- Australia

- /

- Metals and Mining

- /

- ASX:MLX

May 2025's ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.56% at 8,407 points, driven by gains in the IT and Financials sectors. In such a climate, penny stocks—often representing smaller or newer companies—continue to capture attention for their potential growth opportunities at lower price points. Despite their outdated moniker, these stocks can offer value when backed by strong financials and fundamentals, making them intriguing prospects for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.655 | A$207.75M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.835 | A$147.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.85 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$71.47M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.55 | A$168.45M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.715 | A$840.49M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.92 | A$683.39M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 998 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$235.80 million, operates by manufacturing, repairing, overhauling, and supplying mining attachment products and related services for the industrial and resources sectors.

Operations: The company's revenue is derived from three geographical segments: Asia-Pacific contributing A$169.08 million, North America generating A$117.15 million, and South America accounting for A$53.59 million.

Market Cap: A$235.8M

Austin Engineering, with a market cap of A$235.80 million, shows financial stability and growth potential within the penny stock category. The company has demonstrated consistent earnings growth over the past five years, achieving profitability and expanding its revenue base across Asia-Pacific, North America, and South America. Its short-term assets exceed both short-term and long-term liabilities, indicating strong liquidity. While trading slightly below estimated fair value offers an attractive entry point for investors seeking undervalued opportunities in industrial sectors. Recent management changes include the appointment of Sarah Wilson as Company Secretary to enhance corporate governance practices further.

- Click to explore a detailed breakdown of our findings in Austin Engineering's financial health report.

- Evaluate Austin Engineering's prospects by accessing our earnings growth report.

Credit Clear (ASX:CCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Credit Clear Limited develops and implements a receivables management platform and provides receivable collection services in Australia and New Zealand, with a market cap of A$110.41 million.

Operations: Credit Clear generates revenue primarily from its Collections segment, which accounts for A$39.52 million, and its Legal Services segment, contributing A$5.80 million.

Market Cap: A$110.41M

Credit Clear Limited, with a market cap of A$110.41 million, operates in the receivables management sector and is currently unprofitable. Despite this, it has no debt and maintains a stable financial position with short-term assets (A$27.7M) exceeding liabilities (A$19.8M). The company’s earnings are projected to grow significantly at 60.55% annually, supported by positive free cash flow increasing by 25.4% per year, providing a cash runway exceeding three years. Trading at 66.5% below its estimated fair value may present an opportunity for investors seeking undervalued stocks in the technology space despite current profitability challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Credit Clear.

- Gain insights into Credit Clear's outlook and expected performance with our report on the company's earnings estimates.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market cap of A$487.52 million.

Operations: The company's revenue segment includes the Renison Tin Operation, in which it holds a 50% interest, generating A$218.82 million.

Market Cap: A$487.52M

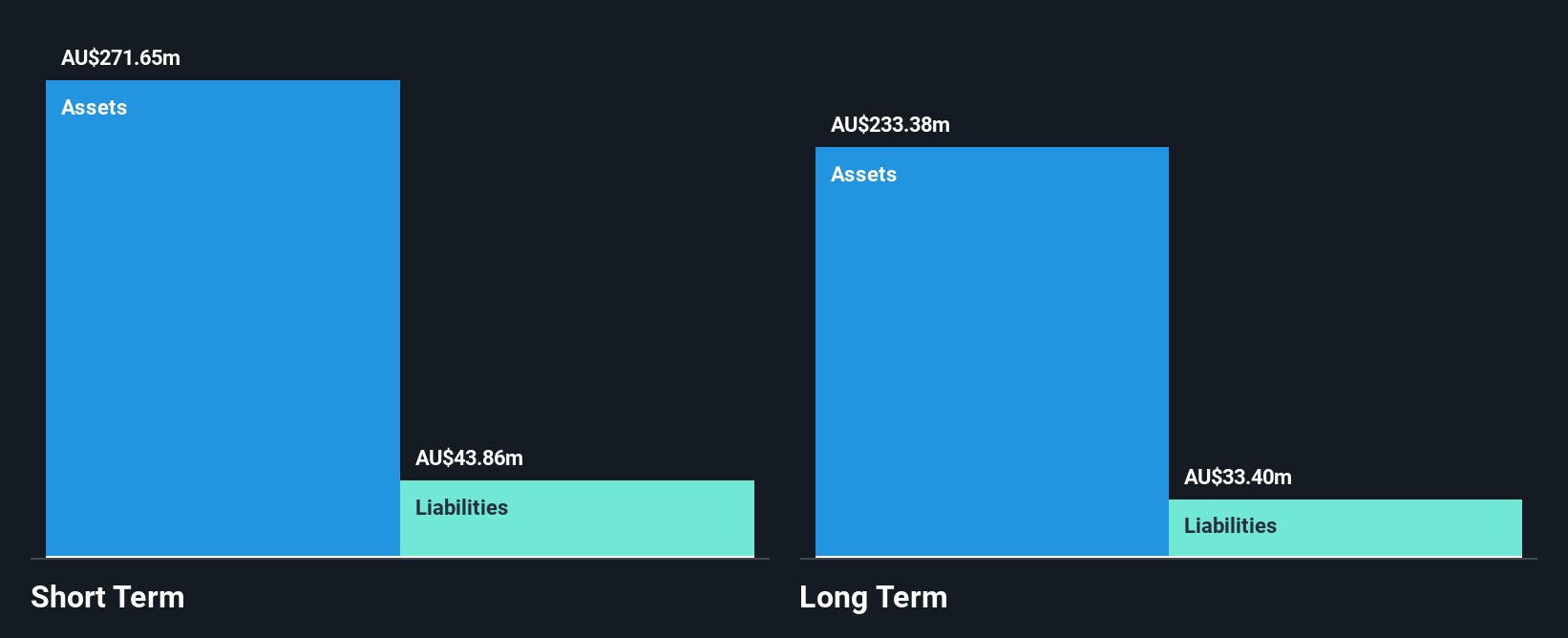

Metals X Limited, with a market cap of A$487.52 million, has demonstrated significant earnings growth of 601.7% over the past year, surpassing industry averages and reflecting improved net profit margins from 9.5% to 46.8%. The company's financial health is robust, with short-term assets (A$271.6M) exceeding both short-term and long-term liabilities and more cash than debt, ensuring strong interest coverage by profits. Despite a large one-off gain impacting recent results, its debt-to-equity ratio has impressively reduced to 0.1% over five years. Trading at a substantial discount to its estimated fair value may attract investors seeking potential undervaluation in the mining sector.

- Navigate through the intricacies of Metals X with our comprehensive balance sheet health report here.

- Evaluate Metals X's historical performance by accessing our past performance report.

Next Steps

- Discover the full array of 998 ASX Penny Stocks right here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MLX

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives