Over the last 7 days, the Australian market has remained flat, but it has shown a robust rise of 17% over the past year with earnings forecast to grow by 12% annually. In this context, identifying dividend stocks that offer stable yields can be an effective strategy for investors seeking income and potential growth in a steady market environment.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.50% | ★★★★★☆ |

| Perenti (ASX:PRN) | 7.66% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.62% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.11% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.21% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.59% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.61% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.45% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.58% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.81% | ★★★★☆☆ |

Click here to see the full list of 41 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

Bendigo and Adelaide Bank (ASX:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bendigo and Adelaide Bank Limited provides banking and financial services to retail customers and small to medium-sized businesses in Australia, with a market cap of A$6.47 billion.

Operations: Bendigo and Adelaide Bank Limited generates revenue through its Consumer segment at A$1.12 billion, Business & Agribusiness segment at A$761.10 million, and Corporate segment at A$67.50 million.

Dividend Yield: 5.4%

Bendigo and Adelaide Bank's dividend payments have been volatile over the past decade, yet they remain covered by earnings with a payout ratio of 65.4%, expected to rise to 72.9% in three years. Despite recent increases, the dividend yield of 5.45% is below top-tier Australian payers. The bank reported net income growth to A$545 million for FY2024, alongside a fully franked full-year dividend increase to A$0.63 per share from A$0.61 in FY2023.

- Navigate through the intricacies of Bendigo and Adelaide Bank with our comprehensive dividend report here.

- Our valuation report unveils the possibility Bendigo and Adelaide Bank's shares may be trading at a discount.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.25 billion.

Operations: MFF Capital Investments Limited generates its revenue primarily through equity investments, amounting to A$659.96 million.

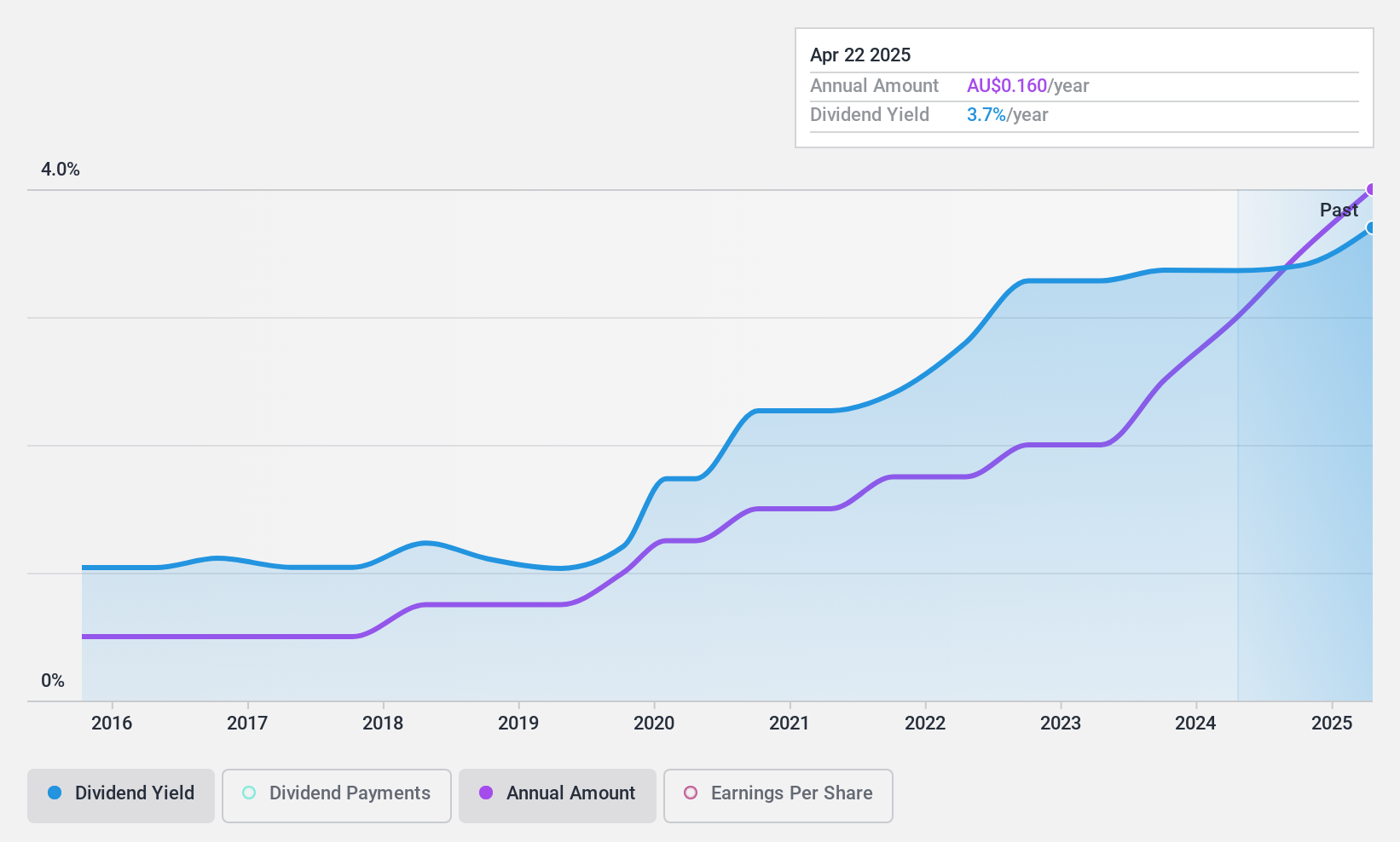

Dividend Yield: 3.6%

MFF Capital Investments has consistently increased its dividends over the past decade, maintaining stability and reliability. The recent announcement of a final dividend of 7 cents per share reflects this trend. Despite a lower yield of 3.61% compared to top-tier Australian dividend payers, MFF's dividends are well-covered by earnings and cash flows, with payout ratios at 16.8% and 24.1%, respectively. Earnings have grown significantly by 38.3%, supporting sustainable dividend payments.

- Get an in-depth perspective on MFF Capital Investments' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of MFF Capital Investments shares in the market.

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited operates as a general insurance brokerage service provider across Australasia, Asia, and Europe, with a market cap of A$6.19 billion.

Operations: Steadfast Group Limited generates revenue primarily from its Insurance Intermediary segment, which accounts for A$1.55 billion, and its Premium Funding segment, contributing A$113 million.

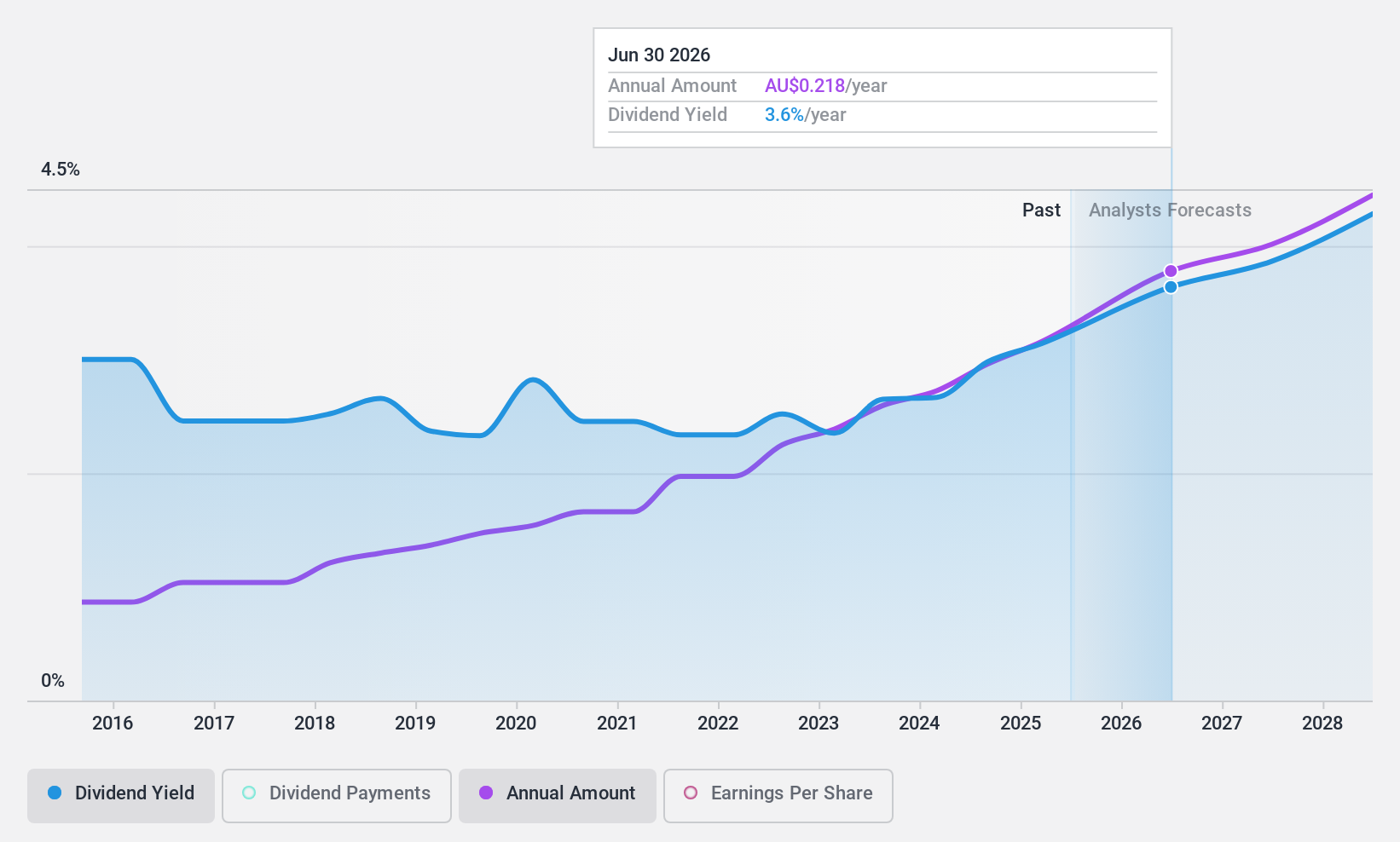

Dividend Yield: 3%

Steadfast Group's recent earnings report showed net income of A$228 million, up from A$189.2 million last year, with earnings per share rising to A$0.212. The company declared a final franked dividend of 10.35 cents per share, though its dividend history has been volatile with past annual drops over 20%. While the current payout ratio of 80.7% suggests dividends are covered by earnings and cash flows, shareholder dilution occurred in the past year.

- Take a closer look at Steadfast Group's potential here in our dividend report.

- Our valuation report unveils the possibility Steadfast Group's shares may be trading at a premium.

Where To Now?

- Click through to start exploring the rest of the 38 Top ASX Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives