- Australia

- /

- Trade Distributors

- /

- ASX:REH

These 4 Measures Indicate That Reece (ASX:REH) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Reece Limited (ASX:REH) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Reece

What Is Reece's Net Debt?

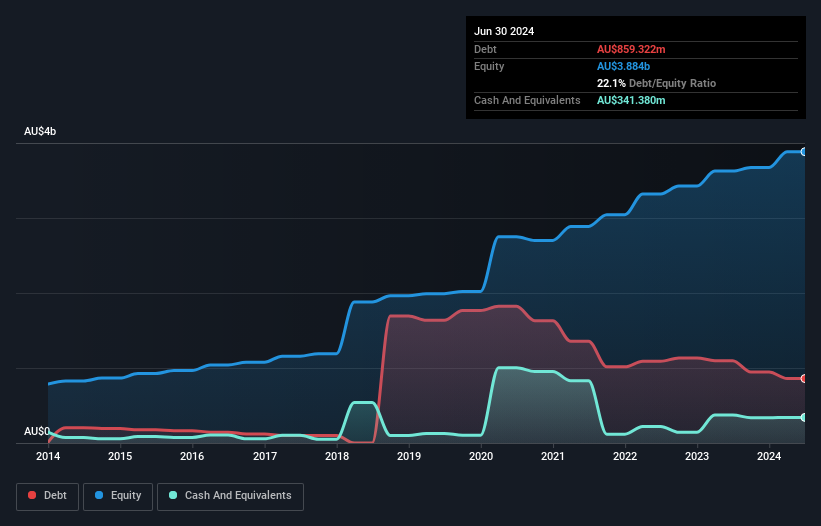

You can click the graphic below for the historical numbers, but it shows that Reece had AU$859.3m of debt in June 2024, down from AU$1.10b, one year before. However, because it has a cash reserve of AU$341.4m, its net debt is less, at about AU$517.9m.

How Strong Is Reece's Balance Sheet?

The latest balance sheet data shows that Reece had liabilities of AU$1.48b due within a year, and liabilities of AU$1.73b falling due after that. On the other hand, it had cash of AU$341.4m and AU$1.34b worth of receivables due within a year. So its liabilities total AU$1.53b more than the combination of its cash and short-term receivables.

Given Reece has a market capitalization of AU$15.1b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 0.63 times EBITDA, Reece is arguably pretty conservatively geared. And it boasts interest cover of 7.3 times, which is more than adequate. While Reece doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Reece's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Reece produced sturdy free cash flow equating to 57% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

The good news is that Reece's demonstrated ability handle its debt, based on its EBITDA, delights us like a fluffy puppy does a toddler. And its conversion of EBIT to free cash flow is good too. Looking at all the aforementioned factors together, it strikes us that Reece can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Reece's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:REH

Reece

Engages in the distribution of plumbing, waterworks, heating, ventilation, air-conditioning, and refrigeration products to commercial and residential customers in Australia, New Zealand, and the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives