- Australia

- /

- Construction

- /

- ASX:SRG

ASX Penny Stocks Under A$100M Market Cap

Reviewed by Simply Wall St

The Australian market is experiencing a cautious atmosphere, influenced by a technology selloff in the U.S. and recent fluctuations in gold prices. Despite these challenges, investors continue to seek opportunities that align with current market conditions. Penny stocks, though an older term, still represent potential growth avenues through smaller or newer companies that demonstrate strong financial health. In this article, we explore three such penny stocks that offer both affordability and promising prospects for investors looking to uncover hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.47 | A$134.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.89 | A$55.42M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$419.88M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.45 | A$254.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$3.10 | A$286.24M | ✅ 3 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$150.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Clover (ASX:CLV) | A$0.65 | A$108.55M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Actinogen Medical (ASX:ACW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Actinogen Medical Limited is an Australian biotechnology company focused on developing therapies for neurological and neuropsychiatric diseases linked to dysregulated brain cortisol, with a market cap of A$101.62 million.

Operations: Actinogen Medical Limited has not reported any revenue segments.

Market Cap: A$101.62M

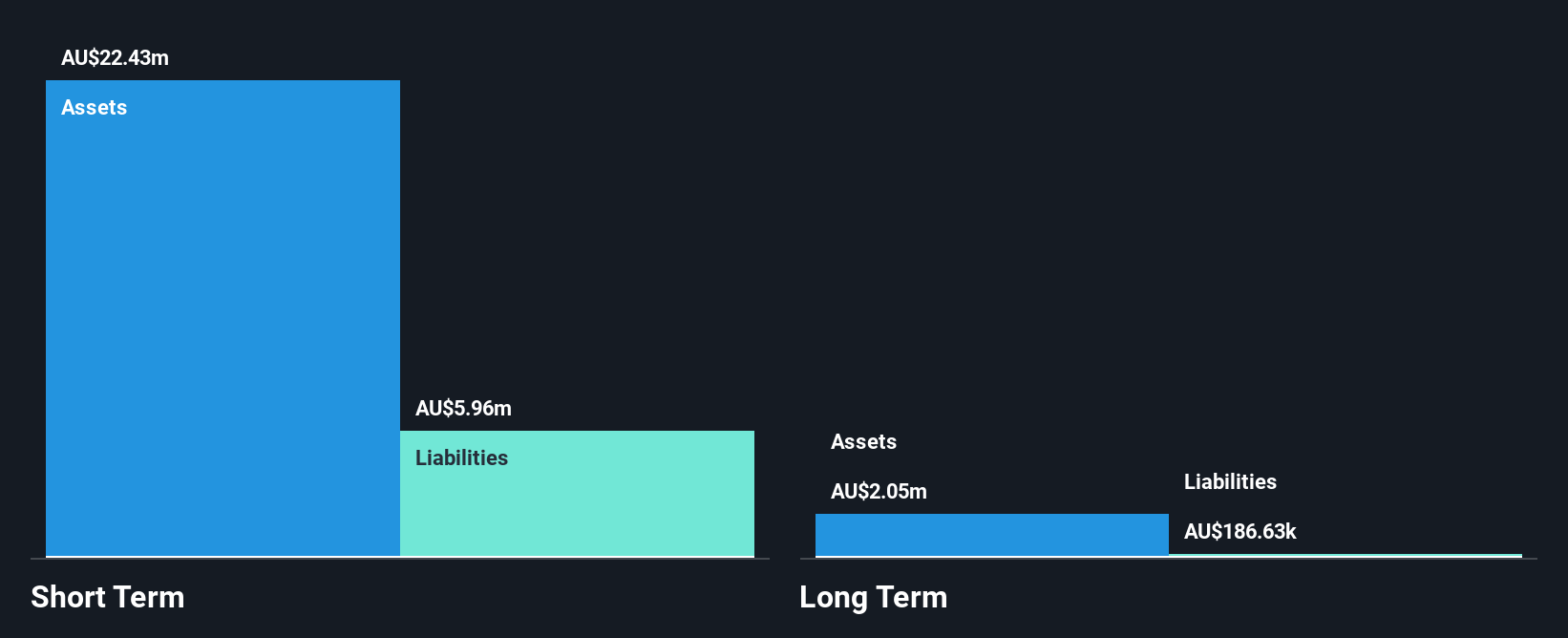

Actinogen Medical Limited, a pre-revenue biotech firm, is navigating the complex path of drug development with its focus on Alzheimer's disease. Recent FDA discussions have clarified the regulatory pathway for its lead candidate, Xanamem®, marking a significant milestone as it prepares for pivotal Phase 3 trials. Despite reporting a net loss and declining revenues to A$6.17 million in FY2025, Actinogen's cash position remains robust relative to liabilities. However, its cash runway is limited if current expenditure trends persist. The company's experienced management and board are steering efforts towards potential partnerships and global regulatory submissions to bolster future prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of Actinogen Medical.

- Evaluate Actinogen Medical's prospects by accessing our earnings growth report.

Frontier Energy (ASX:FHE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontier Energy Limited is a renewable energy company focused on developing an integrated renewable energy facility in Australia, with a market cap of A$149.41 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$149.41M

Frontier Energy Limited, a pre-revenue renewable energy company, is advancing its Waroona Renewable Energy Project in Western Australia. The project aims to become the largest renewable energy precinct in the region, with planned expansions up to 1GW of solar and 660MW of battery storage by 2031. The company's strategy leverages existing grid connections and land assets for rapid market entry without major infrastructure dependencies. Recent developments include securing Certified Reserve Capacity for Stage One, providing an additional revenue stream through reserve capacity payments. Despite a net loss reported for H1 2025, Frontier's expansion aligns with regional energy needs amid retiring coal assets.

- Click here to discover the nuances of Frontier Energy with our detailed analytical financial health report.

- Gain insights into Frontier Energy's historical outcomes by reviewing our past performance report.

SRG Global (ASX:SRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SRG Global Limited operates in engineering, mining, maintenance and construction contracting across Australia and New Zealand with a market cap of A$1.74 billion.

Operations: SRG Global generates revenue from two primary segments: Engineering and Construction, contributing A$455.93 million, and Maintenance and Industrial Services, accounting for A$867.38 million.

Market Cap: A$1.74B

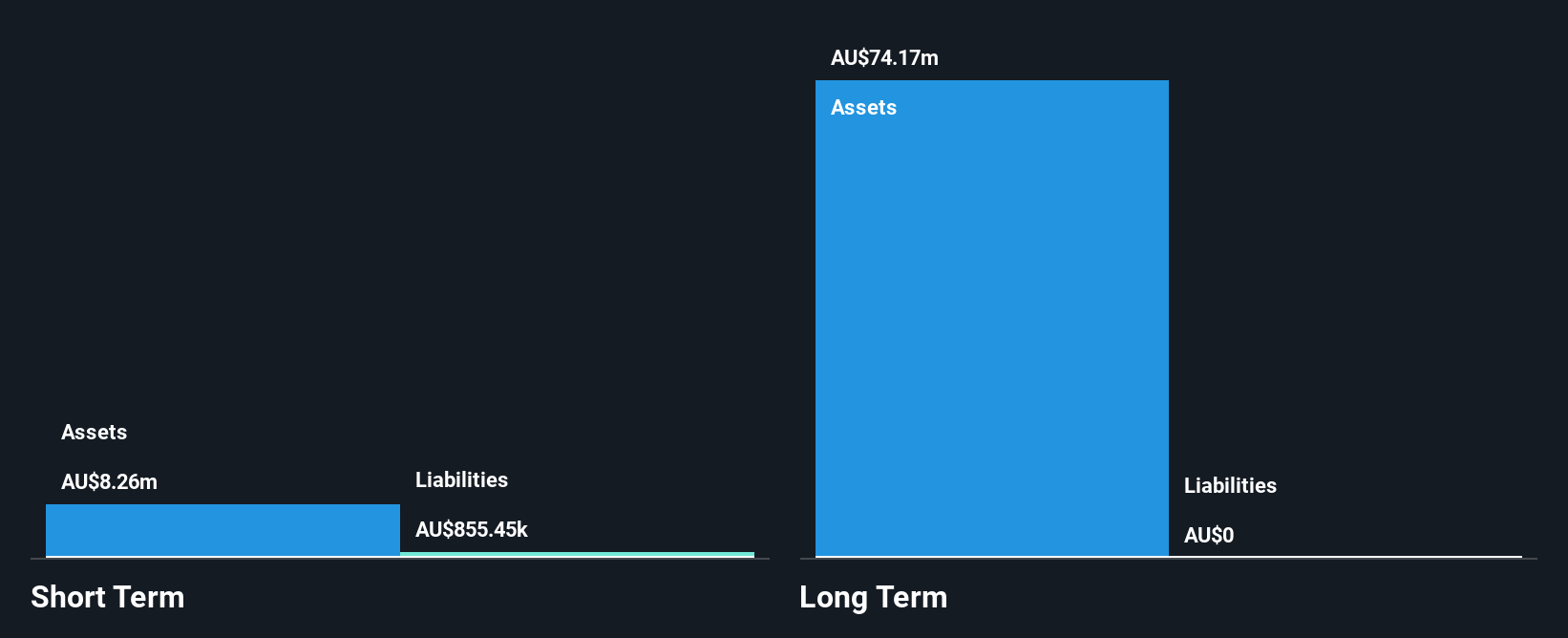

SRG Global Limited, with a market cap of A$1.74 billion, is actively pursuing strategic acquisitions to enhance its footprint in engineering and construction. The company reported solid financial performance for the fiscal year ending June 2025, with revenues of A$1.32 billion and net income of A$47.48 million, reflecting strong earnings growth compared to the previous year. SRG's debt is well covered by operating cash flow, and interest payments are substantially covered by EBIT (44.3x). Despite a low Return on Equity at 12.1%, SRG maintains high-quality earnings and stable weekly volatility (9%), suggesting operational resilience in volatile markets.

- Unlock comprehensive insights into our analysis of SRG Global stock in this financial health report.

- Learn about SRG Global's future growth trajectory here.

Where To Now?

- Access the full spectrum of 418 ASX Penny Stocks by clicking on this link.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRG

SRG Global

Engages in engineering, mining, maintenance and construction contracting in Australia and New Zealand.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives