- Australia

- /

- Capital Markets

- /

- ASX:HM1

Exploring Three Undiscovered Gems In The Australian Stock Market

Reviewed by Simply Wall St

The Australian stock market has recently experienced a downturn, with the ASX200 down 1% and sectors like Discretionary and Financials leading the decline. However, Utilities and Energy have shown resilience, highlighting opportunities within specific industries despite broader market challenges. In this environment, identifying promising small-cap stocks requires a focus on those with strong growth potential and unique value propositions that can thrive even amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

BSP Financial Group (ASX:BFL)

Simply Wall St Value Rating: ★★★★★☆

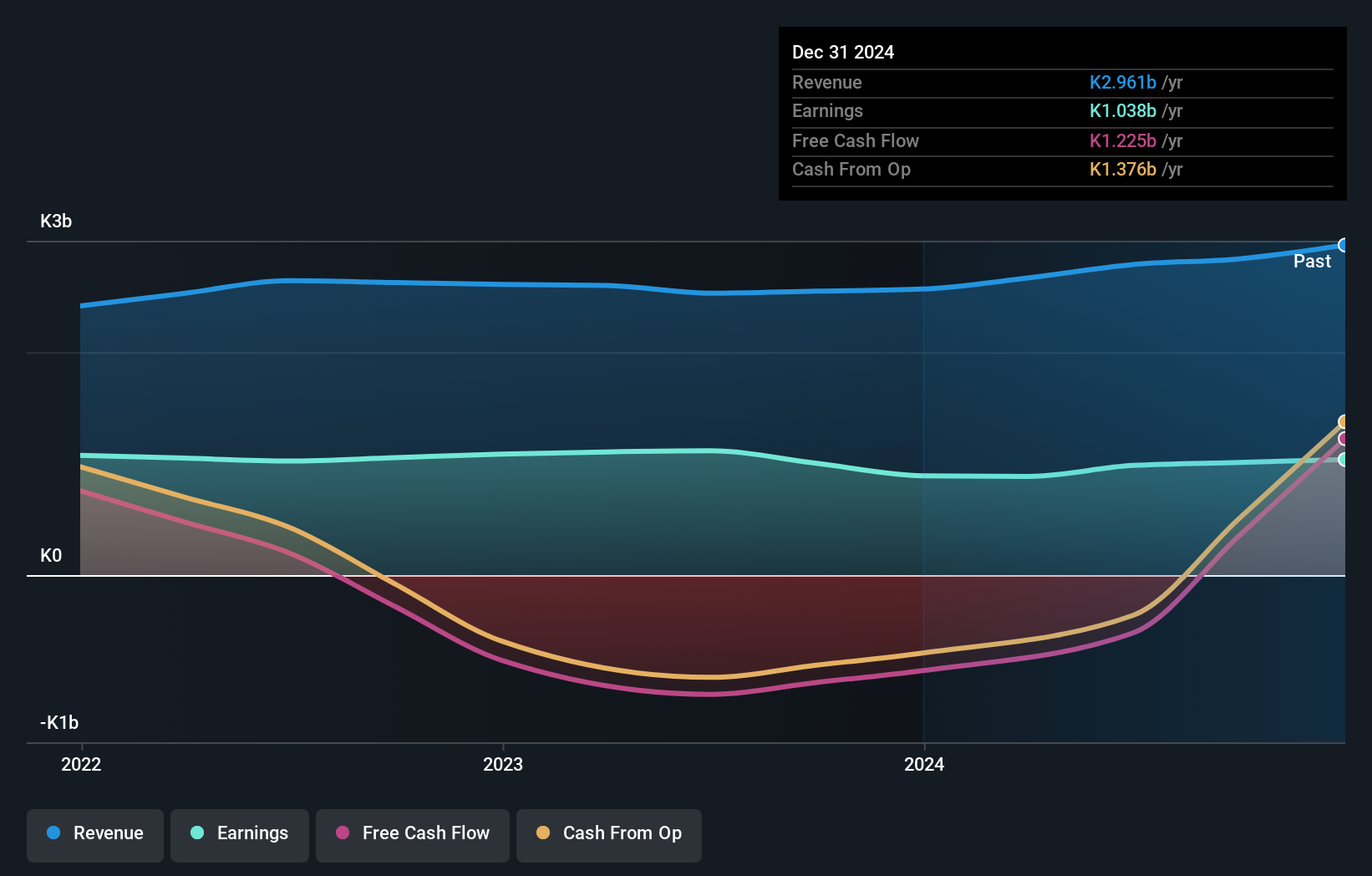

Overview: BSP Financial Group Limited operates as a commercial bank offering financial services to individual and corporate clients across Papua New Guinea, the Solomon Islands, Fiji, the Cook Islands, Samoa, Tonga, Vanuatu, Cambodia, and Laos with a market capitalization of A$3.10 billion.

Operations: BSP Financial Group's revenue primarily stems from its PNG Bank segment, contributing PGK 2.13 billion, followed by Pacific Markets at PGK 638.68 million. The company also generates income from Non-Bank Entities amounting to PGK 112.27 million.

BSP Financial Group, a notable player in the financial sector, boasts total assets of PGK37.4 billion and equity of PGK4.3 billion. With customer deposits forming 91% of its low-risk funding base, it holds PGK30.0 billion in deposits against PGK16.5 billion in loans. Despite a high bad loan ratio at 4%, BSP has a robust allowance for these loans at 108%. The company trades at an attractive P/E ratio of 8x compared to the Australian market's average of 19.8x, although recent earnings growth was negative at -11.8%, lagging behind the industry average by some margin.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

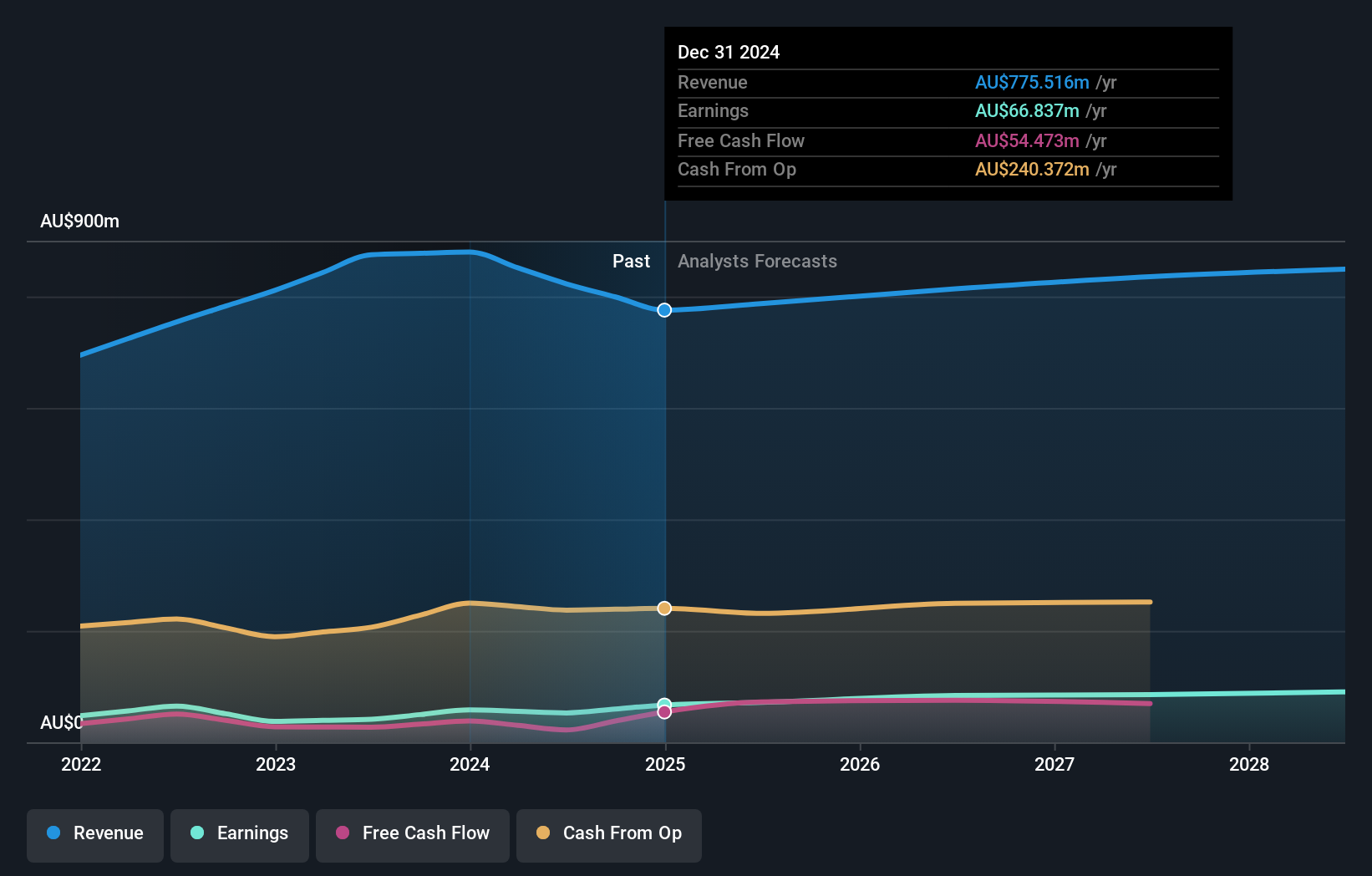

Overview: Emeco Holdings Limited operates in Australia, offering surface and underground mining equipment rental along with complementary equipment and mining services, with a market capitalization of approximately A$468.05 million.

Operations: Emeco Holdings generates revenue primarily through its mining equipment rental services, which account for A$544.75 million, and workshops contributing A$282.41 million. The Pit N Portal segment adds a further A$111.77 million to the company's revenue streams.

Emeco Holdings, a nimble player in the equipment rental sector, showcases robust financial health with its debt to equity ratio dropping significantly from 231% to 44.3% over five years. Its interest payments are well covered by EBIT at 4.7 times, indicating strong operational efficiency. The company trades at an attractive value, notably 54.6% below estimated fair value, and its earnings have surged by 27.4%, outpacing industry growth of 10%. Recent leadership changes include appointing Ian Macliver as Chairman, which could steer strategic initiatives further in the mining sector where his expertise lies.

- Click here to discover the nuances of Emeco Holdings with our detailed analytical health report.

Assess Emeco Holdings' past performance with our detailed historical performance reports.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★☆☆

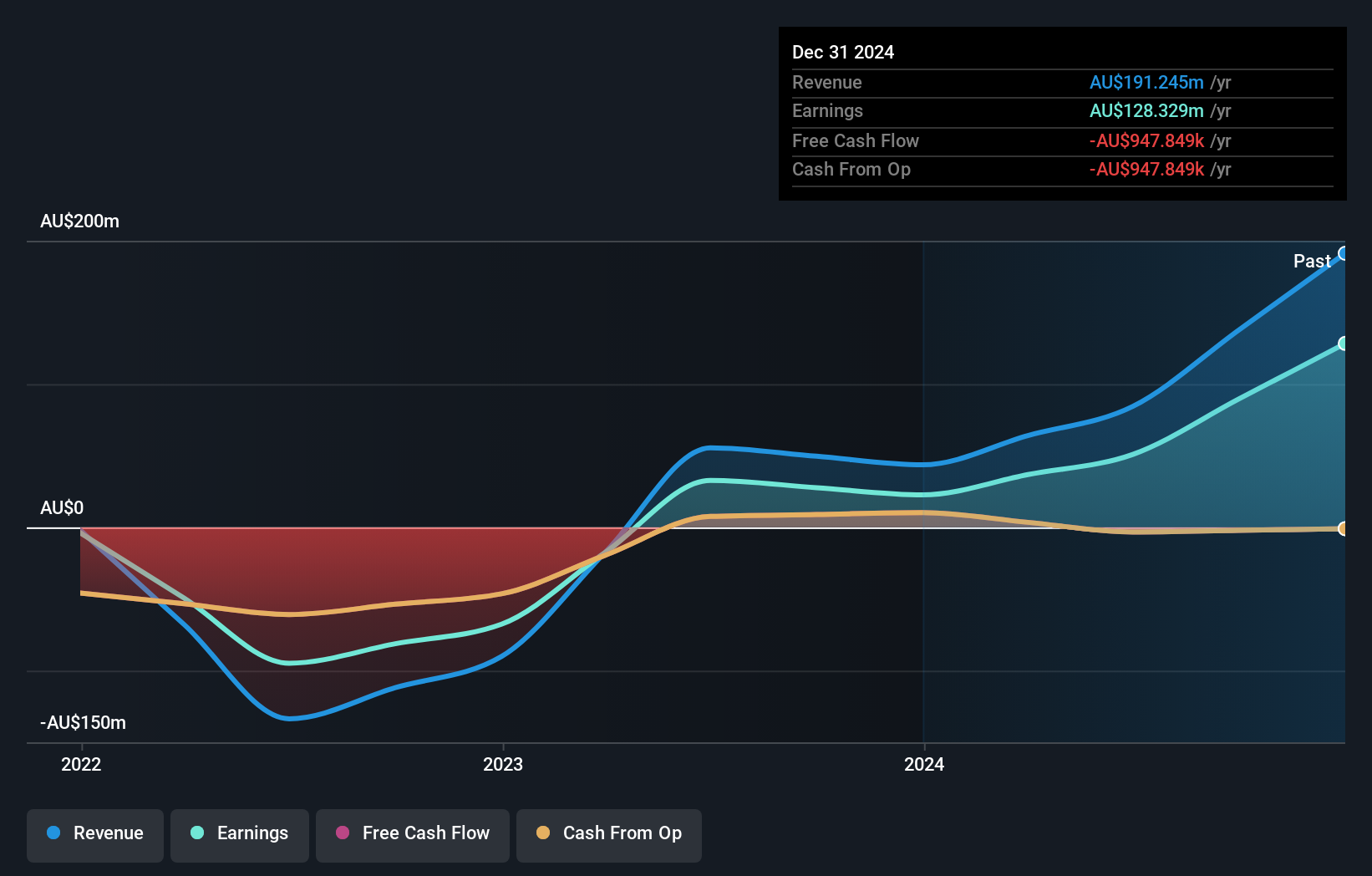

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian investment company that leverages the expertise of leading fund managers to invest in a concentrated portfolio of high-conviction ideas, with a market cap of A$721.29 million.

Operations: The primary revenue for Hearts and Minds Investments comes from investment activities, amounting to A$84.39 million. The company has a market capitalization of A$721.29 million.

Hearts and Minds Investments, a nimble player in the investment space, has showcased robust earnings growth of 56% over the past year, outpacing the industry average of 16%. The company boasts a low price-to-earnings ratio of 14x compared to the Australian market's 20x, suggesting potential undervaluation. Despite an increase in its debt-to-equity ratio from 0% to just 1% over five years, it maintains more cash than total debt. With interest payments comfortably covered by EBIT at an astronomical rate of nearly A$13.80 million times, financial stability seems assured even as free cash flow remains negative.

Summing It All Up

- Discover the full array of 57 ASX Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hearts and Minds Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HM1

Hearts and Minds Investments

Proven track record with adequate balance sheet.