Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like PWR Holdings (ASX:PWH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide PWR Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for PWR Holdings

PWR Holdings' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. PWR Holdings managed to grow EPS by 13% per year, over three years. That's a good rate of growth, if it can be sustained.

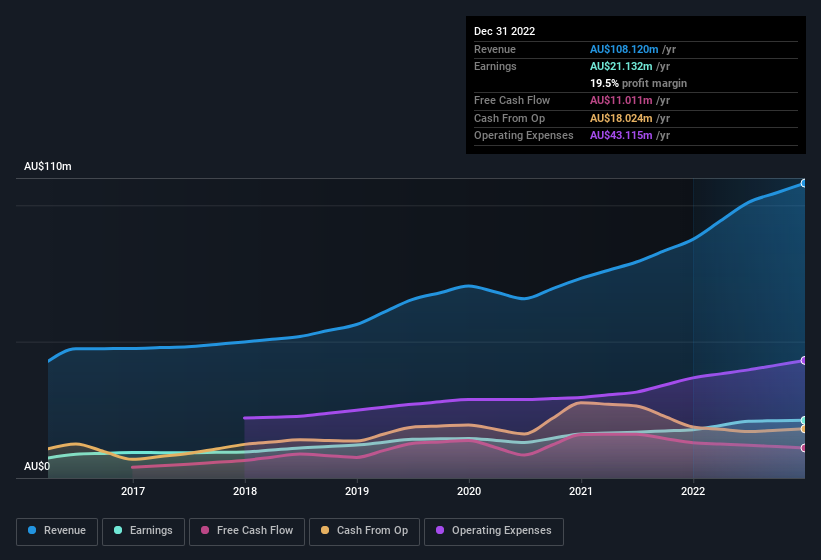

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note PWR Holdings achieved similar EBIT margins to last year, revenue grew by a solid 24% to AU$108m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for PWR Holdings.

Are PWR Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did PWR Holdings insiders refrain from selling stock during the year, but they also spent AU$110k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Independent Non-Executive Director Roland Dane who made the biggest single purchase, worth AU$100k, paying AU$9.98 per share.

Along with the insider buying, another encouraging sign for PWR Holdings is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at AU$132m, they have plenty of motivation to push the business to succeed. At 13% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because PWR Holdings' CEO, Kees Weel, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between AU$602m and AU$2.4b, like PWR Holdings, the median CEO pay is around AU$1.6m.

PWR Holdings' CEO took home a total compensation package of AU$806k in the year prior to June 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does PWR Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of PWR Holdings is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Now, you could try to make up your mind on PWR Holdings by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of PWR Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, Finland, Croatia, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.