Can We See Significant Institutional Ownership On The MyState Limited (ASX:MYS) Share Register?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The big shareholder groups in MyState Limited (ASX:MYS) have power over the company. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Companies that have been privatized tend to have low insider ownership.

MyState is not a large company by global standards. It has a market capitalization of AU$414m, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. Let's delve deeper into each type of owner, to discover more about MYS.

See our latest analysis for MyState

What Does The Institutional Ownership Tell Us About MyState?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

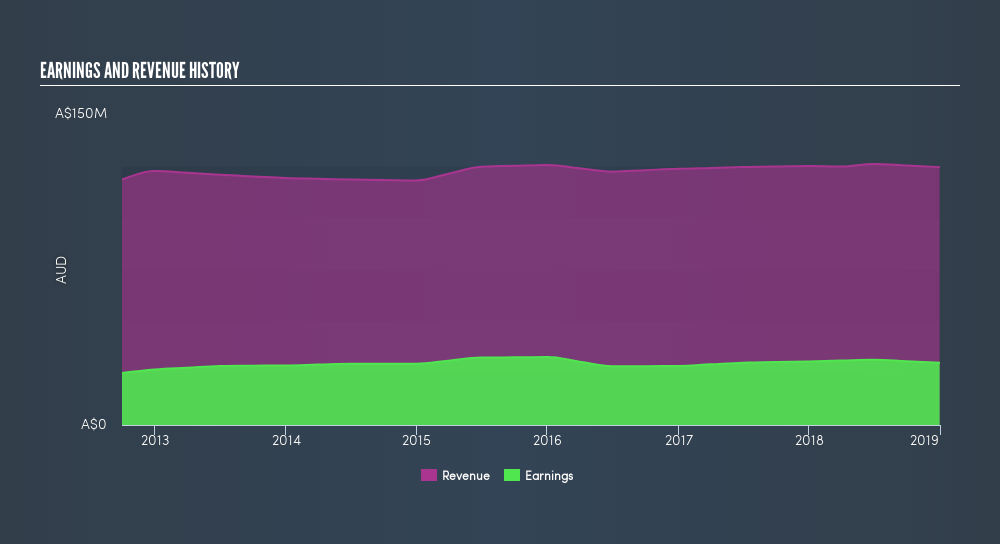

MyState already has institutions on the share registry. Indeed, they own 8.5% of the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see MyState's historic earnings and revenue, below, but keep in mind there's always more to the story.

MyState is not owned by hedge funds. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of MyState

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

We can see that insiders own shares in MyState Limited. In their own names, insiders own AU$13m worth of stock in the AU$414m company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public -- mostly retail investors -- own 87% of MyState . With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MYS

MyState

Through its subsidiaries, provides banking, trustee, and managed fund products and services in Australia.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives