- Australia

- /

- Construction

- /

- ASX:REM

Investors in Remsense Technologies (ASX:REM) from a year ago are still down 50%, even after 26% gain this past week

Remsense Technologies Limited (ASX:REM) shareholders will doubtless be very grateful to see the share price up 50% in the last month. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 61% in one year, under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Remsense Technologies

Remsense Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Remsense Technologies' revenue didn't grow at all in the last year. In fact, it fell 24%. That's not what investors generally want to see. In the absence of profits, it's not unreasonable that the share price fell 61%. Fingers crossed this is the low ebb for the stock. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

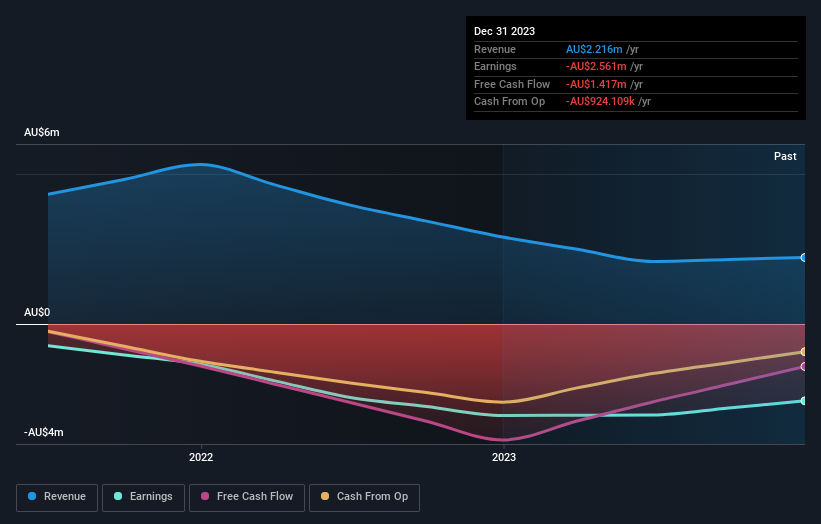

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Remsense Technologies stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Remsense Technologies' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Remsense Technologies hasn't been paying dividends, but its TSR of -50% exceeds its share price return of -61%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Given that the market gained 13% in the last year, Remsense Technologies shareholders might be miffed that they lost 50%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 20%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Remsense Technologies better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Remsense Technologies you should be aware of, and 4 of them are significant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:REM

RemSense Technologies

Provides commercial drone services in Western Australia.

Medium-low with mediocre balance sheet.