- Australia

- /

- Construction

- /

- ASX:SXE

Why Southern Cross Electrical Engineering (ASX:SXE) Is Up 6.0% After Record FY25 Results and Acquisition Update

Reviewed by Sasha Jovanovic

- Southern Cross Electrical Engineering held its Annual General Meeting on October 14, 2025, with all resolutions passed and record FY25 financial results announced, including higher revenue, profitability, and cash balances.

- An important insight from these updates is the company’s ongoing strategy to expand through acquisitions, such as Force Fire, and strengthen its position in key growth sectors like infrastructure and renewables.

- We’ll examine how robust FY25 results and acquisition-driven growth reinforce Southern Cross Electrical Engineering’s investment narrative and future opportunities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Southern Cross Electrical Engineering Investment Narrative Recap

To own shares in Southern Cross Electrical Engineering, you need conviction in its ability to scale through acquisition and sector diversification, especially in renewables and infrastructure. The strong FY25 results and new AGM approvals highlight operational strengths, but these positive signals do not materially alter the most immediate catalyst, continued contract wins in growth sectors, or dampen the key risk from an order book that edged slightly lower year-on-year. Most relevant to the recent AGM is the record FY25 earnings update, which showed substantial revenue and profit growth on the back of completed acquisitions. This illustrates how acquisition-driven expansion remains closely tied to both earnings momentum and future contract opportunities. However, despite these strengths, investors should keep an eye on the declining order book and what it may signal for revenue stability...

Read the full narrative on Southern Cross Electrical Engineering (it's free!)

Southern Cross Electrical Engineering's narrative projects A$977.8 million revenue and A$43.7 million earnings by 2028. This requires 6.9% yearly revenue growth and an increase of A$12 million in earnings from the current A$31.7 million.

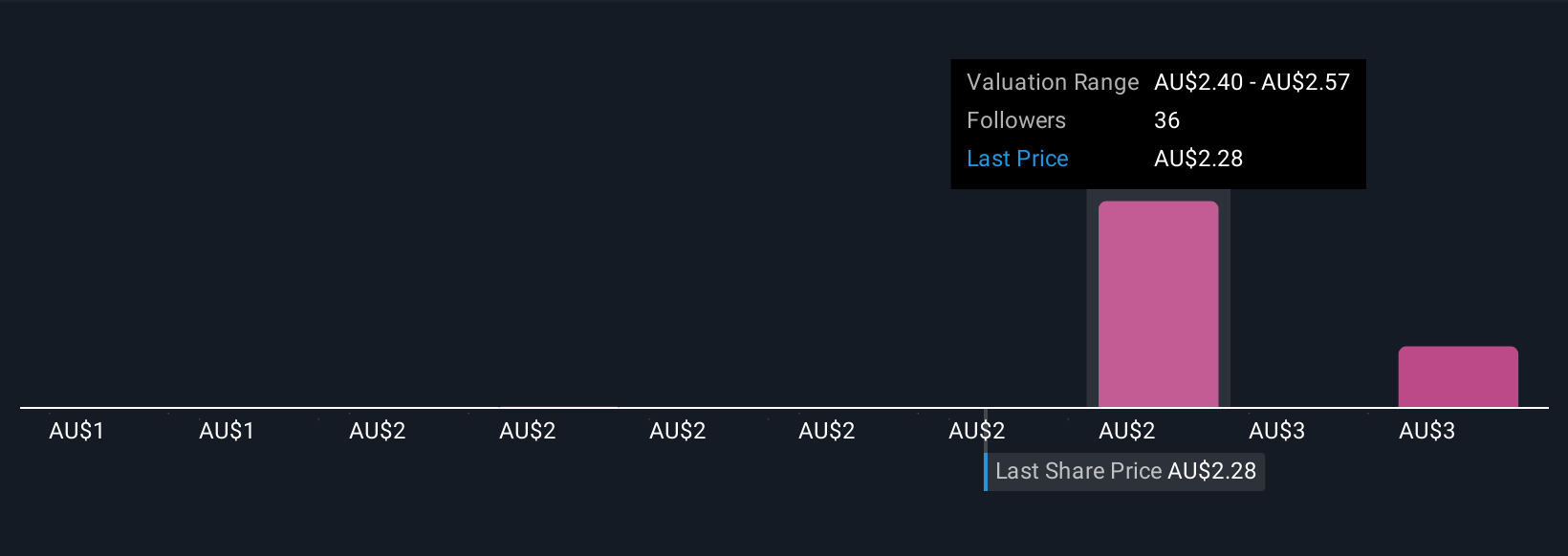

Uncover how Southern Cross Electrical Engineering's forecasts yield a A$2.44 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value for Southern Cross Electrical Engineering between A$1.20 and A$2.92 from 9 perspectives. As fresh contract wins become a near-term focus, you can weigh these diverse views against the risk of order book volatility and explore several alternative viewpoints.

Explore 9 other fair value estimates on Southern Cross Electrical Engineering - why the stock might be worth as much as 28% more than the current price!

Build Your Own Southern Cross Electrical Engineering Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Cross Electrical Engineering research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Cross Electrical Engineering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Cross Electrical Engineering's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives