Why Bendigo and Adelaide Bank (ASX:BEN) Is Down 6.3% After Regulator Flags Major Compliance Gaps

Reviewed by Sasha Jovanovic

- Earlier this week, Bendigo and Adelaide Bank announced it is under investigation by AUSTRAC after an independent Deloitte review uncovered significant deficiencies in its anti-money laundering and counter-terrorism financing controls across multiple branches over several years.

- The bank’s board has committed to fully funding system enhancements and engaging with regulators to address these compliance issues, reflecting a substantial operational and reputational challenge for one of Australia’s key regional lenders.

- We’ll now explore how this renewed regulatory scrutiny and commitment to uplift compliance frameworks could alter Bendigo and Adelaide Bank’s investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bendigo and Adelaide Bank Investment Narrative Recap

To be a shareholder in Bendigo and Adelaide Bank, one needs confidence in the bank’s ability to restore and maintain robust compliance standards while delivering balance sheet growth and operational improvement. The recent AUSTRAC investigation, sparked by significant deficiencies in anti-money laundering controls, has escalated regulatory risk as the most immediate challenge, overshadowing short-term catalysts like loan book expansion and digital investments that once defined the narrative for the stock.

Among recent announcements, the FY 2025 earnings result stands out: the bank reported a net loss of A$97.1 million compared to a previous profit, highlighting operational and compliance costs as key hurdles. This financial performance, together with sharp recent declines in share price, puts renewed focus on the impact of heightened compliance spend and regulatory attention on near-term margin recovery and investor sentiment.

By contrast, investors should pay close attention to the escalating compliance costs and regulatory uncertainty that could materially affect financial outcomes...

Read the full narrative on Bendigo and Adelaide Bank (it's free!)

Bendigo and Adelaide Bank's outlook anticipates revenue of A$2.1 billion and earnings of A$503.9 million by 2028. Achieving this requires annual revenue growth of 3.2% and an earnings increase of about 5% from current earnings of A$479.5 million.

Uncover how Bendigo and Adelaide Bank's forecasts yield a A$11.14 fair value, a 8% upside to its current price.

Exploring Other Perspectives

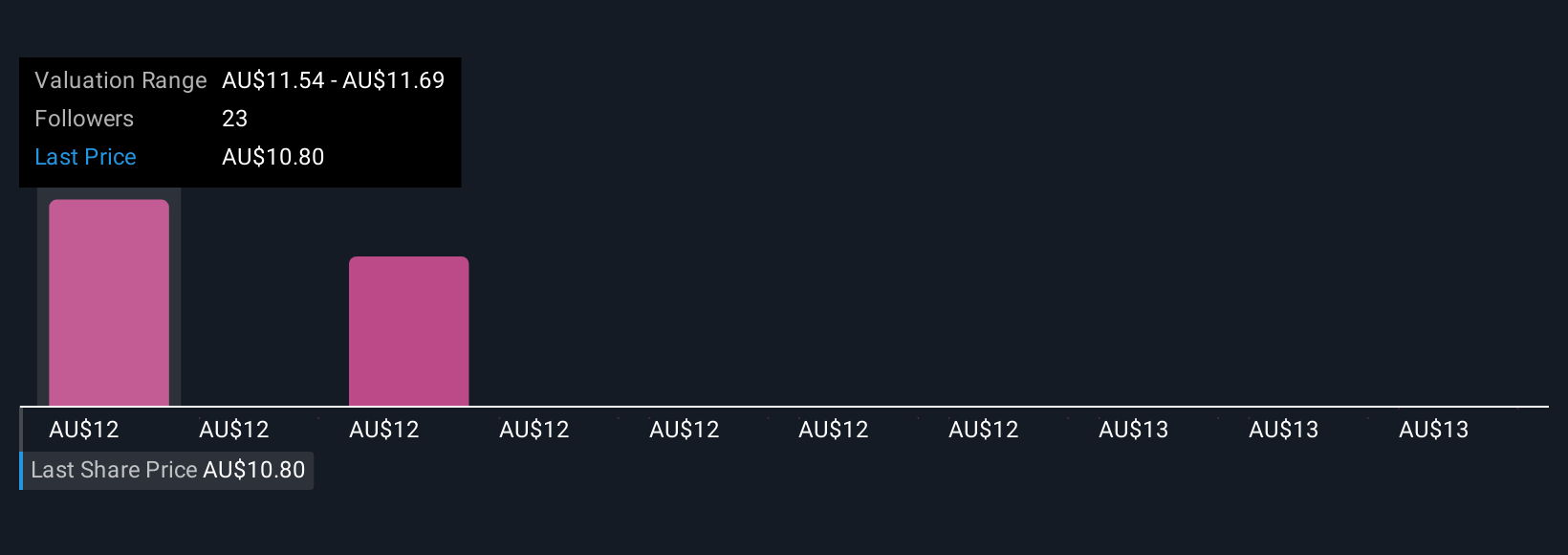

Simply Wall St Community members estimate Bendigo and Adelaide Bank’s fair value between A$11.14 and A$13, based on four distinct views. Amid rising compliance costs and regulatory scrutiny, these varying opinions highlight how market participants see very different prospects for the bank’s recovery and growth.

Explore 4 other fair value estimates on Bendigo and Adelaide Bank - why the stock might be worth as much as 26% more than the current price!

Build Your Own Bendigo and Adelaide Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bendigo and Adelaide Bank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bendigo and Adelaide Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bendigo and Adelaide Bank's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bendigo and Adelaide Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BEN

Bendigo and Adelaide Bank

Engages in the provision of banking and other financial services to retail customers and small to medium sized businesses in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.