- Australia

- /

- Construction

- /

- ASX:VNT

Earnings Beat and Bigger Buyback Could Be a Game Changer for Ventia Services Group (ASX:VNT)

Reviewed by Simply Wall St

- Ventia Services Group recently completed a repurchase of 19,300,000 shares for A$82.7 million, declared an increased interim dividend, and expanded its equity buyback plan authorization by A$50 million to a total of A$150 million.

- These shareholder-focused initiatives were announced alongside strong half-year earnings, with Ventia reporting higher net income and basic earnings per share compared to the prior year.

- Let's examine how the improved earnings and expanded buyback may reshape Ventia's investment narrative and long-term capital management outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Ventia Services Group Investment Narrative Recap

To be a shareholder in Ventia Services Group, you need to believe in the company's ability to drive consistent earnings growth through its contract portfolio and capital management strategies, despite sector-specific risks such as contract delays and regulatory scrutiny. The expanded buyback program and improved interim earnings provide some support for the company's near-term outlook, but do not materially offset the ongoing impact of Transport segment delays, which remain the most important short-term catalyst and risk.

The recent after-tax profit increase, net income rose to A$134.5 million for the half year, stands out as central to the buyback announcement. This profitability improvement, despite slightly lower sales, is highly relevant for investors watching EPS growth and Ventia’s ability to sustain its capital returns program. Even so, investors should be aware that an ongoing increase in serious injury frequency rate...

Read the full narrative on Ventia Services Group (it's free!)

Ventia Services Group's outlook anticipates revenue of A$7.2 billion and earnings of A$290.0 million by 2028. This projection is based on a 5.5% yearly revenue growth and an earnings increase of A$69.8 million from the current earnings of A$220.2 million.

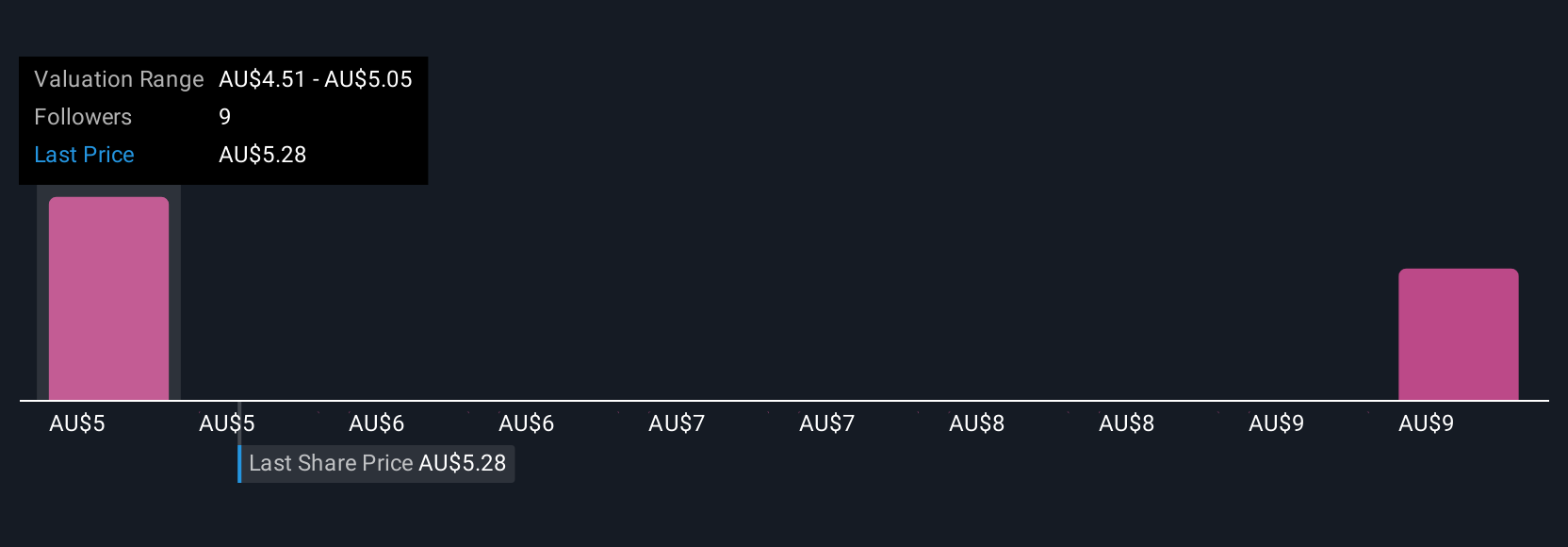

Uncover how Ventia Services Group's forecasts yield a A$5.27 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from A$5.27 to A$7.96, based on two independent views. With investor sentiment divided, the group continues to weigh earnings growth against sector-specific risks like contract delays when assessing Ventia’s long-term potential.

Explore 2 other fair value estimates on Ventia Services Group - why the stock might be worth just A$5.27!

Build Your Own Ventia Services Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ventia Services Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ventia Services Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ventia Services Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VNT

Ventia Services Group

Provides infrastructure services in Australia and New Zealand.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives