- Australia

- /

- Capital Markets

- /

- ASX:NGI

Undiscovered Gems in Australia to Watch This September 2024

Reviewed by Simply Wall St

The Australian market has shown robust performance, with the Materials sector gaining 9.0% while the overall market remained flat last week, and a notable 16% increase over the past year. In light of these conditions and expected earnings growth of 12% per annum over the next few years, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

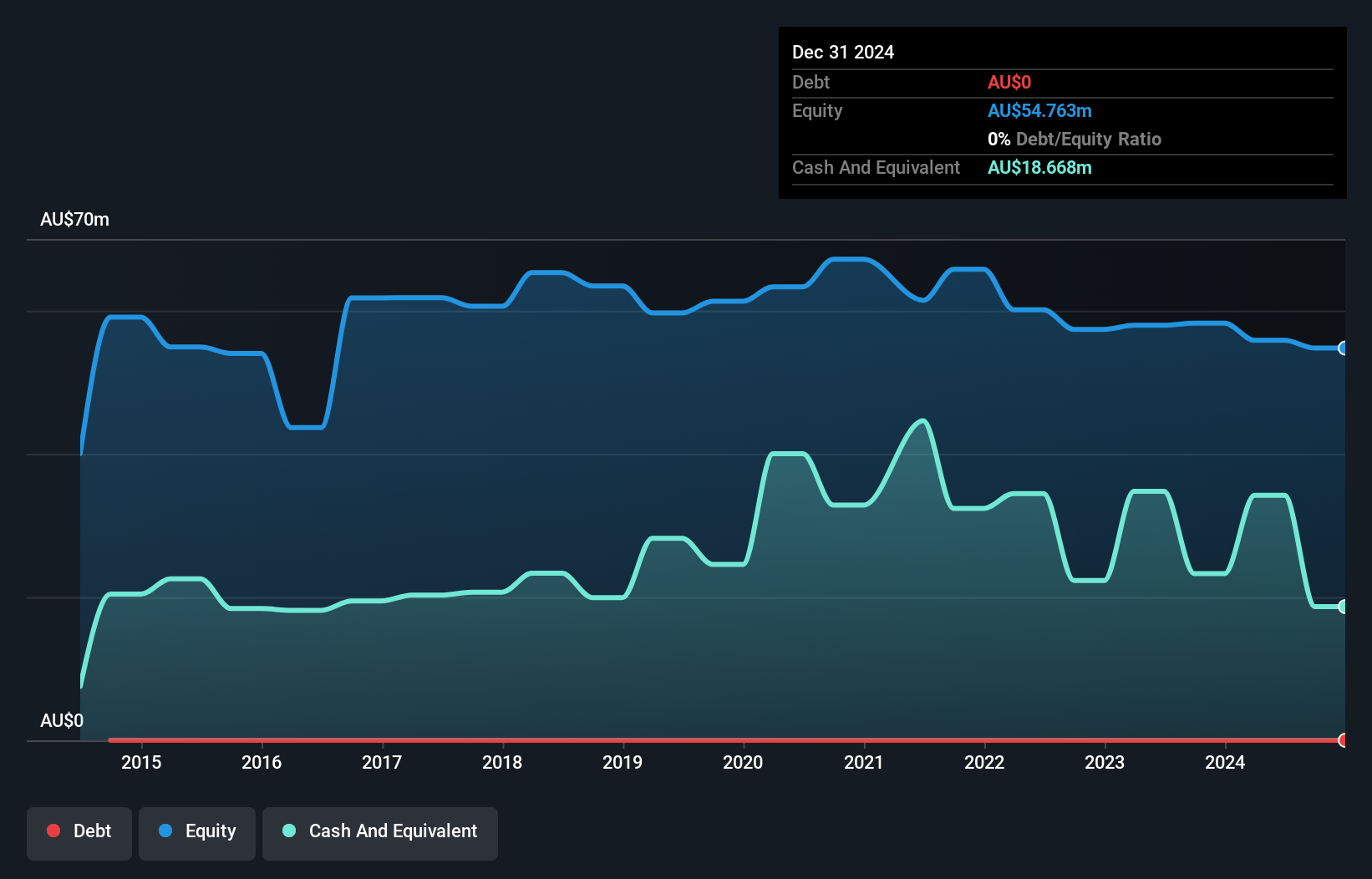

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States with a market cap of A$1.19 billion.

Operations: DroneShield generates revenue primarily from its Aerospace & Defense segment, which totals A$67.52 million. The company focuses on developing and commercializing hardware and software for drone detection and security in key markets such as Australia and the United States.

DroneShield has demonstrated impressive earnings growth of 612.7% over the past year, significantly outpacing the Aerospace & Defense industry’s 14.4%. Despite this, shareholders experienced dilution in the past year and its share price has been highly volatile over the last three months. The company is trading at 49% below its estimated fair value and remains debt-free, a notable improvement from five years ago when its debt to equity ratio was 41.5%.

- Unlock comprehensive insights into our analysis of DroneShield stock in this health report.

Understand DroneShield's track record by examining our Past report.

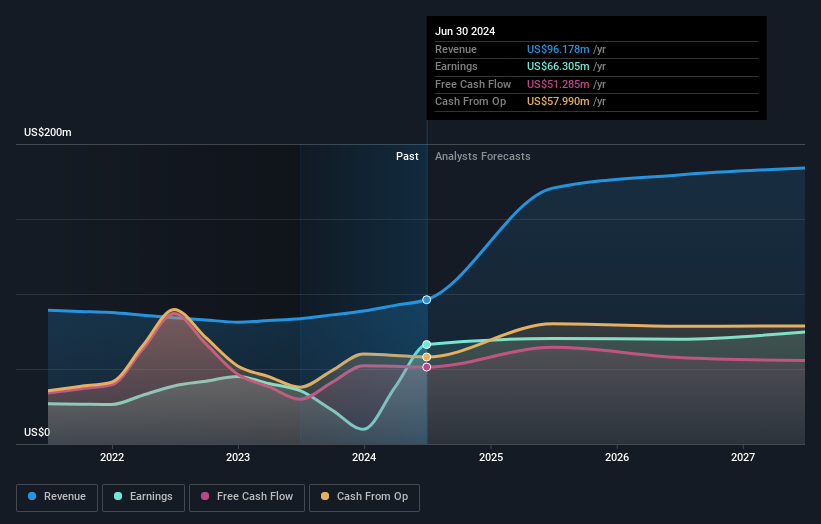

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments (ASX:NGI) is a fund management company based in Australia with a market cap of A$852.74 million.

Operations: Navigator Global Investments generates revenue primarily from its Lighthouse segment, which contributed $95.93 million. The company also reported a minor contribution of $0.25 million from corporate and adjustments activities.

Navigator Global Investments (NGI) stands out with a notable earnings growth of 86.7% over the past year, significantly outperforming the Capital Markets industry’s 17.2%. The company reported net income of US$66.31 million for the year ending June 30, 2024, up from US$35.51 million previously. Trading at approximately 44.8% below its estimated fair value and being debt-free further enhances its appeal as an undervalued investment opportunity in Australia’s financial sector.

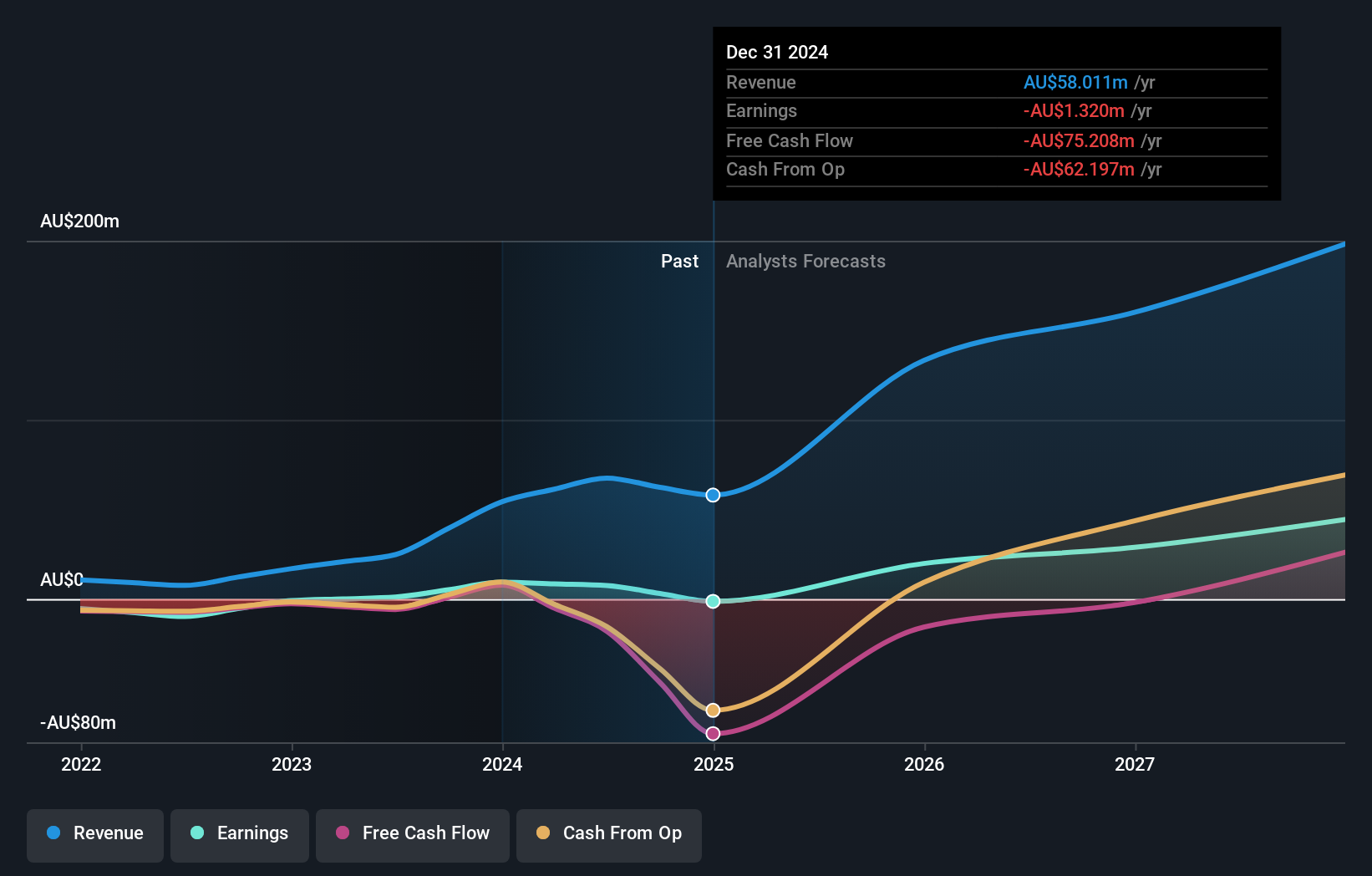

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Value Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$664.30 million.

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment (A$72.67 million) and Advisory segment (A$31.41 million).

RPMGlobal Holdings, with a market cap under A$500 million, has shown impressive growth. The company reported revenue of A$104.19 million for the year ending June 30, 2024, up from A$91.56 million the previous year. Net income also surged to A$8.66 million from A$3.69 million last year, reflecting high-quality earnings and no debt over the past five years. Additionally, RPMGlobal's earnings per share doubled to A$0.038 from A$0.016 in 2023.

- Get an in-depth perspective on RPMGlobal Holdings' performance by reading our health report here.

Examine RPMGlobal Holdings' past performance report to understand how it has performed in the past.

Summing It All Up

- Click through to start exploring the rest of the 53 ASX Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with excellent balance sheet.