- Australia

- /

- Construction

- /

- ASX:VNT

3 ASX Penny Stocks With Market Caps Under A$4B

Reviewed by Simply Wall St

As the ASX 200 prepares to open slightly lower following the holiday break, Australian investors are closely watching market trends influenced by U.S. movements and a post-Christmas spending slowdown. For those looking beyond established giants, penny stocks—often representing smaller or newer companies—continue to offer intriguing possibilities despite being considered an outdated term. These stocks can present growth opportunities at lower price points, particularly when supported by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.36 billion.

Operations: The company's revenue is primarily derived from its Retail segment, generating A$1.27 billion, and its Wholesale segment, contributing A$463.20 million.

Market Cap: A$1.36B

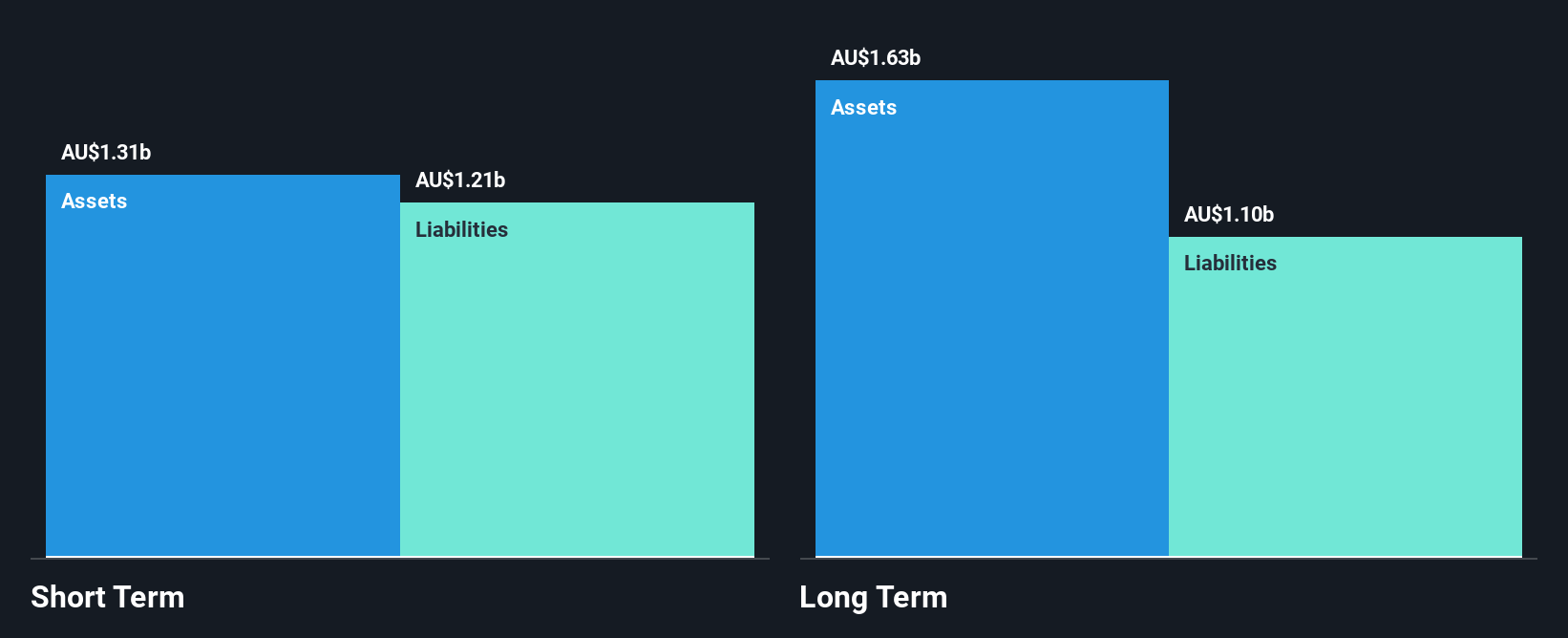

Accent Group's recent board appointments, including Dave Forsey as an Independent Non-Executive Director, bring seasoned retail expertise to the company. Despite a challenging year with negative earnings growth of -32.7%, Accent maintains solid fundamentals; its debt is well covered by operating cash flow, and short-term assets exceed liabilities. However, profit margins have declined from 6.2% to 4.1%, and long-term liabilities remain uncovered by short-term assets. The stock trades significantly below its estimated fair value, presenting potential upside if management can navigate current challenges effectively while leveraging new strategic insights from its refreshed board composition.

- Click here to discover the nuances of Accent Group with our detailed analytical financial health report.

- Understand Accent Group's earnings outlook by examining our growth report.

Southern Cross Gold (ASX:SXG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Gold Ltd is an Australian company focused on the exploration of natural resources, with a market cap of A$694.56 million.

Operations: Southern Cross Gold Ltd has not reported any specific revenue segments.

Market Cap: A$694.56M

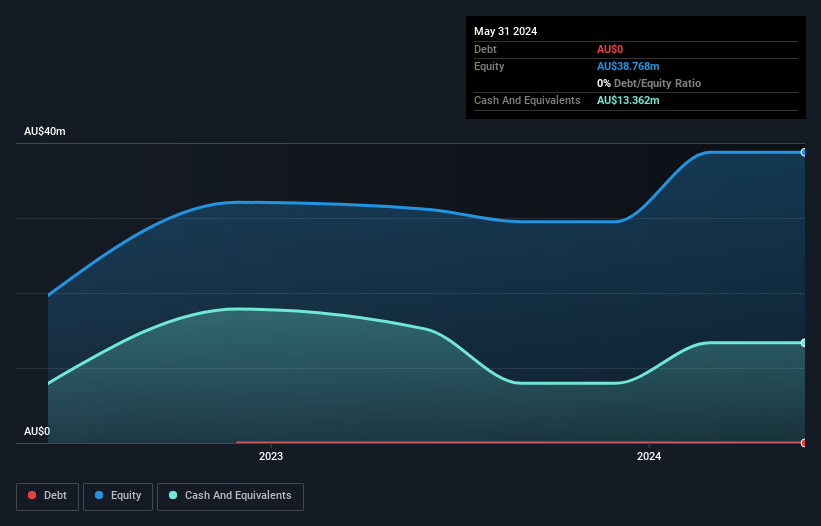

Southern Cross Gold Ltd, with a market cap of A$694.56 million, remains pre-revenue and unprofitable but is debt-free. The company's exploration efforts at the Sunday Creek Gold-Antimony Project in Victoria are yielding promising results, highlighted by recent high-grade gold and antimony discoveries. These findings underline the project's strategic importance amid global supply constraints on antimony, especially following China's export restrictions. Despite shareholder dilution over the past year, Southern Cross's robust cash position supports ongoing exploration activities aimed at expanding mineralization potential. The board's relative inexperience may pose challenges as they navigate these opportunities.

- Unlock comprehensive insights into our analysis of Southern Cross Gold stock in this financial health report.

- Learn about Southern Cross Gold's future growth trajectory here.

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited offers infrastructure services across Australia and New Zealand, with a market capitalization of A$3.11 billion.

Operations: The company generates revenue from four primary segments: Transport (A$657.6 million), Telecommunications (A$1.50 billion), Infrastructure Services (A$1.30 billion), and Defence and Social Infrastructure (A$2.51 billion).

Market Cap: A$3.11B

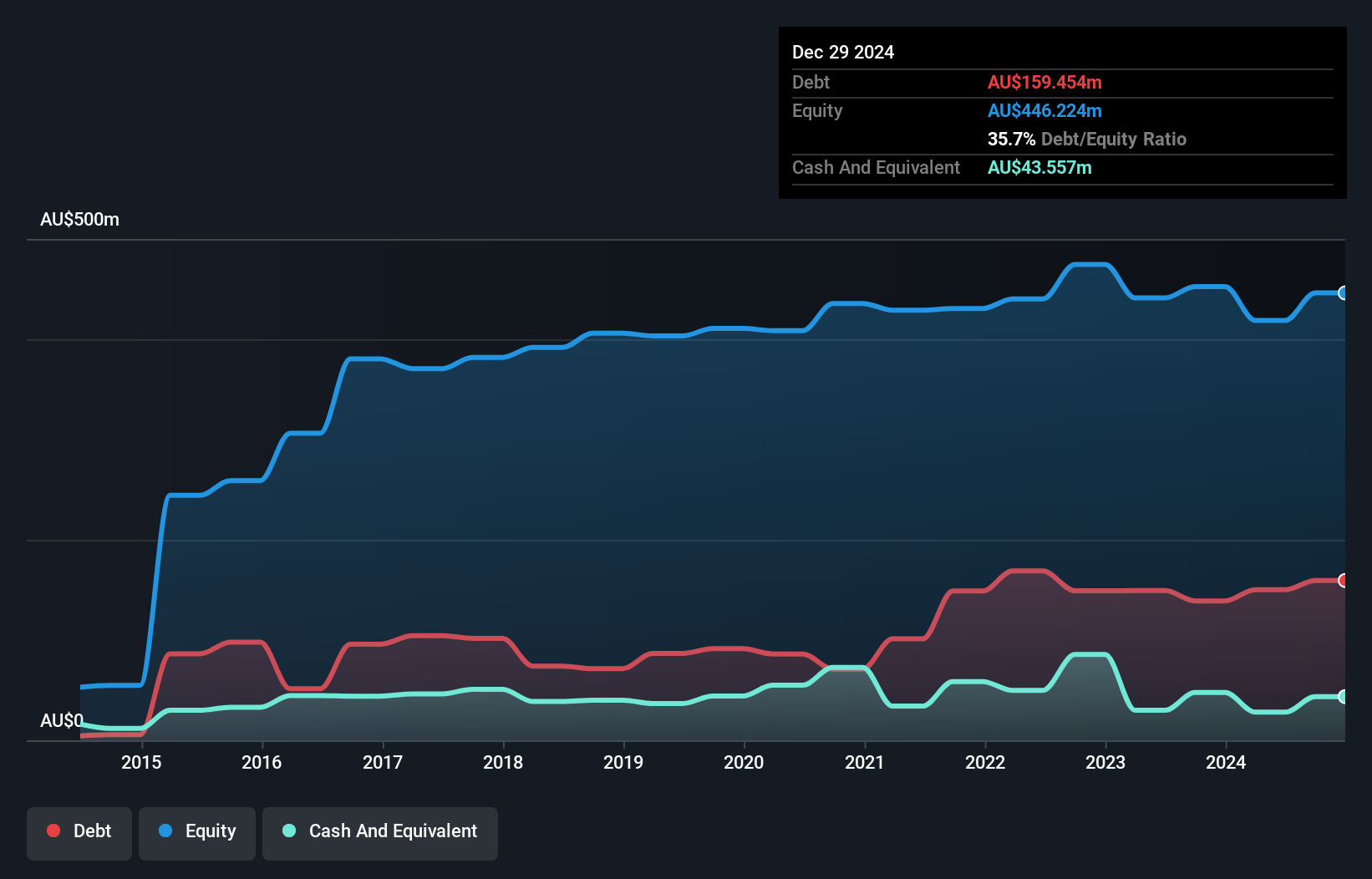

Ventia Services Group, with a market cap of A$3.11 billion, demonstrates financial stability through its short-term assets exceeding both short and long-term liabilities. Despite a high debt-to-equity ratio of 63.8%, the company's interest payments are well covered by EBIT, indicating manageable debt levels. Recent contracts with NBN Co and NSW Public Works bolster revenue prospects, adding A$275 million in value. However, legal challenges from the ACCC could pose risks. While Ventia trades below estimated fair value and shows strong historical earnings growth, its management team is relatively inexperienced which may impact strategic execution moving forward.

- Get an in-depth perspective on Ventia Services Group's performance by reading our balance sheet health report here.

- Assess Ventia Services Group's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1,050 ASX Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VNT

Ventia Services Group

Provides infrastructure services in Australia and New Zealand.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives