With EPS Growth And More, Vmoto (ASX:VMT) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Vmoto (ASX:VMT), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Vmoto

How Fast Is Vmoto Growing Its Earnings Per Share?

In the last three years Vmoto's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Vmoto's EPS has risen over the last 12 months, growing from AU$0.029 to AU$0.035. There's little doubt shareholders would be happy with that 22% gain.

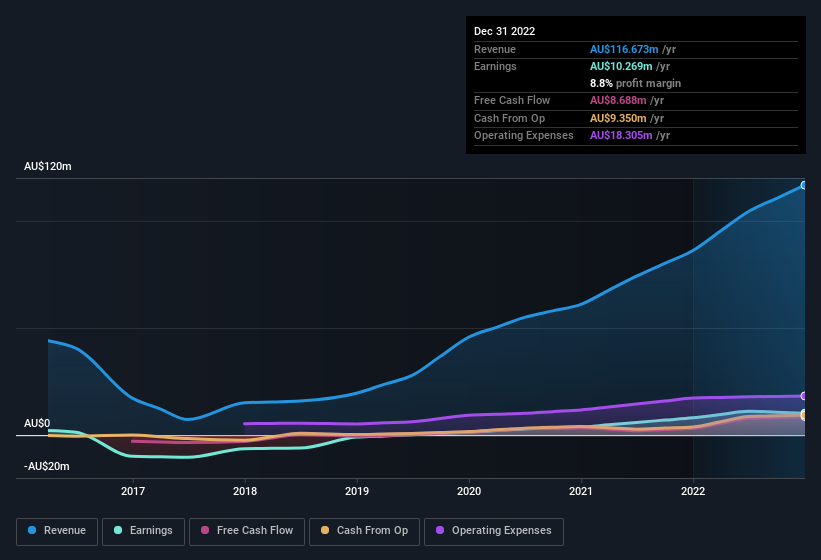

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Vmoto remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 35% to AU$117m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Vmoto is no giant, with a market capitalisation of AU$99m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Vmoto Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Vmoto insiders refrain from selling stock during the year, but they also spent AU$104k buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the MD & Executive Director, Yiting Chen, who made the biggest single acquisition, paying AU$49k for shares at about AU$0.42 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Vmoto insiders own more than a third of the company. In fact, they own 44% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have AU$44m invested in the business, at the current share price. That's nothing to sneeze at!

Does Vmoto Deserve A Spot On Your Watchlist?

As previously touched on, Vmoto is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. What about risks? Every company has them, and we've spotted 2 warning signs for Vmoto you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Vmoto, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VMT

Vmoto

Engages in the development, manufacture, marketing, and distribution of electric two-wheel vehicles worldwide.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives