- Australia

- /

- Construction

- /

- ASX:SHA

ASX Penny Stocks Spotlight: Jatcorp Among 3 Promising Picks

Reviewed by Simply Wall St

The Australian stock market has shown resilience with the ASX200 closing up 0.18% at 8,300 points, driven by gains in sectors like Staples and Energy. While traditional sectors have performed well, there's a growing interest in exploring smaller-scale investments such as penny stocks. Although the term 'penny stocks' may seem outdated, these stocks often represent smaller or newer companies that can offer significant growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.585 | A$70.63M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$332.15M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$337.98M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$104.55M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$825.78M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.205 | A$1.09B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$67.53M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.00 | A$486.42M | ★★★★☆☆ |

Click here to see the full list of 1,041 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Jatcorp (ASX:JAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jatcorp Limited is involved in the production and sale of dairy and nutrient products in Australia, with a market capitalization of A$41.01 million.

Operations: The company generates revenue primarily from the trading of fast-moving consumer goods, amounting to A$52.46 million.

Market Cap: A$41.01M

Jatcorp Limited, with a market capitalization of A$41.01 million, has shown significant financial improvement by becoming profitable in the past year. The company reported sales of A$52.46 million for the full year ending June 30, 2024, up from A$36.88 million previously, and net income reached A$2.22 million compared to a loss of A$4.48 million the prior year. Jatcorp's interest payments are well-covered by EBIT and its debt is supported by operating cash flow, indicating solid financial management despite an inexperienced board with an average tenure of 2.1 years.

- Take a closer look at Jatcorp's potential here in our financial health report.

- Review our historical performance report to gain insights into Jatcorp's track record.

SHAPE Australia (ASX:SHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SHAPE Australia Corporation Limited operates in the construction, fitout, and refurbishment of commercial properties across Australia with a market cap of A$228.01 million.

Operations: The company's revenue is primarily derived from its heavy construction segment, amounting to A$839.00 million.

Market Cap: A$228.01M

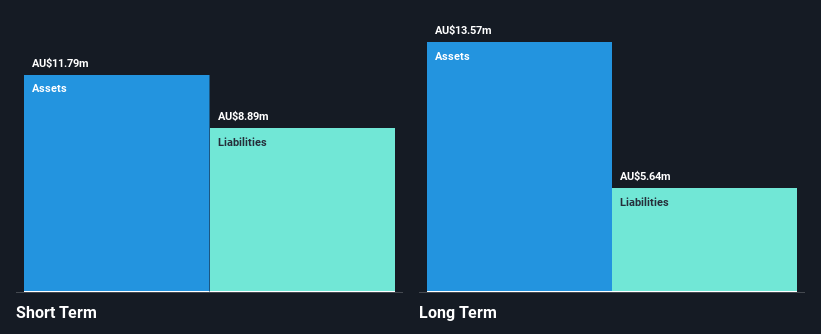

SHAPE Australia Corporation Limited, with a market cap of A$228.01 million, operates debt-free and reported sales of A$838.73 million for the year ending June 30, 2024. Its net income increased to A$16.01 million from A$10.5 million the previous year, reflecting improved profit margins and high-quality earnings. The company's short-term assets cover both short- and long-term liabilities comfortably. Despite an unstable dividend track record, SHAPE's return on equity is outstanding at 51.2%. Earnings growth has been robust at 52.6%, surpassing industry averages, although future growth is forecasted to moderate at 5.17% annually.

- Click to explore a detailed breakdown of our findings in SHAPE Australia's financial health report.

- Assess SHAPE Australia's future earnings estimates with our detailed growth reports.

VRX Silica (ASX:VRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VRX Silica Limited, along with its subsidiaries, is involved in the exploration and development of mineral properties in Australia and has a market cap of A$24.50 million.

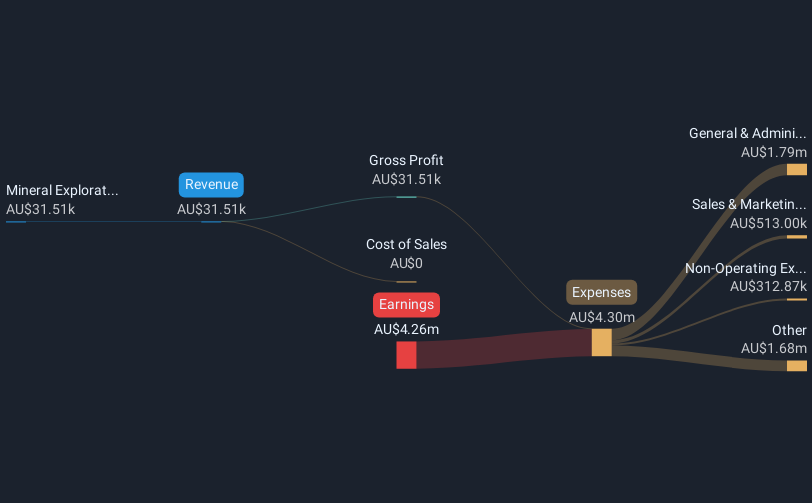

Operations: The company generates revenue from its mineral exploration activities, amounting to A$0.03 million.

Market Cap: A$24.5M

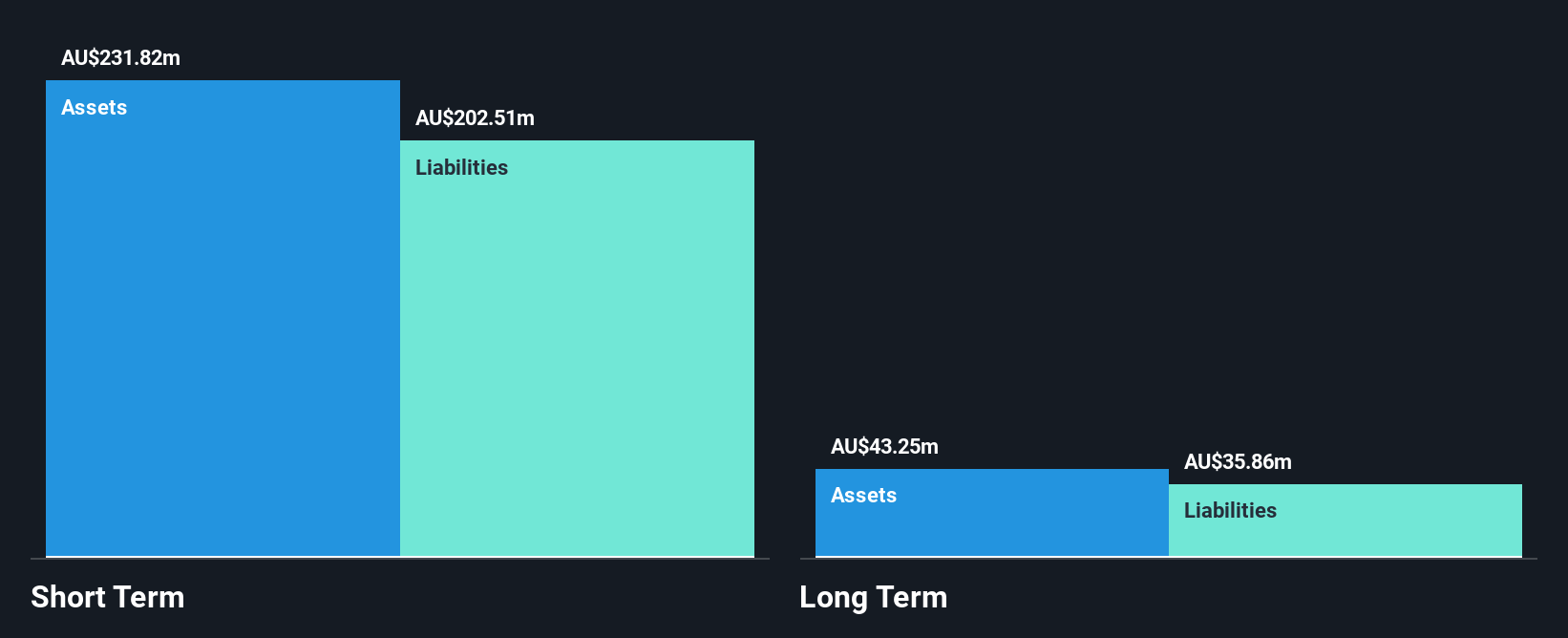

VRX Silica, with a market cap of A$24.50 million, is currently pre-revenue, generating only A$32K from mineral exploration activities. The company remains debt-free and its short-term assets of A$2.4 million comfortably cover both short- and long-term liabilities. However, VRX faces challenges such as a highly volatile share price and less than one year of cash runway based on current free cash flow trends. Shareholders have experienced dilution over the past year with shares outstanding increasing by 7.7%. Despite these hurdles, the board of directors boasts an average tenure of 14.2 years, indicating seasoned leadership amidst financial instability.

- Click here and access our complete financial health analysis report to understand the dynamics of VRX Silica.

- Explore historical data to track VRX Silica's performance over time in our past results report.

Summing It All Up

- Dive into all 1,041 of the ASX Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHA

SHAPE Australia

Engages in the construction, fitout, and refurbishment of commercial properties in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.