- Australia

- /

- Trade Distributors

- /

- ASX:EHL

ASX Penny Stocks Spotlight: Accent Group And 2 Other Promising Picks

Reviewed by Simply Wall St

The ASX200 is poised to open slightly higher, reflecting a cautious stance influenced by Wall Street's response to ongoing US-China trade negotiations. In this climate of uncertainty, investors often seek opportunities that balance risk and potential reward. Penny stocks, though considered a niche area, can offer such opportunities by providing access to smaller or newer companies with growth potential. As we explore these investment options, it's important to recognize that some penny stocks may combine affordability with strong financial health, making them compelling considerations for those looking beyond traditional market players.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.60 | A$128.87M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.09 | A$154.26M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.565 | A$73.83M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.45 | A$377.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$117.3M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.30 | A$2.62B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$161.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.825 | A$613.5M | ✅ 4 ⚠️ 3 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$2.96 | A$244.91M | ✅ 3 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.55 | A$1.17B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 987 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$1.02 billion.

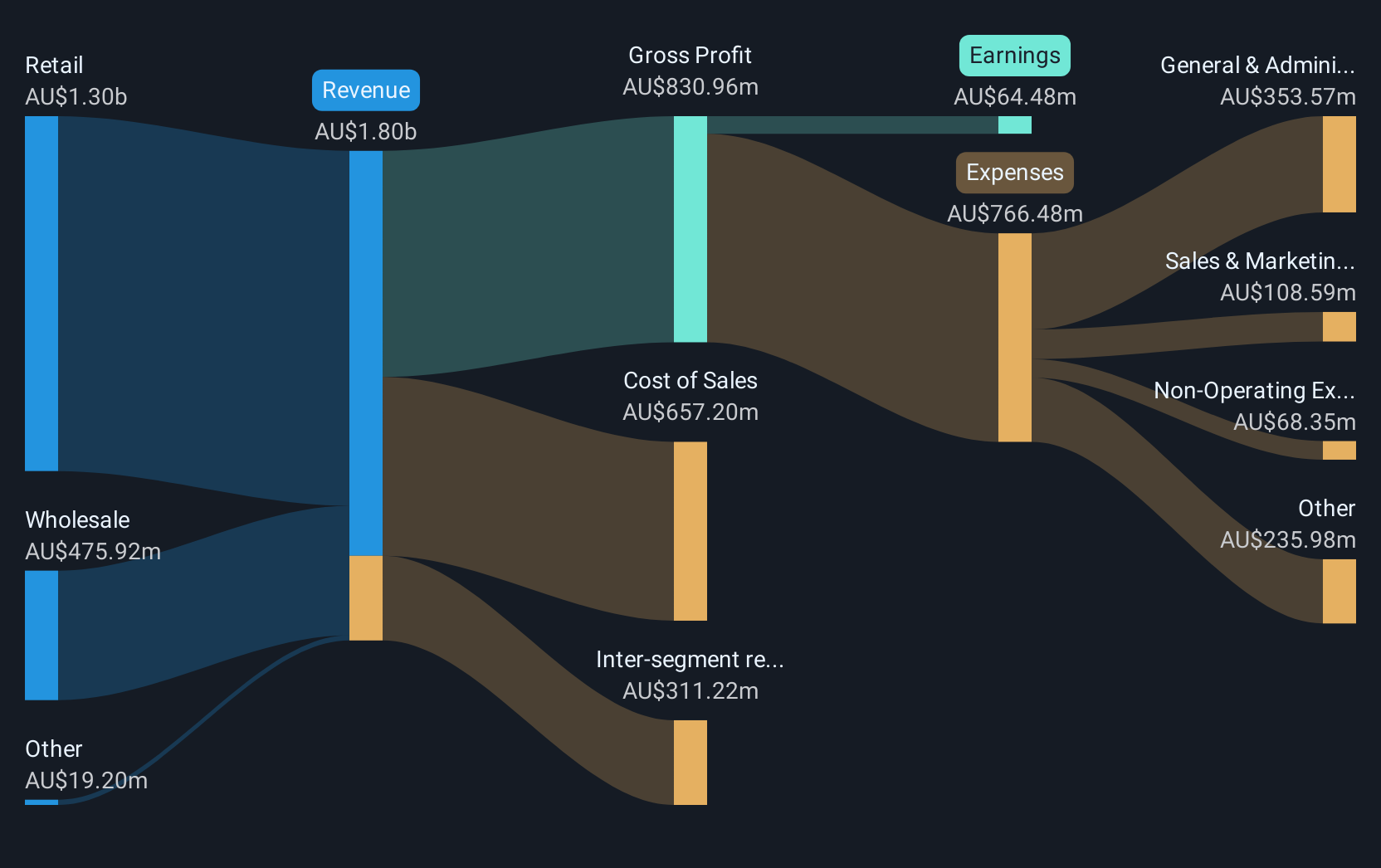

Operations: Accent Group generates revenue primarily through its retail segment, which accounts for A$1.30 billion, and its wholesale segment, contributing A$475.92 million.

Market Cap: A$1.02B

Accent Group's recent strategic retail partnership with Frasers Group to launch Sports Direct in Australia and New Zealand highlights a significant growth opportunity, potentially enhancing its market presence and access to global brands. Despite a stable weekly volatility of 5% over the past year, Accent faces challenges such as negative earnings growth and declining profit margins. Its debt levels have increased but remain satisfactorily covered by operating cash flow. The management team is experienced, though the board is relatively new. Analysts suggest potential price appreciation, indicating perceived undervaluation relative to peers and industry standards.

- Dive into the specifics of Accent Group here with our thorough balance sheet health report.

- Assess Accent Group's future earnings estimates with our detailed growth reports.

Emeco Holdings (ASX:EHL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emeco Holdings Limited offers surface and underground mining equipment rental, along with complementary equipment and mining services in Australia, with a market cap of A$388.44 million.

Operations: The company's revenue is derived from two primary segments: Rental, generating A$579.43 million, and Workshops, contributing A$292.97 million.

Market Cap: A$388.44M

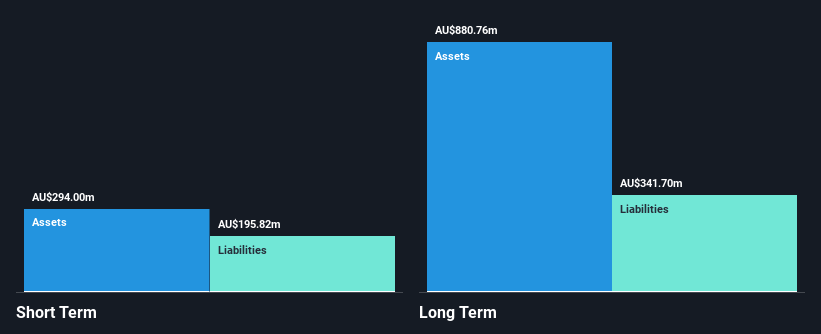

Emeco Holdings Limited demonstrates a solid financial footing with its A$388.44 million market cap and diversified revenue streams from Rental (A$579.43 million) and Workshops (A$292.97 million). The company reported a net income increase to A$33.58 million for the half year ending December 2024, reflecting improved profit margins from 6.6% to 8.6%. While short-term liabilities are well-covered by assets, long-term liabilities exceed them slightly, posing a risk factor. Emeco's debt management is commendable with reduced leverage over five years and interest payments well-covered by EBIT, suggesting prudent financial oversight despite an inexperienced board.

- Click to explore a detailed breakdown of our findings in Emeco Holdings' financial health report.

- Understand Emeco Holdings' earnings outlook by examining our growth report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market cap of A$366.98 million.

Operations: The company's revenue is primarily derived from its Payments segment, which generated A$464.66 million, while the Banking segment contributed A$14.88 million.

Market Cap: A$366.98M

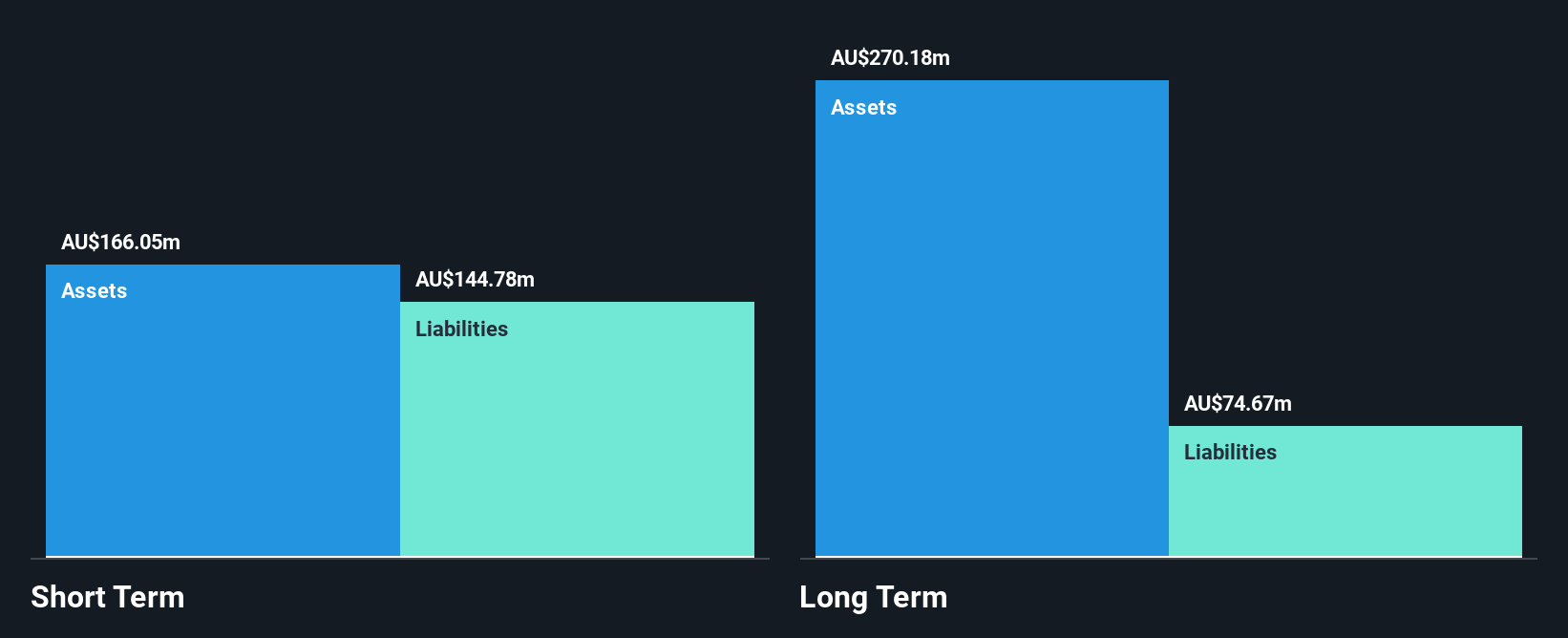

Tyro Payments Limited, with a market cap of A$366.98 million, has shown significant financial growth, achieving profitability over the past five years and maintaining a debt-free status. For the half year ending December 2024, Tyro reported revenue of A$248.31 million and net income doubling to A$10.26 million from the previous year. The company's short-term assets comfortably cover both its short- and long-term liabilities, indicating strong liquidity management. Despite low return on equity at 14.2%, Tyro's earnings growth outpaced industry averages last year, although future earnings are expected to decline slightly by 2.3% annually over three years.

- Navigate through the intricacies of Tyro Payments with our comprehensive balance sheet health report here.

- Explore Tyro Payments' analyst forecasts in our growth report.

Make It Happen

- Unlock our comprehensive list of 987 ASX Penny Stocks by clicking here.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emeco Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EHL

Emeco Holdings

Provides surface and underground mining equipment rental, complementary equipment, and mining services in Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives