In the Investment world, dividends play a pivotal role, offering a dependable source of income, known for their stability even in the midst of market oscillations. As we delve into February 2024, our attention is drawn to three dividend stocks deserving consideration for savvy investors.

Explore our screener now and discover your ideal dividend stocks !

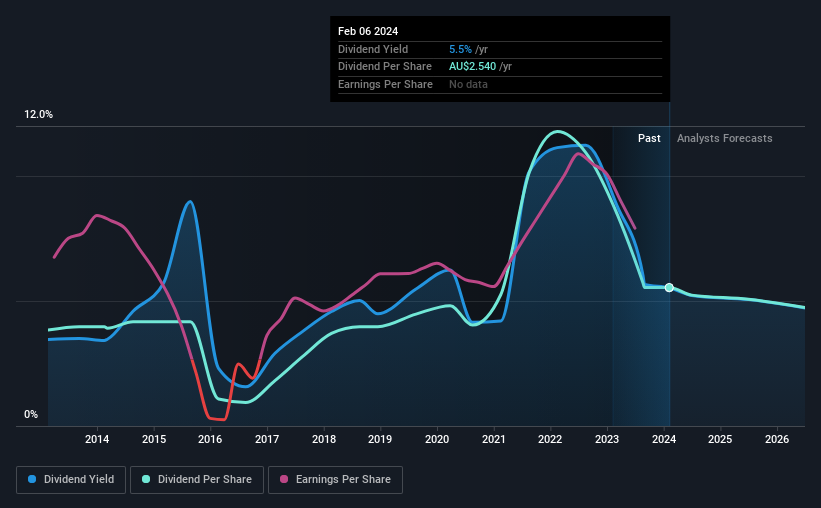

BHP Group ( ASX:BHP )

- Overview: Established in 1851, BHP Group is a global resources company with a rich history.

- Operations: Primarily engaged in mineral extraction, with a focus on copper, iron ore, and coal. BHP's largest revenue contributor is its iron ore segment, generating over A$24 billion.

Dividend Yield: 5.5%

BHP's dividend yield, though trailing behind the top quartile of Australian market payers, the company's dividend remains robust, supported by earnings and operating cash flow coverage. Demonstrating fiscal prudence, BHP has consistently reduced its debt-to-equity ratio over the past five years, maintaining a satisfactory net debt level. Over the last decade, the company has shown notable earnings growth and increased dividend payments, solidifying its position in the market. However, caution is advised due to recent profit margin declines and projected decreases in revenue and earnings, signaling potential instability for investors seeking secure high-yield investments in this sector. Explore a detailed breakdown of our findings on BHP Group .

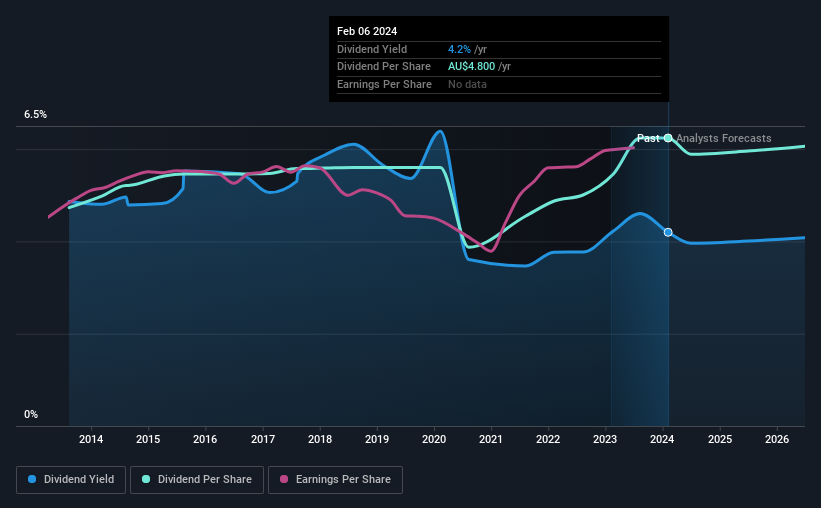

Commonwealth Bank of Australia ( ASX:CBA )

- Overview: Established in 1911, Commonwealth Bank of Australia (CBA) is a stalwart in the financial services sector.

- Operations: CBA operates through segments such as Retail Banking Services and Business Banking, with retail banking being the primary revenue generator at A$11.96 billion.

- Dividend Yield: 4.2%

CBA projects a dividend yield of 4.2%, but its strength extends beyond mere numbers. While not securing a top-tier position among Australian market payers, CBA's resilience lies in well-covered earnings with a sustainable payout ratio of 74.6%. The bank maintains a conservative stance, as evident in a low allowance for bad loans (78%) and a suitable Loans to Assets ratio (74%). Despite modest annual earnings upticks, investors should weigh potential dividend payment volatility over the past decade when considering consistent income streams.

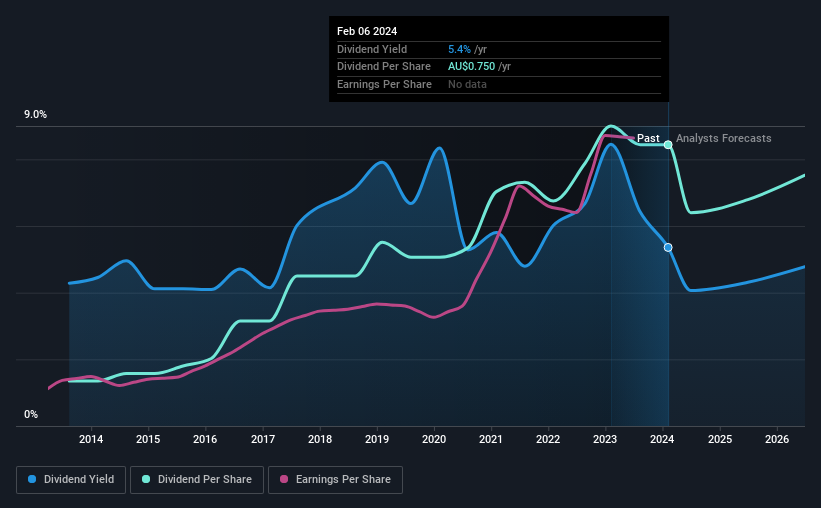

Nick Scali ( ASX:NCK )

- Overview: Operating since 1962, Nick Scali is a prominent retailer of household furniture in Australia and New Zealand.

- Operations: With a market cap of A$972.81 million, Nick Scali's primary revenue comes from furniture retailing.

- Dividend Yield: 6.2%

Nick Scali presents dividends well-supported by both earnings and cash flows. The company's track record demonstrates reliability and stability in dividends over the past decade, making it an appealing option for income-focused investors. Although not securing a top spot among the highest payers in terms of yield compared to Australia's elite, Nick Scali's appeal is rooted in its consistent performance and attractiveness to those seeking stable income streams. Unlock comprehensive insights into our analysis of Nick Scali .

Next Steps

Exploring a dividend portfolio? The Simply Wall St Screener, with its Top Dividend Stocks screen, proves instrumental. This tool effectively highlights exemplary stocks without overpromising future gains, offering potential for income-focused investors. Ready to explore? Dive into this smart screener and let it guide your next investment move .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives