- Australia

- /

- Aerospace & Defense

- /

- ASX:EOS

Our Take On Electro Optic Systems Holdings Limited's (ASX:EOS) CEO Salary

Ben Greene is the CEO of Electro Optic Systems Holdings Limited (ASX:EOS). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Electro Optic Systems Holdings

How Does Ben Greene's Compensation Compare With Similar Sized Companies?

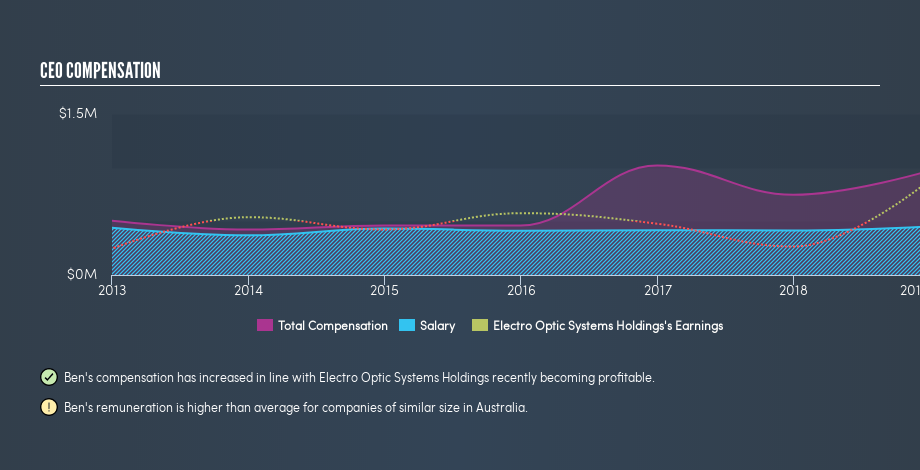

Our data indicates that Electro Optic Systems Holdings Limited is worth AU$372m, and total annual CEO compensation is AU$972k. (This number is for the twelve months until December 2018). We think total compensation is more important but we note that the CEO salary is lower, at AU$453k. We examined companies with market caps from AU$148m to AU$591m, and discovered that the median CEO total compensation of that group was AU$717k.

Thus we can conclude that Ben Greene receives more in total compensation than the median of a group of companies in the same market, and of similar size to Electro Optic Systems Holdings Limited. However, this doesn't necessarily mean the pay is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see, below, how CEO compensation at Electro Optic Systems Holdings has changed over time.

Is Electro Optic Systems Holdings Limited Growing?

On average over the last three years, Electro Optic Systems Holdings Limited has shrunk earnings per share by 2.4% each year (measured with a line of best fit). It achieved revenue growth of 275% over the last year.

Investors should note that, over three years, earnings per share are down. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch.

Has Electro Optic Systems Holdings Limited Been A Good Investment?

I think that the total shareholder return of 115%, over three years, would leave most Electro Optic Systems Holdings Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

We compared the total CEO remuneration paid by Electro Optic Systems Holdings Limited, and compared it to remuneration at a group of similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Over the last three years returns to investors have been great, though we might have liked stronger business growth. As a result of the juicy return to investors, the CEO remuneration may well be quite reasonable. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Electro Optic Systems Holdings.

Important note: Electro Optic Systems Holdings may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:EOS

Electro Optic Systems Holdings

Engages in the development, manufacture, and sale of telescopes and dome enclosures, laser satellite tracking systems, electro-optic fire control systems, and microwave satellite dishes and receivers.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives