- Australia

- /

- Aerospace & Defense

- /

- ASX:EOS

There's Reason For Concern Over Electro Optic Systems Holdings Limited's (ASX:EOS) Price

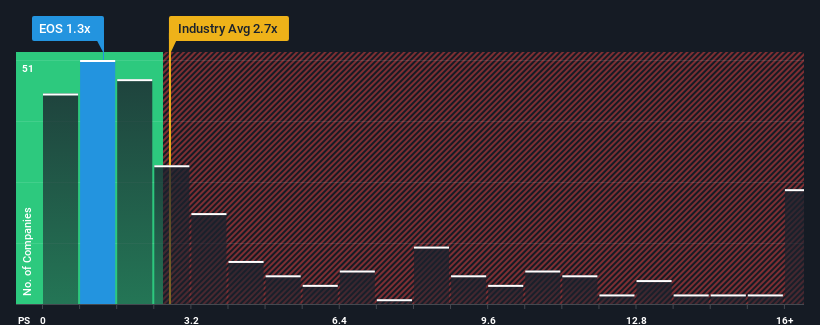

Electro Optic Systems Holdings Limited's (ASX:EOS) price-to-sales (or "P/S") ratio of 1.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in Australia have P/S ratios below 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Electro Optic Systems Holdings

What Does Electro Optic Systems Holdings' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Electro Optic Systems Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Electro Optic Systems Holdings.How Is Electro Optic Systems Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Electro Optic Systems Holdings' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 59%. Revenue has also lifted 22% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 9.1% per year over the next three years. That's shaping up to be similar to the 7.8% per annum growth forecast for the broader industry.

In light of this, it's curious that Electro Optic Systems Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Electro Optic Systems Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Electro Optic Systems Holdings has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Electro Optic Systems Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Electro Optic Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EOS

Electro Optic Systems Holdings

Engages in the development, manufacture, and sale of telescopes and dome enclosures, laser satellite tracking systems, and remote weapon systems.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives