Will Commonwealth Bank’s AI Car Tool Shape Its Digital Edge in Financial Services (ASX:CBA)?

Reviewed by Sasha Jovanovic

- In the past week, Commonwealth Bank of Australia introduced an AI-powered assistant on its Cars for CommBank platform, offering consumers detailed car price discovery previously exclusive to dealers.

- This launch represents the first such tool in Australia and marks Commonwealth Bank's push to extend advanced digital services directly to its retail customers.

- We'll explore how the introduction of this AI-driven tool could impact Commonwealth Bank's digital strategy and competitive positioning in financial services.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Commonwealth Bank of Australia Investment Narrative Recap

Commonwealth Bank of Australia (CBA) shareholders must believe the bank’s scale, digital focus, and leading market position can support consistently strong earnings and dividends, even as competition increases and digital disruptors threaten traditional profit streams. The recent launch of an AI-powered car pricing assistant on Cars for CommBank is an important digital innovation, though its near-term financial impact appears limited, with margin pressures and technology investment outlays remaining the most important catalyst and risk to watch.

Of CBA’s recent announcements, the full-year net interest income result of A$24.02 billion illustrates how lending remains the backbone of earnings, directly tying to net interest margin pressure as a key catalyst for shares. The ongoing balance between technology investments and revenue growth remains front of mind for many investors, particularly as customer expectations for digital offerings accelerate.

But while CBA’s digital advances can reinforce customer retention, investors should also be mindful that...

Read the full narrative on Commonwealth Bank of Australia (it's free!)

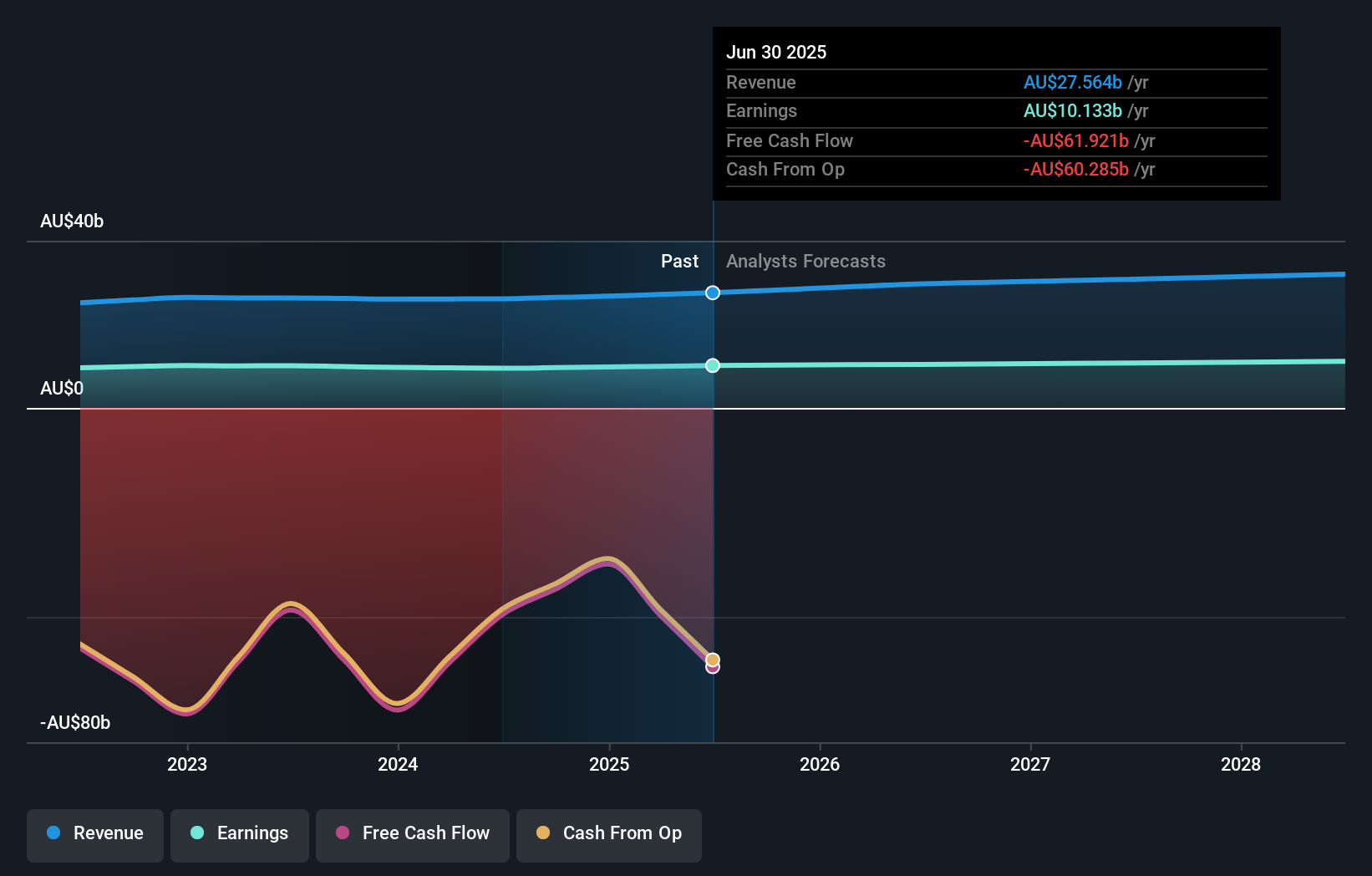

Commonwealth Bank of Australia's narrative projects A$31.9 billion revenue and A$11.2 billion earnings by 2028. This requires 4.9% yearly revenue growth and a A$1.1 billion earnings increase from A$10.1 billion currently.

Uncover how Commonwealth Bank of Australia's forecasts yield a A$120.47 fair value, a 24% downside to its current price.

Exploring Other Perspectives

Thirteen fair value estimates from the Simply Wall St Community range from A$100 to A$147.26 per share. With so many opinions, it is clear growing digital competition could be a pivotal factor influencing future outcomes, so you may want to consider a variety of viewpoints yourself.

Explore 13 other fair value estimates on Commonwealth Bank of Australia - why the stock might be worth 37% less than the current price!

Build Your Own Commonwealth Bank of Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commonwealth Bank of Australia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commonwealth Bank of Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commonwealth Bank of Australia's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives