Judo Bank (ASX:JDO): Assessing Valuation After Strong Net Income Growth and Upbeat Earnings Outlook

Reviewed by Kshitija Bhandaru

Judo Capital Holdings (ASX:JDO) has announced impressive net income growth and is projecting further earnings momentum, even as it navigates a challenging climate with higher bad loan ratios. Investors appear to be watching closely.

See our latest analysis for Judo Capital Holdings.

The share price has been steady over the past year, but Judo Capital Holdings has quietly delivered an 8.8% total shareholder return for investors. This hints that underlying business momentum and recent profit growth are starting to shift sentiment. Short-term investors may have overlooked this; however, longer-term performance suggests resilience is building despite sector headwinds.

If you’re curious what other financial standouts are gaining traction, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With analyst targets suggesting up to 17% upside and intrinsic value estimates indicating an even wider discount, the question emerges: Is Judo Capital Holdings still undervalued, or is the market already pricing in its growth potential?

Most Popular Narrative: 14.5% Undervalued

Judo Capital Holdings' most widely followed narrative pins its fair value above the latest close price, signaling potential room for price appreciation if forecasts play out as projected.

Judo's ongoing technology investment and platform re-architecture has enabled a step change in product flexibility, operational efficiency, and banker productivity. This positions the bank to capitalize on accelerating SME demand for digital-first, agile banking solutions, supporting long-term revenue growth and margin expansion.

Want to see what's powering this bullish view? The narrative relies on aggressive revenue growth, rising margins, and a profit outlook that surprises even veteran analysts. Curious how these growth projections stack up against the current price? The full narrative lays out the financial moves behind the target value.

Result: Fair Value of $2.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected competition in SME lending or rising funding costs could challenge Judo Capital Holdings’ growth outlook and put pressure on future profitability.

Find out about the key risks to this Judo Capital Holdings narrative.

Another View: Multiples Suggest a Richer Price

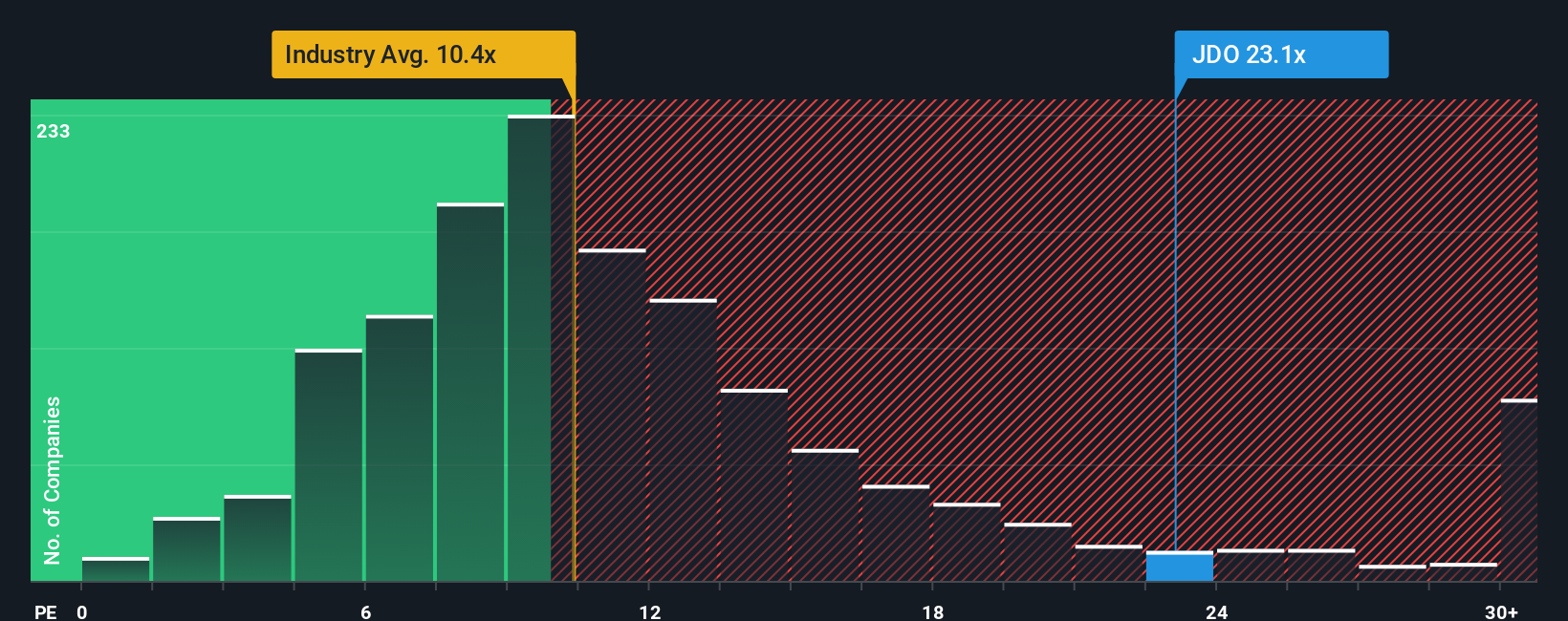

While discounted cash flow suggests Judo Capital Holdings offers value, a look at its current price-to-earnings ratio tells a different story. Shares trade at 23.1x earnings, above both the global banks average (10.3x) and the calculated fair ratio of 20.5x. This hints the market may have already priced in much of the optimism. Does this premium reflect genuine quality, or does it signal caution for new buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Judo Capital Holdings Narrative

If you’d rather sift through the numbers and draw your own conclusions, it’s quick and easy to shape a personal thesis and see the bigger picture. So why not Do it your way?

A great starting point for your Judo Capital Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investment strategy and make the most of these handpicked lists. Skipping them could mean missing tomorrow’s most compelling opportunities.

- Uncover hidden gems by tracking market catalysts with these 3564 penny stocks with strong financials, showing real financial strength and the potential to outperform expectations.

- Target steady cash flow and income by searching for top-performing picks among these 19 dividend stocks with yields > 3%, yielding over 3% today.

- Capitalize on the AI boom by seeing which innovators are setting the pace in automation, data intelligence, and machine learning with these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JDO

Judo Capital Holdings

Through its subsidiaries, engages in the provision of various banking products and services for small and medium businesses in Australia.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives