- Australia

- /

- Electrical

- /

- ASX:ECL

If EPS Growth Is Important To You, Excelsior Capital (ASX:ECL) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Excelsior Capital (ASX:ECL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Excelsior Capital

Excelsior Capital's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Excelsior Capital has managed to grow EPS by 34% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

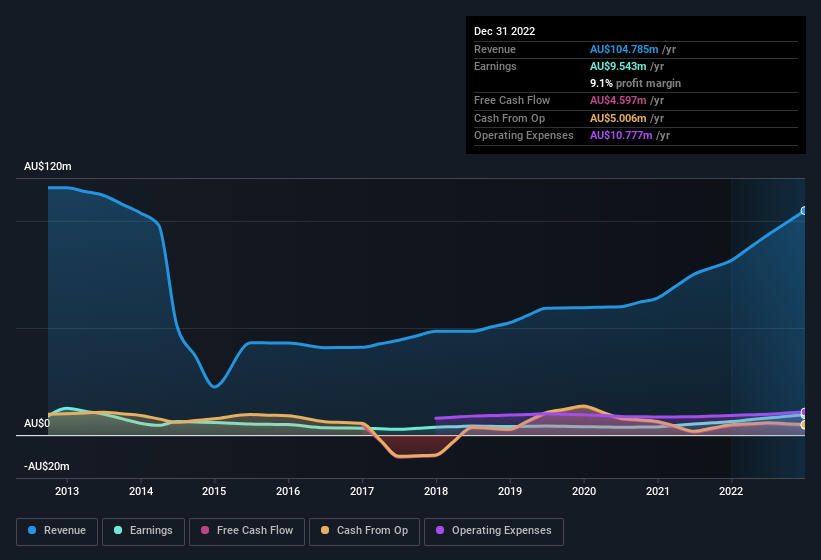

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Excelsior Capital remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 29% to AU$105m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Excelsior Capital isn't a huge company, given its market capitalisation of AU$74m. That makes it extra important to check on its balance sheet strength.

Are Excelsior Capital Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Excelsior Capital shareholders is that no insiders reported selling shares in the last year. Add in the fact that Peter E. Murray, the company insider of the company, paid AU$72k for shares at around AU$2.06 each. It seems that at least one insider is prepared to show the market there is potential within Excelsior Capital.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Excelsior Capital will reveal that insiders own a significant piece of the pie. In fact, they own 60% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at AU$44m at the current share price. So there's plenty there to keep them focused!

Should You Add Excelsior Capital To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Excelsior Capital's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 1 warning sign for Excelsior Capital that we have uncovered.

The good news is that Excelsior Capital is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Excelsior Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ECL

Excelsior Capital

Invests in direct and indirect investments and listed and unlisted instruments in Australia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives