- Australia

- /

- Construction

- /

- ASX:VNT

Is Ventia’s Debt-Fueled 43% ROE Reshaping the Investment Case for ASX:VNT?

Reviewed by Sasha Jovanovic

- In the past week, Ventia Services Group Limited reported a Return on Equity (ROE) of 43%, significantly exceeding the construction industry average, driven by a debt-to-equity ratio of 1.27 indicating substantial leverage.

- This elevated ROE highlights robust capital management but also raises concerns about increased financial risk if market or operating conditions deteriorate.

- To understand how Ventia's elevated and debt-boosted ROE could affect its risk profile and growth outlook, we’ll examine its investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ventia Services Group Investment Narrative Recap

To be a shareholder in Ventia Services Group, you need to believe that the company’s strong pipeline of long-term government and infrastructure contracts can support sustained cash flow and earnings growth, even as recent news of a 43% ROE, driven by higher leverage, underscores strong returns but magnifies the company’s exposure to financial risk. While the elevated ROE is striking, it does not materially alter the current short-term catalyst, which remains continued contract wins and renewals, nor does it lessen the biggest risk, Ventia’s reliance on government spending and contract retendering, which could affect revenue visibility if policy or budget priorities shift.

Among recent announcements, Ventia’s A$2.7 billion contract packages from the Department of Defence stand out in direct support of its multi-year contracted revenue base. This contract deepens its government relationships and extends Ventia’s order book, reinforcing confidence in work-in-hand as the critical growth catalyst even with the company’s leverage now in sharper focus.

However, in contrast to recent contract wins, investors should not overlook the heightened financial risk from increased debt if...

Read the full narrative on Ventia Services Group (it's free!)

Ventia Services Group's outlook anticipates A$7.2 billion in revenue and A$308.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.7% and an earnings increase of A$55.3 million from current earnings of A$253.3 million.

Uncover how Ventia Services Group's forecasts yield a A$5.40 fair value, in line with its current price.

Exploring Other Perspectives

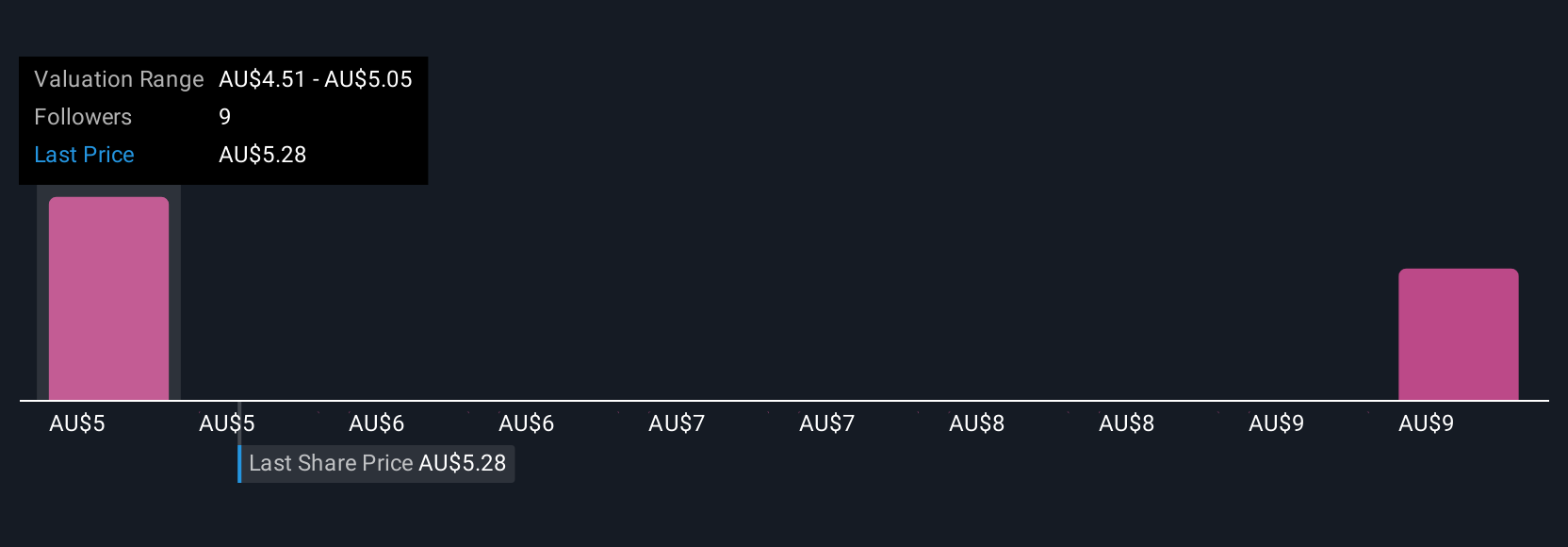

Fair value estimates from the Simply Wall St Community range from A$5.40 to A$8.87 across two different views. While opinions range widely, the recent announcement of an elevated, leverage-driven ROE highlights growing financial risk that readers should factor into their own outlook for Ventia’s future performance.

Explore 2 other fair value estimates on Ventia Services Group - why the stock might be worth just A$5.40!

Build Your Own Ventia Services Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ventia Services Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ventia Services Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ventia Services Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VNT

Ventia Services Group

Provides infrastructure services in Australia and New Zealand.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives