- Australia

- /

- Aerospace & Defense

- /

- ASX:EOS

Do Analyst Downgrades Signal a Shift in EOS’s Long-Term Strategy and Outlook (ASX:EOS)?

Reviewed by Sasha Jovanovic

- Electro Optic Systems Holdings Limited recently had its CFO and COO, Clive Cuthel, present at the Australian Equities Day in Singapore, following analyst downgrades to revenue and earnings forecasts for the company.

- Analysts now expect slower sales growth and a loss-making year for EOS compared to previous projections, prompting stakeholders to reassess both near- and long-term prospects for the defense and aerospace firm.

- We’ll explore how analyst concerns about weaker sales growth affect the investment narrative and outlook for Electro Optic Systems Holdings.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Electro Optic Systems Holdings Investment Narrative Recap

To be a shareholder in Electro Optic Systems Holdings, you need to believe in the company’s ability to secure ongoing defense and space technology contracts despite recent setbacks in sales forecasts. The latest analyst downgrades reflect reduced conviction around near-term sales growth, which may weigh on momentum for EOS’s next major export or development win, a key short-term catalyst. At the same time, weaker revenue outlooks also amplify the risk of delays in commercial adoption or procurement cycles, but the direct impact on core technology programs appears limited.

Among recent announcements, EOS’s index inclusion in the S&P/ASX Small Ordinaries and S&P/ASX 300 is most relevant, as it can boost institutional exposure even as analyst forecasts are being cut. The addition could enhance liquidity and visibility while the company works to address analyst concerns around revenue and profitability, supporting its access to growth capital if new contracts are secured.

On the other hand, the risk of contract delays and procurement cycle slowdowns is something investors should be particularly aware of, especially as ...

Read the full narrative on Electro Optic Systems Holdings (it's free!)

Electro Optic Systems Holdings is projected to achieve A$253.0 million in revenue and A$25.2 million in earnings by 2028. This outlook assumes 30.0% annual revenue growth and an earnings increase of A$93.2 million from the current loss of A$-68.0 million.

Uncover how Electro Optic Systems Holdings' forecasts yield a A$8.44 fair value, a 4% downside to its current price.

Exploring Other Perspectives

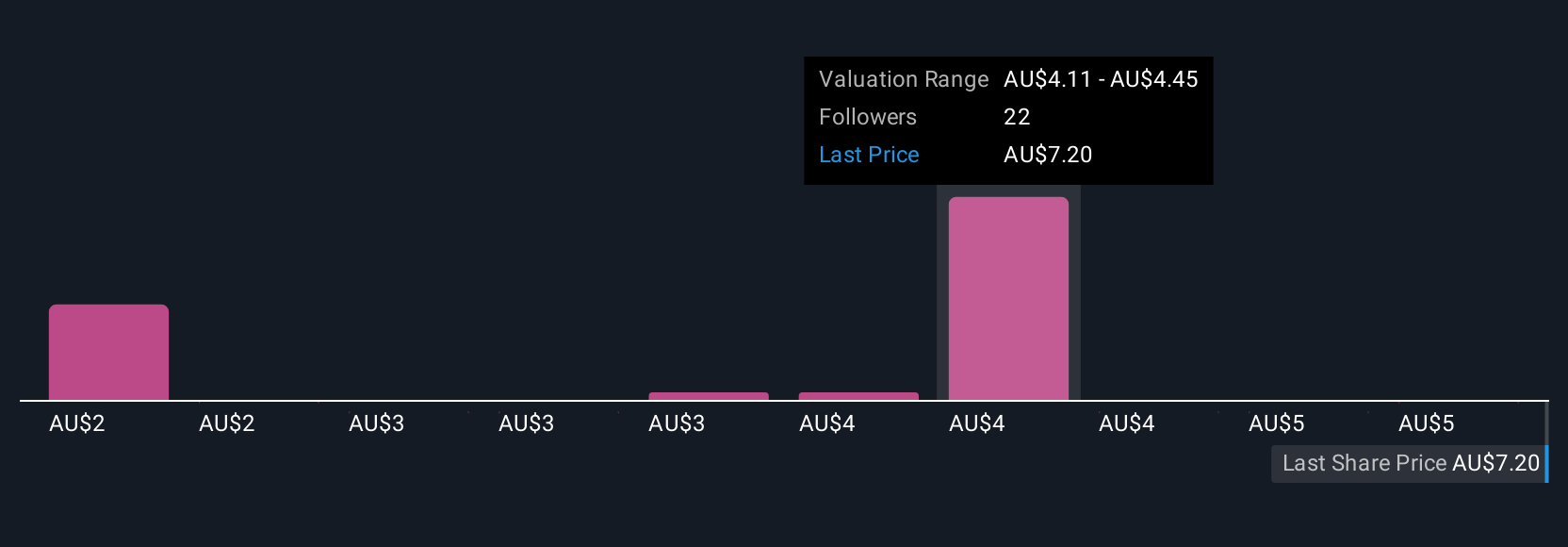

The Simply Wall St Community has set fair value estimates for EOS ranging from A$2.07 to A$8.44, with 9 distinct views. Many are focused on the expected pace of new contract wins, which could have far-reaching effects for future performance, explore these different perspectives to round out your own research.

Explore 9 other fair value estimates on Electro Optic Systems Holdings - why the stock might be worth as much as A$8.44!

Build Your Own Electro Optic Systems Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electro Optic Systems Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Electro Optic Systems Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electro Optic Systems Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electro Optic Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EOS

Electro Optic Systems Holdings

Engages in the development, manufacture, and sale of telescopes and dome enclosures, laser satellite tracking systems, and remote weapon systems.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.