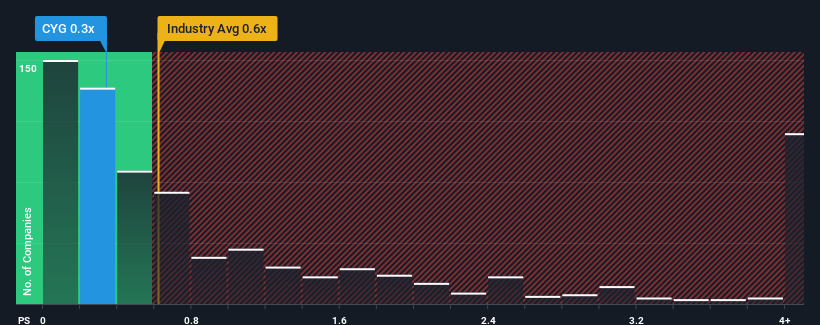

When close to half the companies operating in the Trade Distributors industry in Australia have price-to-sales ratios (or "P/S") above 1.7x, you may consider Coventry Group Ltd (ASX:CYG) as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Coventry Group

What Does Coventry Group's Recent Performance Look Like?

Recent revenue growth for Coventry Group has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Coventry Group will be hoping that this isn't the case.

Keen to find out how analysts think Coventry Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Coventry Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.4% last year. Revenue has also lifted 29% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.6% per year during the coming three years according to the one analyst following the company. With the industry predicted to deliver 5.1% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Coventry Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Coventry Group's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Coventry Group remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 4 warning signs for Coventry Group that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CYG

Coventry Group

Primarily engages in the distribution of industrial products and services in Australia and New Zealand.

Adequate balance sheet slight.

Market Insights

Community Narratives