In the last week, the Australian market has been flat, but it's up 16% over the past year with earnings forecasted to grow by 13% annually. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$65.64M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.995 | A$330.52M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$322.48M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.69 | A$94.04M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$781.68M | ★★★★★☆ |

| Duratec (ASX:DUR) | A$1.34 | A$345.3M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$237.13M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.95 | A$114.72M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,048 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Reef Casino Trust (ASX:RCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

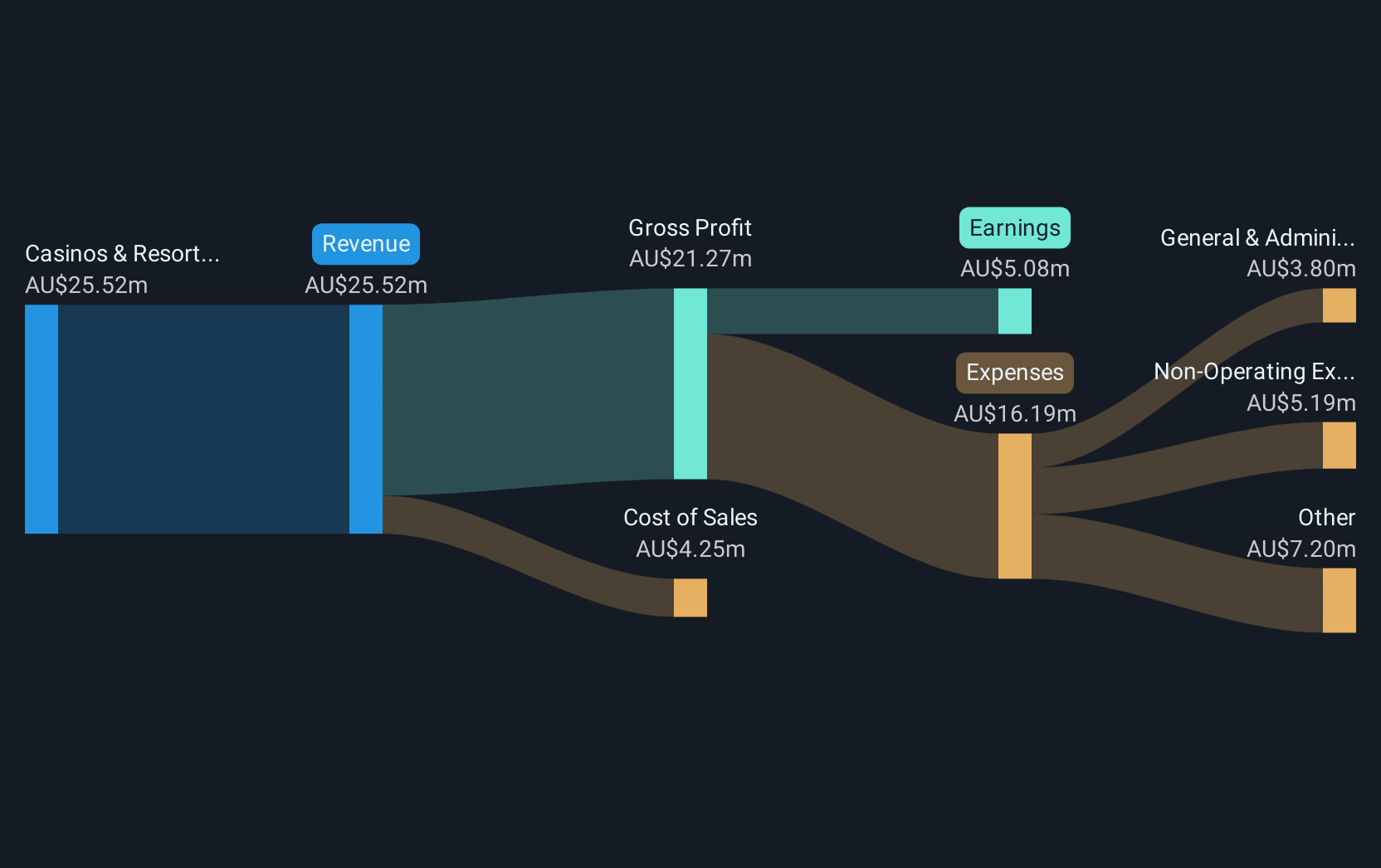

Overview: Reef Casino Trust operates as an owner and lessor of the Reef Hotel Casino complex in Cairns, North Queensland, Australia, with a market cap of A$66.48 million.

Operations: The company generates revenue of A$26.20 million from its Casinos & Resorts segment.

Market Cap: A$66.48M

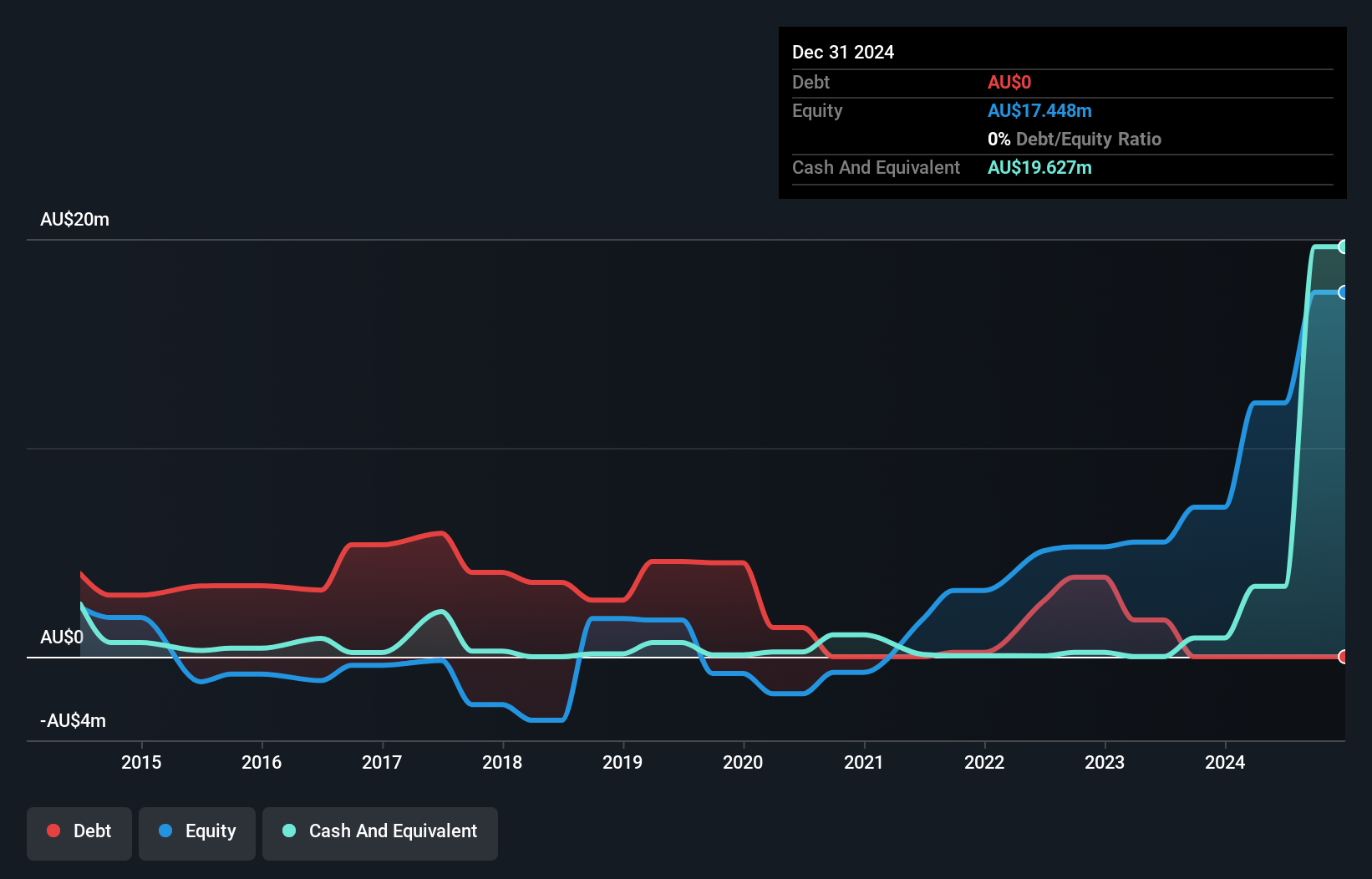

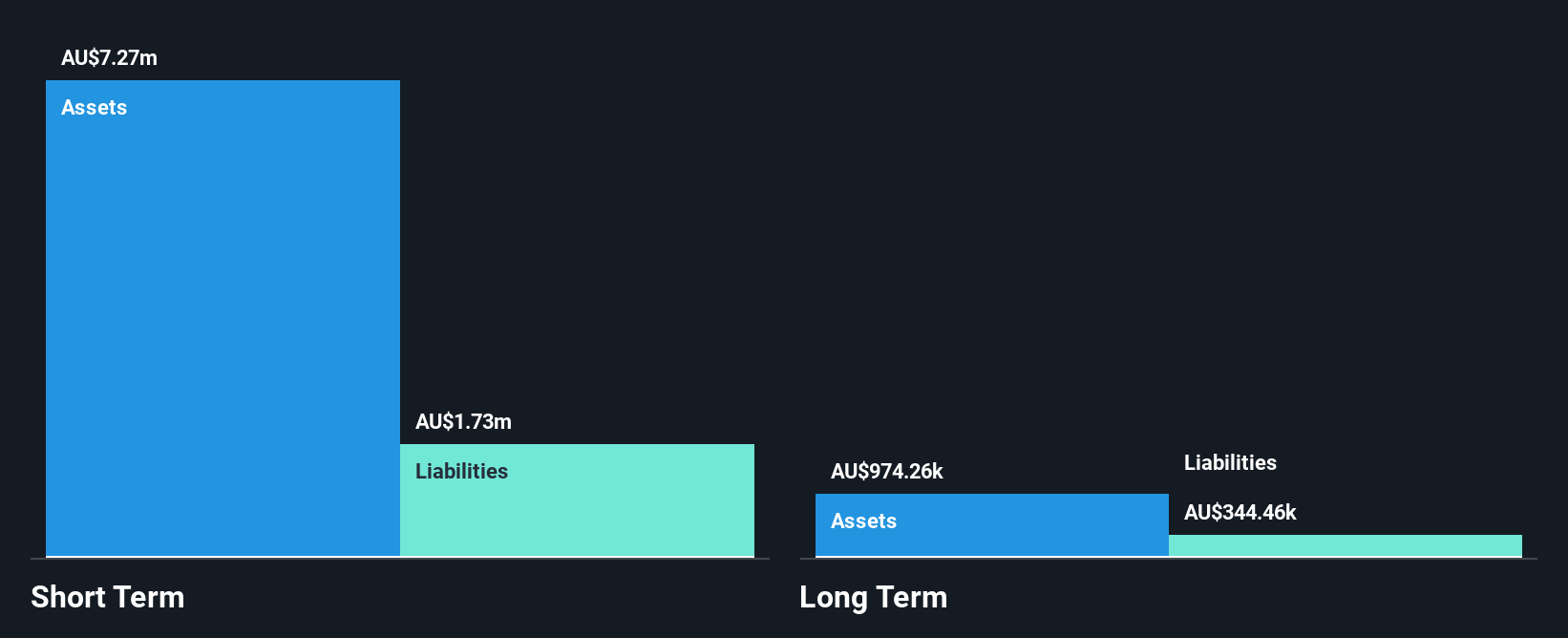

Reef Casino Trust, with a market cap of A$66.48 million, presents a mixed picture for investors interested in penny stocks. While its short-term assets exceed liabilities and the company boasts an outstanding return on equity of 49%, challenges persist. The trust's earnings have significantly grown by 23.8% annually over five years, yet recent negative earnings growth and declining profit margins raise concerns about profitability trends. Although debt levels are well-managed with more cash than total debt, long-term liabilities remain uncovered by short-term assets. Additionally, the dividend yield is not well supported by current earnings, indicating potential sustainability issues.

- Click here to discover the nuances of Reef Casino Trust with our detailed analytical financial health report.

- Assess Reef Casino Trust's previous results with our detailed historical performance reports.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$219.66 million.

Operations: The company generates its revenue from the Lighting and Audio-Visual Markets, amounting to A$136.31 million.

Market Cap: A$219.66M

SKS Technologies Group, with a market cap of A$219.66 million, offers an intriguing prospect in the penny stock arena. The company has shown remarkable earnings growth of 948% over the past year, surpassing its five-year average growth rate of 47.4% annually. SKS's net profit margin improved to 4.9%, and it boasts an impressive return on equity of 54.5%. Despite shareholder dilution due to a 2.1% increase in shares outstanding, SKS remains debt-free with short-term assets covering both short- and long-term liabilities comfortably, suggesting a solid financial footing amidst its rapid expansion trajectory.

- Get an in-depth perspective on SKS Technologies Group's performance by reading our balance sheet health report here.

- Gain insights into SKS Technologies Group's future direction by reviewing our growth report.

Terragen Holdings (ASX:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Terragen Holdings Limited focuses on the research, development, production, and sale of biological products for the agriculture sector in Australia and New Zealand, with a market cap of A$13.29 million.

Operations: The company's revenue is primarily derived from its Agricultural Biotech segment, amounting to A$2.14 million.

Market Cap: A$13.29M

Terragen Holdings, with a market cap of A$13.29 million, is navigating the penny stock landscape with a focus on agricultural biotech. Despite being unprofitable and having no meaningful revenue (A$2.14 million), it maintains more cash than debt and covers its short- and long-term liabilities with short-term assets of A$6.1 million. Recent efforts to raise A$5 million through equity offerings may support its cash runway of over a year, although its share price remains highly volatile. The company's board and management are relatively new, averaging 1.2 years in tenure, which could impact strategic stability moving forward.

- Take a closer look at Terragen Holdings' potential here in our financial health report.

- Understand Terragen Holdings' track record by examining our performance history report.

Key Takeaways

- Take a closer look at our ASX Penny Stocks list of 1,048 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terragen Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TGH

Terragen Holdings

Engages in the research, development, production, and sale of biological products for the agriculture sector in Australia and New Zealand.

Flawless balance sheet slight.

Market Insights

Community Narratives