Last Update 21 Aug 25

Fair value Increased 11%The consensus analyst price target for Emeco Holdings has increased to A$1.23, primarily driven by an improved revenue growth outlook and a modest uptick in future earnings multiples.

Valuation Changes

Summary of Valuation Changes for Emeco Holdings

- The Consensus Analyst Price Target has significantly risen from A$1.10 to A$1.23.

- The Consensus Revenue Growth forecasts for Emeco Holdings has significantly risen from 2.8% per annum to 5.3% per annum.

- The Future P/E for Emeco Holdings has risen slightly from 8.35x to 8.76x.

Key Takeaways

- Expansion into ESG-compliant equipment and digital services positions Emeco for sustainable revenue growth, improved margins, and greater operational efficiency.

- Strong rental contract pipeline and disciplined capital management underpin earnings stability, enhanced profitability, and financial flexibility for future market share gains.

- Heavy reliance on traditional mining, high capital needs, refinancing risks, and slow adaptation to industry shifts pose threats to profitability and long-term viability.

Catalysts

About Emeco Holdings- Engages in the provision of surface and underground mining equipment rental, complementary equipment, and mining services in Australia.

- Ongoing expansion and integration of maintenance and asset management services, along with increased adoption of battery-powered and low-emission fleets, positions Emeco to benefit from customer demand for modern, ESG-compliant equipment, likely boosting both revenue and margins.

- Investments in digitalization, automation, and telematics are driving operational efficiency and data-driven maintenance solutions, which should improve cost structure, enhance customer value-add, and result in rising net margins over time.

- Robust growth in recurring, higher-margin fully maintained rental contracts, supported by extensions with major customers and a strong pipeline across all commodity classes, is expected to underpin revenue growth and earnings stability.

- Growing utilization rates, especially in the underground fleet (with management targeting 80%+), combined with disciplined CapEx and asset optimization, are set to increase asset returns, free cash flow, and overall profitability.

- Significant deleveraging and improving return on capital provide financial flexibility to pursue new opportunities-enabling further market share gains as mining operators increase outsourcing and seek reliable partners, which is likely to positively impact future earnings and return on equity.

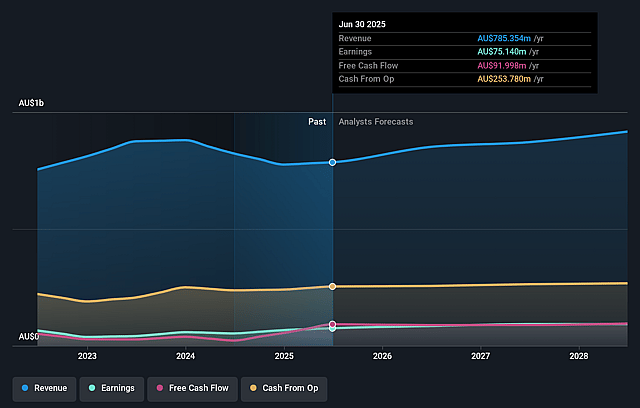

Emeco Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Emeco Holdings's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.6% today to 10.1% in 3 years time.

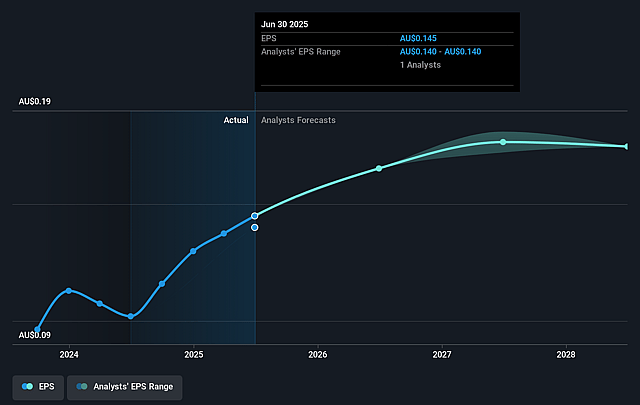

- Analysts expect earnings to reach A$92.7 million (and earnings per share of A$0.17) by about September 2028, up from A$75.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, up from 7.2x today. This future PE is lower than the current PE for the AU Trade Distributors industry at 16.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Emeco Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Emeco remains highly exposed to the Australian mining sector, including significant legacy and potential future exposure to thermal coal, which faces long-term structural decline and decarbonization pressures-potentially reducing revenue opportunities and utilization rates over time.

- While management highlights robust fleet utilization and margin expansion, the business remains capital intensive, requiring ongoing high levels of sustaining CapEx to maintain and rebuild equipment, which could constrain long-term free cash flow and pressure net margins if demand softens or costs rise.

- The upcoming maturity of $250 million in fixed-rate notes in July 2026 and reliance on favorable refinancing conditions exposes Emeco to refinancing risk-increased interest rates or a less supportive credit market could materially raise finance costs and reduce net profit.

- The text shows positive short-term trends in underground equipment utilization, but low utilization rates (currently 65%, with a goal to reach ~80%), highlight the inherent risk of revenue and earnings volatility if market demand for underground mining does not continue to recover as projected.

- The sector is experiencing accelerating shifts towards electrification, automation, and heightened ESG requirements; although Emeco reports some early steps in repositioning (e.g., battery-powered fleet rebuilds), slow adaptation could lead to asset obsolescence, client loss, and regulatory headwinds impacting both revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.227 for Emeco Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.4, and the most bearish reporting a price target of just A$1.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$916.6 million, earnings will come to A$92.7 million, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 8.7%.

- Given the current share price of A$1.05, the analyst price target of A$1.23 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.