- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield Limited's (ASX:DRO) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- DroneShield's Annual General Meeting to take place on 28th of May

- Salary of AU$663.3k is part of CEO Oleg Vornik's total remuneration

- The overall pay is 945% above the industry average

- DroneShield's total shareholder return over the past three years was 455% while its EPS grew by 97% over the past three years

Under the guidance of CEO Oleg Vornik, DroneShield Limited (ASX:DRO) has performed reasonably well recently. As shareholders go into the upcoming AGM on 28th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for DroneShield

Comparing DroneShield Limited's CEO Compensation With The Industry

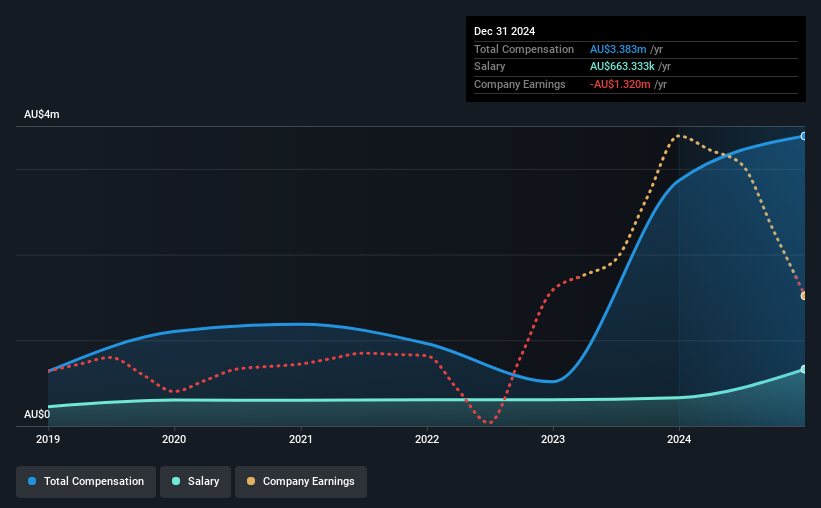

According to our data, DroneShield Limited has a market capitalization of AU$1.1b, and paid its CEO total annual compensation worth AU$3.4m over the year to December 2024. Notably, that's an increase of 18% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$663k.

In comparison with other companies in the Australia Aerospace & Defense industry with market capitalizations ranging from AU$624m to AU$2.5b, the reported median CEO total compensation was AU$324k. Accordingly, our analysis reveals that DroneShield Limited pays Oleg Vornik north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$663k | AU$330k | 20% |

| Other | AU$2.7m | AU$2.5m | 80% |

| Total Compensation | AU$3.4m | AU$2.9m | 100% |

Speaking on an industry level, nearly 41% of total compensation represents salary, while the remainder of 59% is other remuneration. It's interesting to note that DroneShield allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

DroneShield Limited's Growth

DroneShield Limited has seen its earnings per share (EPS) increase by 97% a year over the past three years. In the last year, its revenue is up 7.0%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has DroneShield Limited Been A Good Investment?

Most shareholders would probably be pleased with DroneShield Limited for providing a total return of 455% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for DroneShield that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives