- Australia

- /

- Trade Distributors

- /

- ASX:EHL

Discovering 3 Hidden Australian Stocks With Strong Potential

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, yet over the past 12 months, it has risen by 7.2%, with earnings projected to grow by 11% per annum in the coming years. In this context of steady growth and promising forecasts, identifying stocks with strong potential often involves looking beyond well-known names to uncover hidden gems that may offer unique opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Carlton Investments | 0.02% | 9.10% | 8.68% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited provides surface and underground mining equipment rental and related services in Australia, with a market capitalization of approximately A$609.67 million.

Operations: Emeco Holdings generates revenue primarily from equipment rental, contributing A$615.39 million, and workshops, adding A$273.47 million. The company's financial performance includes a net profit margin trend worth noting for its impact on overall profitability.

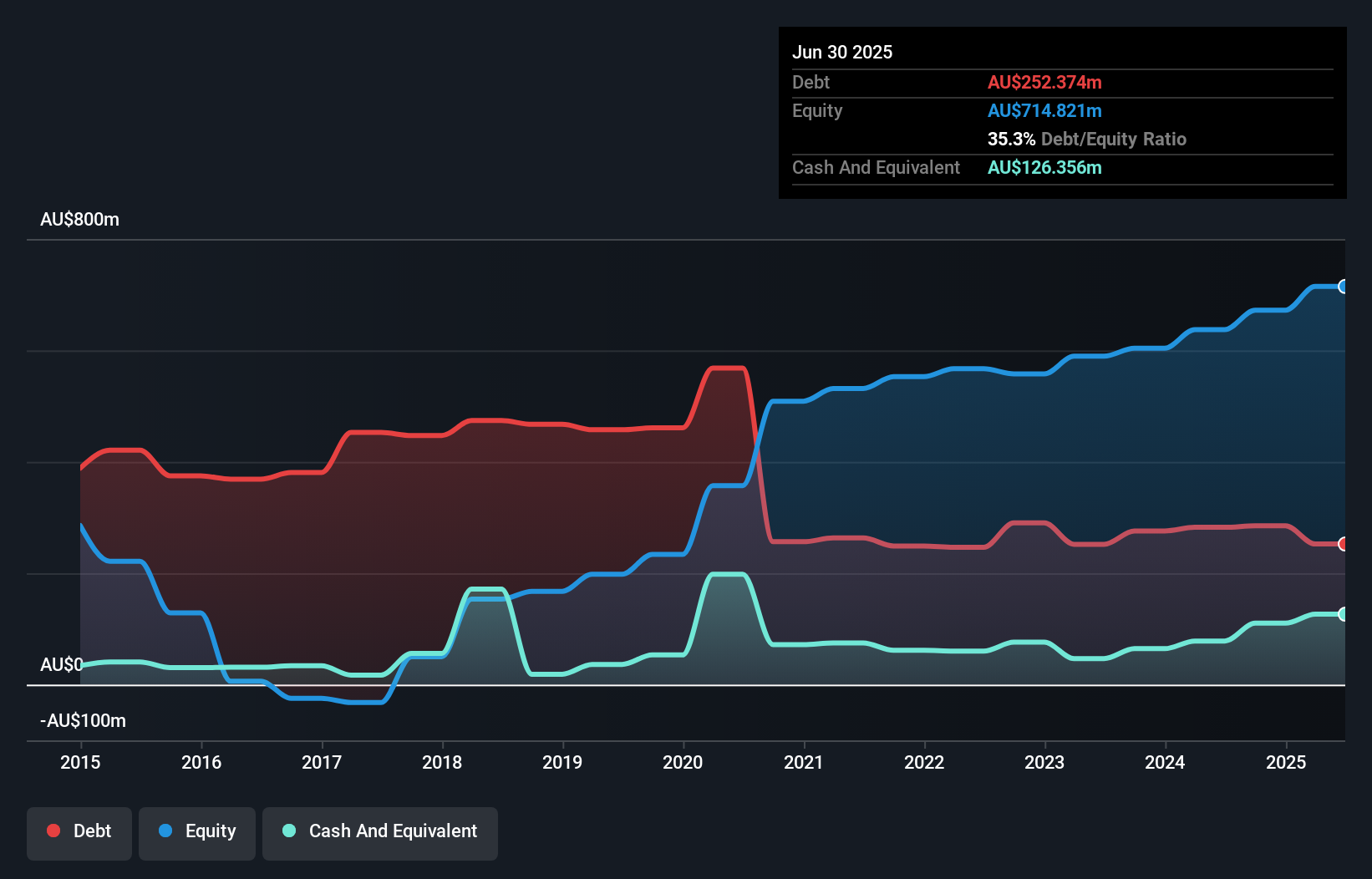

Emeco Holdings, a small player in the equipment rental industry, has seen its earnings grow by 42.7% over the past year, outpacing the Trade Distributors industry growth of 17.1%. The company's debt to equity ratio has improved significantly from 159.1% to 35.3% over five years, indicating better financial health. Emeco's net income rose to A$75.14 million for the year ending June 2025 from A$52.66 million previously, reflecting strong profitability despite sales dropping slightly to A$785.35 million from A$822.73 million last year due to market challenges and evolving industry demands toward electrification and automation.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★★

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.84 billion.

Operations: MFF Capital Investments generates revenue primarily from its equity investments, amounting to A$631.43 million. The firm has a market capitalization of A$2.84 billion, reflecting its substantial presence in the investment management sector.

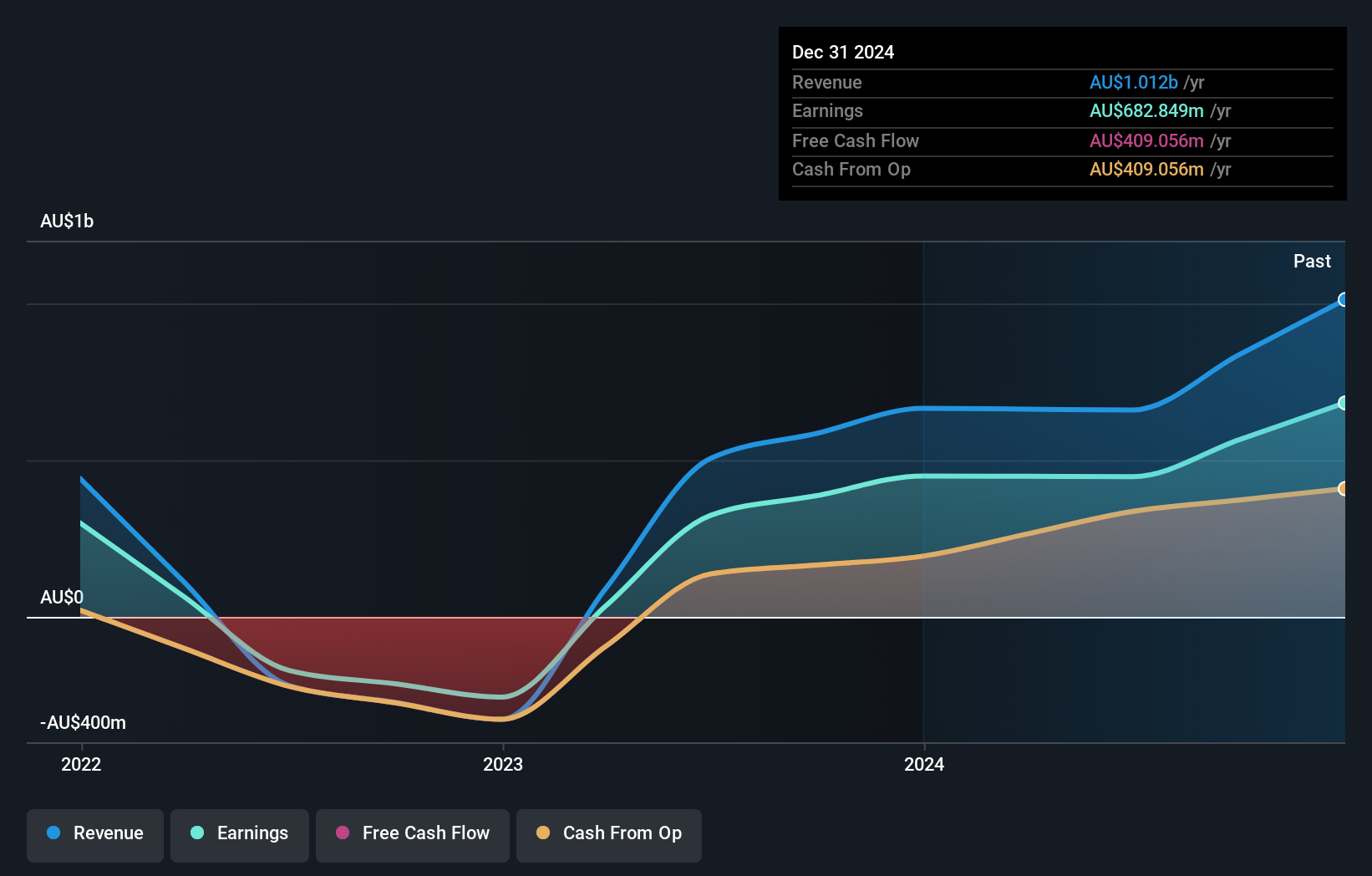

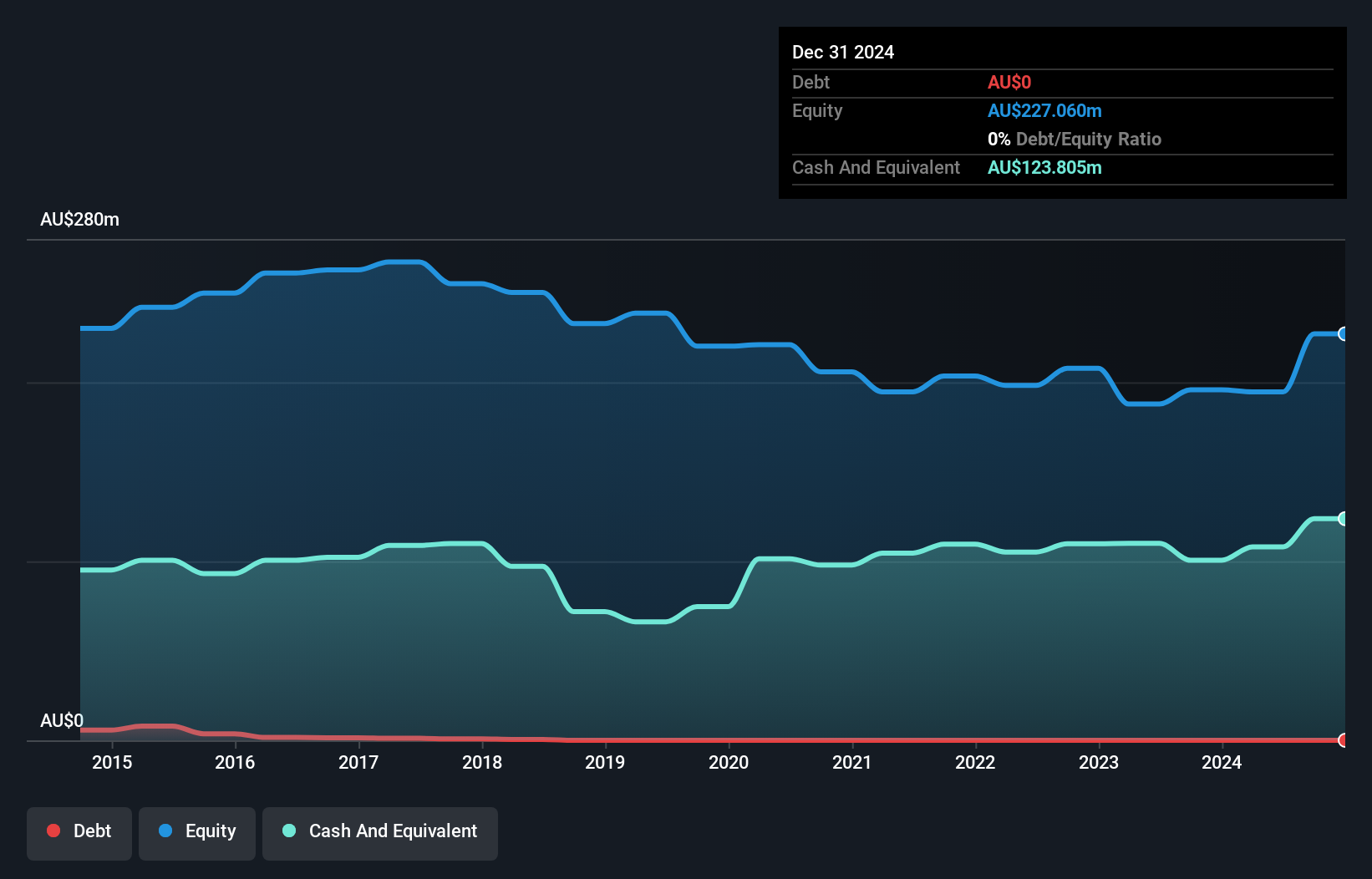

MFF Capital Investments stands out with its debt-free status and high-quality earnings, offering a solid foundation for investors. Despite a slight dip in net income to A$431.97 million from A$447.36 million last year, the company remains profitable with positive free cash flow of A$336.49 million as of June 2025. Trading at 66% below estimated fair value suggests potential upside, though recent negative earnings growth of -3.4% lags behind the industry average of 5.9%. Leadership changes include Kirsten Morton as CFO and Matthew Githens as Chief Risk Officer, bringing extensive experience in finance and risk management to the team.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited operates internationally, offering executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$726.41 million.

Operations: Revenue for Servcorp comes primarily from real estate rental, amounting to A$349.86 million. The company's net profit margin is a key financial indicator to consider when evaluating its profitability.

Servcorp, a nimble player in Australia's business services sector, showcases robust financial health with no debt and consistent earnings growth of 29.5% annually over the past five years. The company reported net income of A$53.12 million for the year ending June 2025, up from A$39.04 million previously, reflecting its strategic expansion into Japan and UAE markets. Trading at a significant discount to its fair value estimate, Servcorp's shares are priced attractively at A$7.2 per share according to analysts' consensus targets. Despite strong performance indicators and high-quality earnings, potential investors should weigh operational cost challenges and market competition risks carefully before proceeding further.

Key Takeaways

- Access the full spectrum of 51 ASX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emeco Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EHL

Emeco Holdings

Engages in the provision of surface and underground mining equipment rental, complementary equipment, and mining services in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion