on the parade too much, but we did also find 2 warning signs for ALS that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of ALS, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ALQ

ALS

Engages in the provision of professional technical services primarily in the areas of testing, measurement, and inspection in Africa, Asia Pacific, Europe, the Middle East, North Africa, and the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives