- Australia

- /

- Commercial Services

- /

- ASX:MAD

3 Undiscovered Gems In Australia With Promising Potential

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 closing up 0.92% at 8,070 points, driven by strong performances in the Energy and Utilities sectors. As investors navigate these dynamic conditions, identifying undiscovered gems can be crucial for tapping into promising opportunities that align with current economic trends and sector strengths.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited is an Australian company that offers rental and complementary services for surface and underground mining equipment, with a market capitalization of approximately A$393.58 million.

Operations: Emeco generates revenue primarily from its Rental segment, contributing A$579.43 million, and Workshops, adding A$292.97 million. The company's cost structure and financial performance are influenced by these revenue streams.

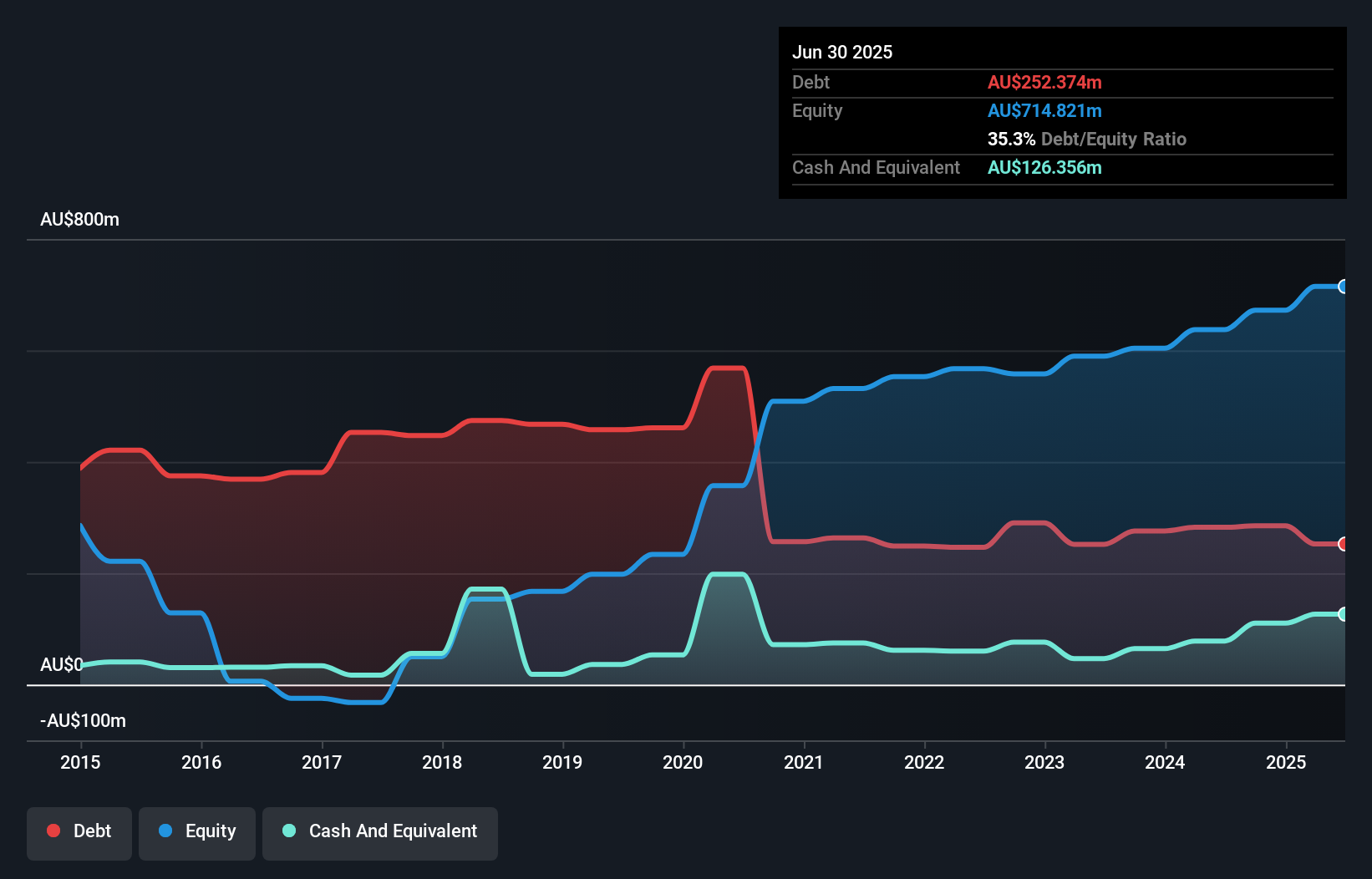

Emeco Holdings, a mining equipment rental and services provider in Australia, has shown promising signs of growth. Over the past year, earnings grew by 15.1%, outpacing the Trade Distributors industry at 12.1%. The company trades at a notable discount, about 56% below estimated fair value, suggesting potential for value investors. Emeco's debt to equity ratio improved significantly from 197% to 42% over five years, reflecting disciplined capital management. Recent earnings reported A$33.58 million net income for half-year ending December 2024 compared to A$19.4 million previously, indicating robust financial health despite sales dipping slightly from A$434 million to A$387 million year-on-year.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★★★

Overview: Mader Group Limited is a contracting company that delivers specialist technical services across the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of approximately A$1.27 billion.

Operations: Mader Group's primary revenue stream is from its Staffing & Outsourcing Services, generating A$811.54 million.

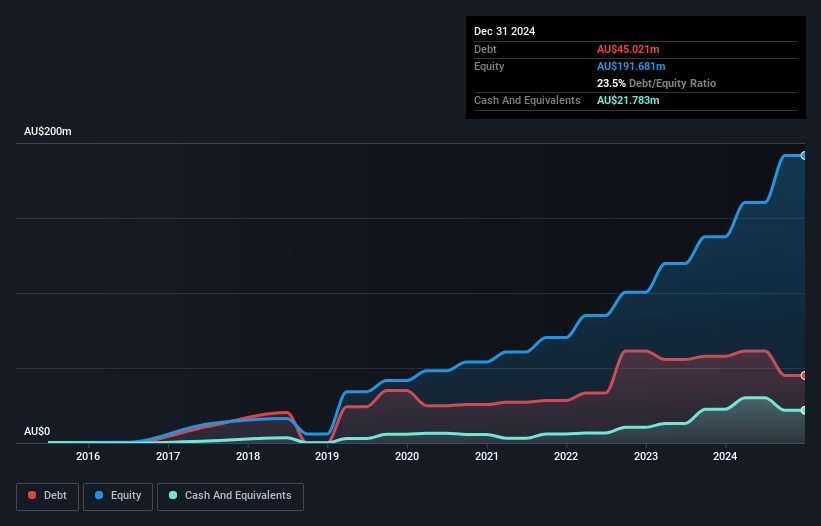

Mader Group, a nimble player in technical services for mining and energy sectors, is making waves with its robust financial health and strategic expansion plans. The company recently declared an interim dividend of A$8.1 million, reflecting a 31% payout ratio from net profits. Its earnings grew by 15% last year, outpacing the industry average of 6%. Mader's debt to equity ratio impressively decreased from 84% to 24% over five years, showcasing effective debt management. With earnings forecasted to grow annually by about 13%, Mader seems poised for continued success despite market challenges like labor instability and safety concerns.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments, trading as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of approximately A$845.39 million.

Operations: HFA Holdings Limited generates revenue primarily through its Lighthouse segment, which contributes approximately $137.95 million. The company has a market capitalization of about A$845.39 million.

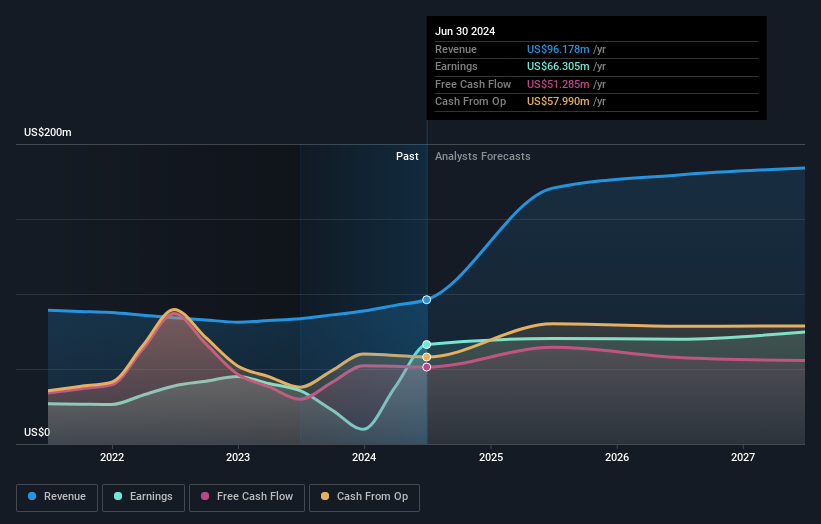

Navigator Global Investments, a nimble player in the financial sector, has shown impressive earnings growth of 306.8% over the past year, significantly outpacing its industry peers. Despite this surge, it's crucial to note that a substantial one-off gain of US$53.8 million influenced these results. With revenue for H1 2025 at US$148.06 million compared to last year's US$105.9 million and net income climbing from US$9.98 million to US$68.79 million, Navigator is trading at an attractive value—53% below fair estimates—but faces potential earnings volatility due to dependence on performance fees and forecasted declines averaging 11% annually over three years.

Key Takeaways

- Get an in-depth perspective on all 51 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives