- Australia

- /

- Renewable Energy

- /

- ASX:LGI

ASX Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As the Australian market experiences a brief pause in its upward momentum, with the S&P/ASX 200 index showing slight fluctuations amidst global uncertainties, investors are keenly observing potential opportunities. Penny stocks, though often seen as a throwback term, remain relevant for those looking to explore growth prospects at relatively lower price points. These smaller or newer companies can offer unique opportunities when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.52 | A$149.03M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.18 | A$102.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.79 | A$431.41M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.40 | A$250.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.24M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.48 | A$368.9M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.41 | A$1.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$375.39M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 443 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

DroneShield (ASX:DRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$2.81 billion.

Operations: DroneShield's revenue is derived from its Aerospace & Defense segment, which generated A$107.17 million.

Market Cap: A$2.81B

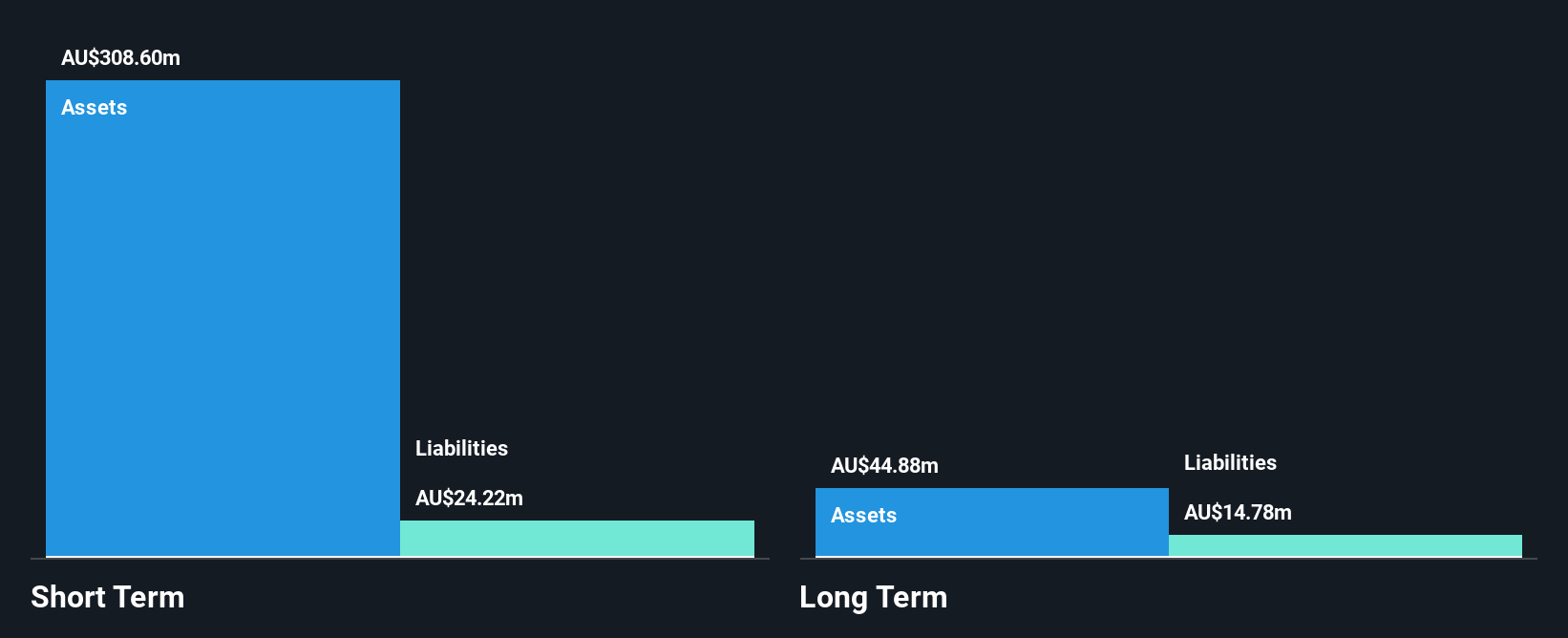

DroneShield Limited, a company in the Aerospace & Defense sector, has shown significant revenue growth with A$72.32 million reported for the first half of 2025, up from A$23.31 million the previous year. Despite its volatile share price and low return on equity at 1.8%, DroneShield remains debt-free and has strong short-term assets covering both short and long-term liabilities. The company's net profit margin decreased to 5.2% from last year's 11.3%. However, it achieved profitability with a net income of A$2.12 million compared to a loss last year, indicating potential for future earnings growth amidst high volatility.

- Get an in-depth perspective on DroneShield's performance by reading our balance sheet health report here.

- Explore DroneShield's analyst forecasts in our growth report.

Judo Capital Holdings (ASX:JDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Judo Capital Holdings Limited, with a market cap of A$1.93 billion, provides banking products and services to small and medium businesses in Australia through its subsidiaries.

Operations: The company generates revenue primarily through its Small and Medium Enterprises (SMEs) Lending segment, which accounted for A$347.4 million.

Market Cap: A$1.93B

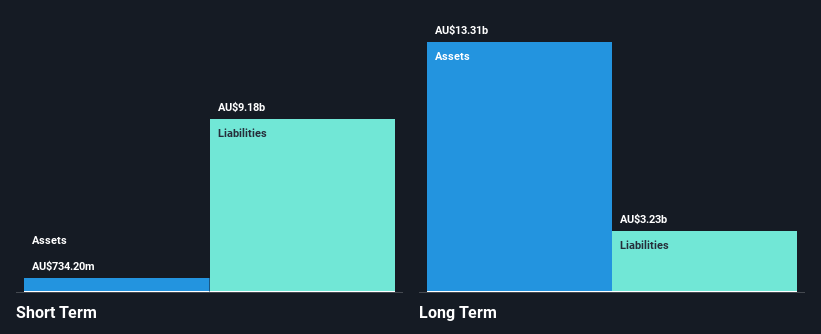

Judo Capital Holdings Limited demonstrates a solid financial foundation with its revenue primarily driven by the SME Lending segment, generating A$347.4 million. The company has not diluted shareholders recently and maintains appropriate loan levels, supported by low-risk funding sources like customer deposits. Despite a high level of bad loans at 3.4%, Judo's earnings have grown 23.6% over the past year, outpacing industry averages and improving net profit margins to 24.9%. The recent earnings report shows an increase in net income to A$86.4 million, reflecting continued profitability and growth potential in a competitive market environment.

- Jump into the full analysis health report here for a deeper understanding of Judo Capital Holdings.

- Assess Judo Capital Holdings' future earnings estimates with our detailed growth reports.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited is an Australian company specializing in carbon abatement and renewable energy solutions using biogas from landfill, with a market cap of A$349.02 million.

Operations: The company's revenue is primarily derived from Carbon Abatement (A$17.29 million), Renewable Energy (A$17.08 million), and Infrastructure Construction and Management (A$2.37 million).

Market Cap: A$349.02M

LGI Limited, with a market cap of A$349.02 million, focuses on carbon abatement and renewable energy solutions. The company recently announced a contract to explore a 12MW/24MWh battery energy storage system at Belrose landfill, aligning with its strategy to expand flexible electricity generation assets. LGI's financials reveal stable revenue growth from A$33.25 million to A$36.78 million over the past year despite negative earnings growth and reduced profit margins from 20.1% to 17.6%. Although debt levels have decreased significantly over five years, short-term assets do not cover long-term liabilities, posing potential financial challenges.

- Unlock comprehensive insights into our analysis of LGI stock in this financial health report.

- Review our growth performance report to gain insights into LGI's future.

Key Takeaways

- Explore the 443 names from our ASX Penny Stocks screener here.

- Want To Explore Some Alternatives? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGI

LGI

Provides carbon abatement and renewable energy solutions with biogas from landfill in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives