For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Excelsior Capital (ASX:ECL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Excelsior Capital

Excelsior Capital's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Excelsior Capital's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

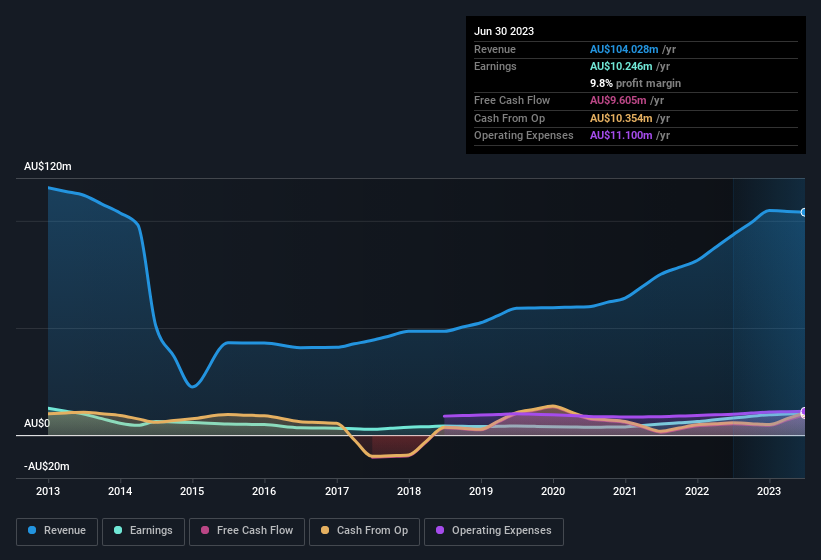

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Excelsior Capital maintained stable EBIT margins over the last year, all while growing revenue 11% to AU$104m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Excelsior Capital isn't a huge company, given its market capitalisation of AU$93m. That makes it extra important to check on its balance sheet strength.

Are Excelsior Capital Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Excelsior Capital shares, in the last year. With that in mind, it's heartening that Peter E. Murray, the company insider of the company, paid AU$72k for shares at around AU$2.06 each. It seems that at least one insider is prepared to show the market there is potential within Excelsior Capital.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Excelsior Capital will reveal that insiders own a significant piece of the pie. In fact, they own 58% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about AU$53m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add Excelsior Capital To Your Watchlist?

Excelsior Capital's earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Excelsior Capital deserves timely attention. We don't want to rain on the parade too much, but we did also find 1 warning sign for Excelsior Capital that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Excelsior Capital, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Excelsior Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ECL

Excelsior Capital

Invests in direct and indirect investments and listed and unlisted instruments in Australia.

Flawless balance sheet with acceptable track record.