With EPS Growth And More, Westpac Banking (ASX:WBC) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Westpac Banking (ASX:WBC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Westpac Banking with the means to add long-term value to shareholders.

Check out our latest analysis for Westpac Banking

How Quickly Is Westpac Banking Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Westpac Banking has grown EPS by 48% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

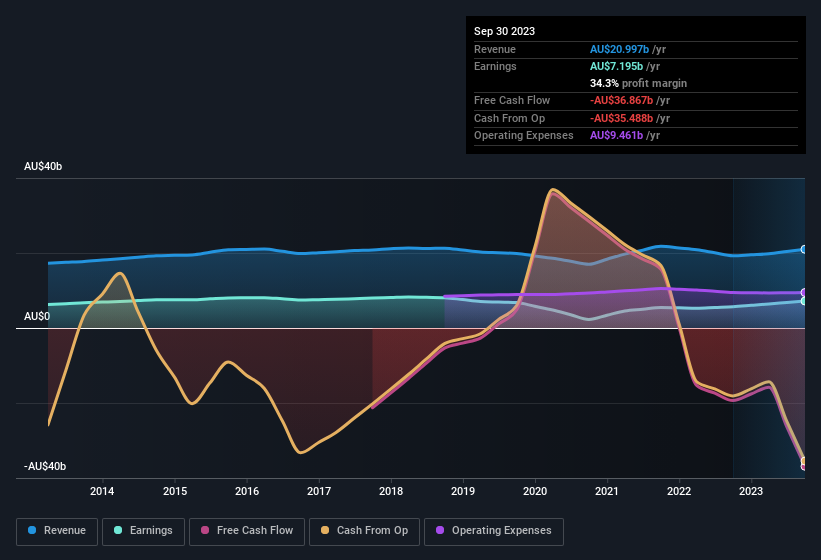

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Westpac Banking's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Westpac Banking remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 9.0% to AU$21b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Westpac Banking's future profits.

Are Westpac Banking Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Westpac Banking top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Non-Executive Director, Nora Scheinkestel, paid AU$79k to buy shares at an average price of AU$21.88. Strong buying like that could be a sign of opportunity.

Along with the insider buying, another encouraging sign for Westpac Banking is that insiders, as a group, have a considerable shareholding. Indeed, they hold AU$26m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.03% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Westpac Banking Deserve A Spot On Your Watchlist?

Westpac Banking's earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Westpac Banking belongs near the top of your watchlist. Before you take the next step you should know about the 2 warning signs for Westpac Banking (1 is concerning!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Westpac Banking isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Westpac Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WBC

Westpac Banking

Provides banking and other financial services in Australia, New Zealand, the Pacific Islands, Asia, the Americas, and Europe.

Excellent balance sheet with proven track record.