- Australia

- /

- Aerospace & Defense

- /

- ASX:HCL

Why Investors Shouldn't Be Surprised By HighCom Limited's (ASX:HCL) 57% Share Price Plunge

The HighCom Limited (ASX:HCL) share price has fared very poorly over the last month, falling by a substantial 57%. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

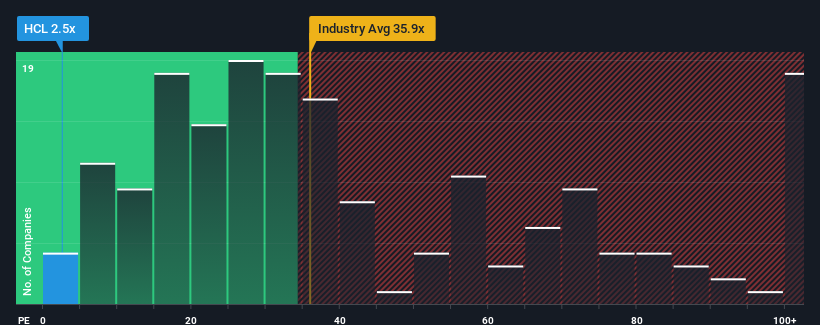

Since its price has dipped substantially, HighCom may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 2.5x, since almost half of all companies in Australia have P/E ratios greater than 20x and even P/E's higher than 37x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, HighCom has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for HighCom

How Is HighCom's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as HighCom's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.1%. Still, the latest three year period has seen an excellent 906% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 4.1% each year over the next three years. Meanwhile, the broader market is forecast to expand by 16% each year, which paints a poor picture.

With this information, we are not surprised that HighCom is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Having almost fallen off a cliff, HighCom's share price has pulled its P/E way down as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of HighCom's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - HighCom has 4 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of HighCom's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HighCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HCL

HighCom

Provides armors and technologies for defense sectors in Australia, the Asia Pacific, North America, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026