- Australia

- /

- Electrical

- /

- ASX:SKS

3 ASX Penny Stocks With A$100M Market Cap

Reviewed by Simply Wall St

Australian shares are experiencing a modest gain, with the recent Wall Street rally showing signs of slowing down. Despite this, the market's enthusiasm remains high, and investors are increasingly turning their attention to gold as it reaches significant price milestones. In this context, penny stocks—often representing smaller or newer companies—continue to attract interest due to their potential for uncovering hidden value. While the term 'penny stock' may seem outdated, these investments can still offer compelling opportunities when backed by strong financials. In this article, we explore three such stocks on the ASX that combine balance sheet strength with potential growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.53 | A$119.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.06M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.71 | A$417.24M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.30 | A$243.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Count (ASX:CUP) | A$1.05 | A$174.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.75 | A$358.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EcoGraf Limited focuses on the exploration and production of graphite products for the lithium-ion battery and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$187.22 million.

Operations: The company generates revenue from its operations in Australia, amounting to A$3.72 million.

Market Cap: A$187.22M

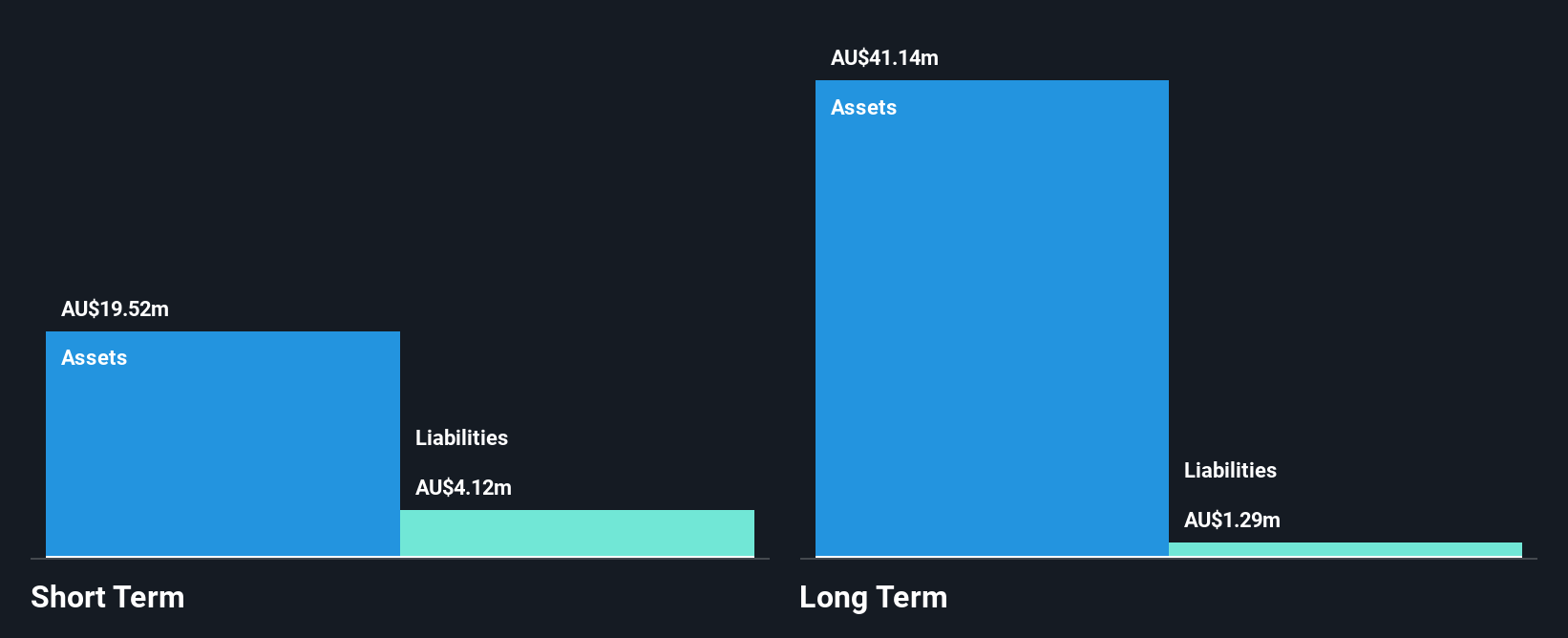

EcoGraf Limited, with a market cap of A$187.22 million, remains pre-revenue as it focuses on graphite production for battery markets. The company reported A$3.72 million in revenue for the year ending June 2025 but remains unprofitable with a net loss of A$5.01 million. Despite being debt-free and having experienced management and board teams, EcoGraf faces challenges with less than a year of cash runway based on current free cash flow trends. Short-term assets exceed liabilities, providing some financial stability; however, profitability has not improved over the past five years, highlighting ongoing operational hurdles in its growth trajectory.

- Click to explore a detailed breakdown of our findings in EcoGraf's financial health report.

- Assess EcoGraf's previous results with our detailed historical performance reports.

Rand Mining (ASX:RND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rand Mining Limited is involved in the exploration, development, and production of mineral properties in Australia with a market cap of A$158.68 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, amounting to A$43.28 million.

Market Cap: A$158.68M

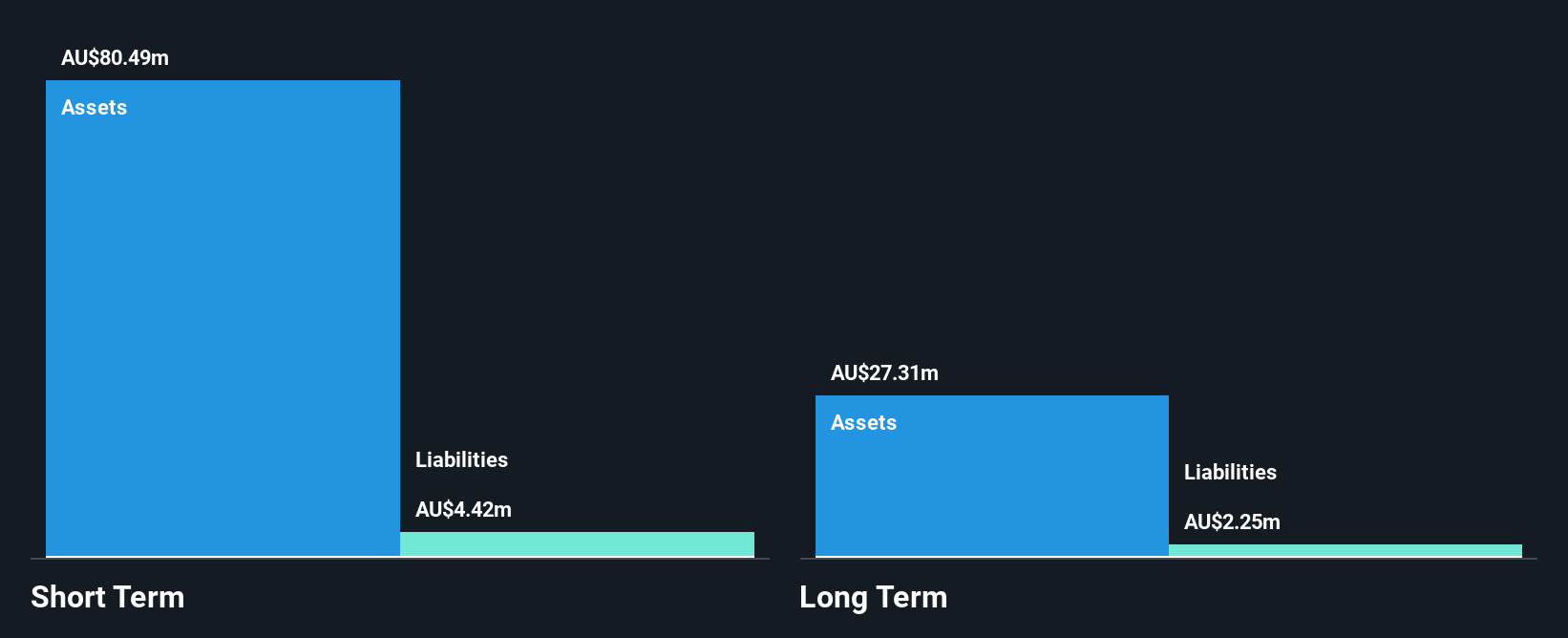

Rand Mining Limited, with a market cap of A$158.68 million, reported significant growth in earnings and revenue for the year ending June 2025. Revenue increased to A$43.27 million from A$34.76 million the previous year, while net income nearly doubled to A$13.13 million. The company boasts strong financial health with short-term assets far exceeding liabilities and no debt on its balance sheet, eliminating concerns about interest payments or coverage by operating cash flow. Although trading below estimated fair value and showing robust profit growth compared to industry peers, its dividend sustainability remains questionable due to inadequate free cash flow coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Rand Mining.

- Gain insights into Rand Mining's historical outcomes by reviewing our past performance report.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market capitalization of A$498.97 million.

Operations: The company generates revenue of A$261.66 million from its operations in the lighting and audio-visual markets.

Market Cap: A$498.97M

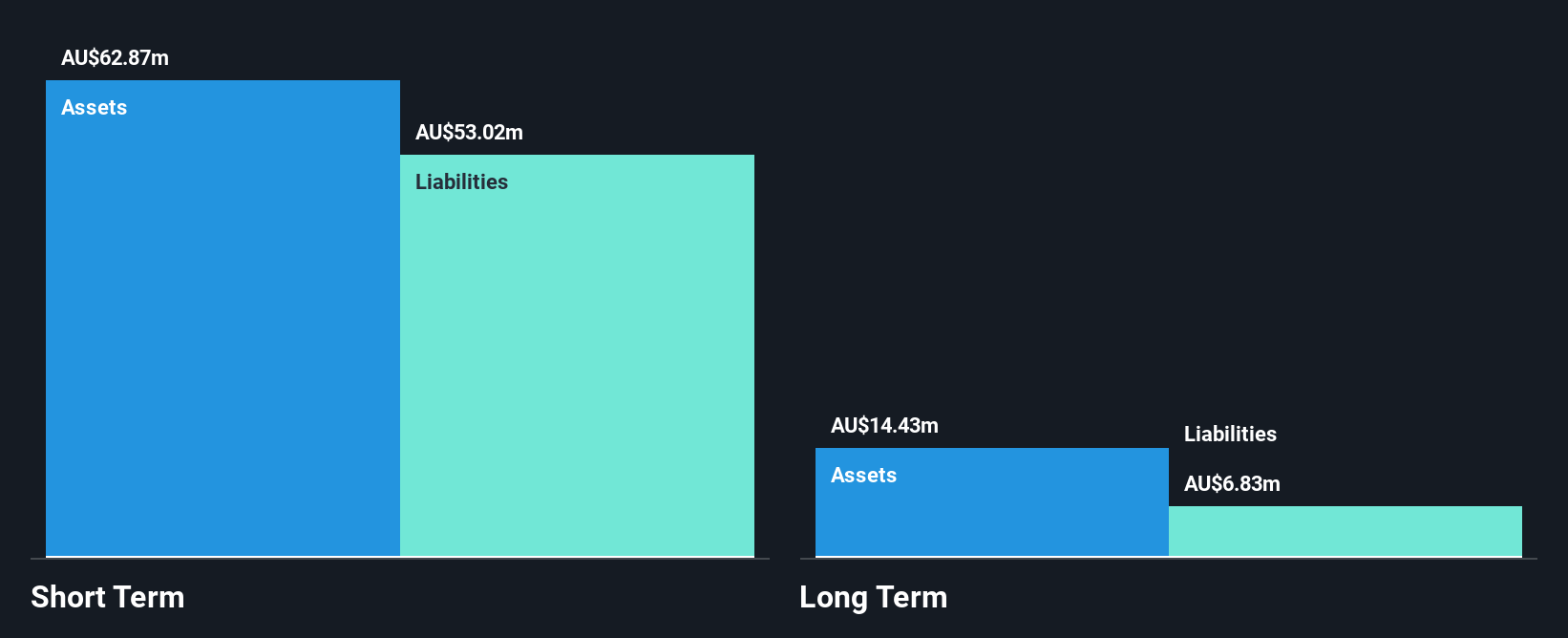

SKS Technologies Group has demonstrated strong financial performance, with earnings growing 111.8% over the past year, surpassing its five-year average growth of 55.8%. The company reported significant revenue growth to A$263.23 million for the fiscal year ending June 2025, up from A$136.52 million previously, and net income more than doubled to A$14.03 million. SKS is debt-free with short-term assets exceeding both short and long-term liabilities, highlighting solid financial health. Despite recent insider selling activity, SKS maintains high-quality earnings and offers a cash dividend of A$0.05 per share scheduled for October 2025 payment.

- Unlock comprehensive insights into our analysis of SKS Technologies Group stock in this financial health report.

- Assess SKS Technologies Group's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Investigate our full lineup of 423 ASX Penny Stocks right here.

- Contemplating Other Strategies? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives