The Market Lifts LaserBond Limited (ASX:LBL) Shares 25% But It Can Do More

Those holding LaserBond Limited (ASX:LBL) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

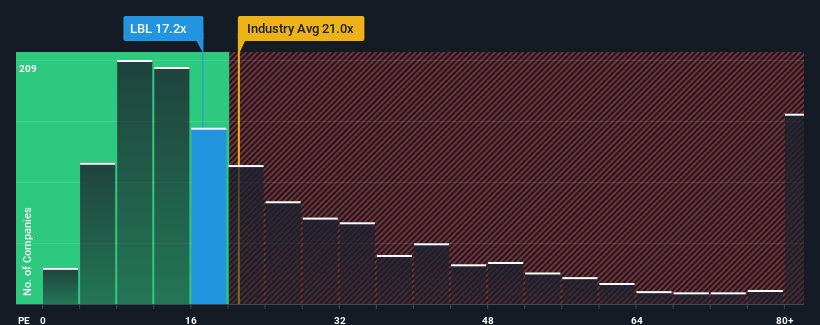

Although its price has surged higher, you could still be forgiven for feeling indifferent about LaserBond's P/E ratio of 17.2x, since the median price-to-earnings (or "P/E") ratio in Australia is also close to 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

LaserBond could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for LaserBond

What Are Growth Metrics Telling Us About The P/E?

LaserBond's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 42% each year during the coming three years according to the two analysts following the company. With the market only predicted to deliver 15% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that LaserBond is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On LaserBond's P/E

LaserBond's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that LaserBond currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 2 warning signs for LaserBond that you need to take into consideration.

You might be able to find a better investment than LaserBond. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LBL

LaserBond

A surface engineering company, engages in the development and application of materials, technologies, and methodologies to enhance operating performance and wear life of capital-intensive machinery components in Australia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives