How Does Apollo Tourism & Leisure's (ASX:ATL) CEO Pay Compare With Company Performance?

Luke Trouchet became the CEO of Apollo Tourism & Leisure Ltd (ASX:ATL) in 2001, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Apollo Tourism & Leisure

Comparing Apollo Tourism & Leisure Ltd's CEO Compensation With the industry

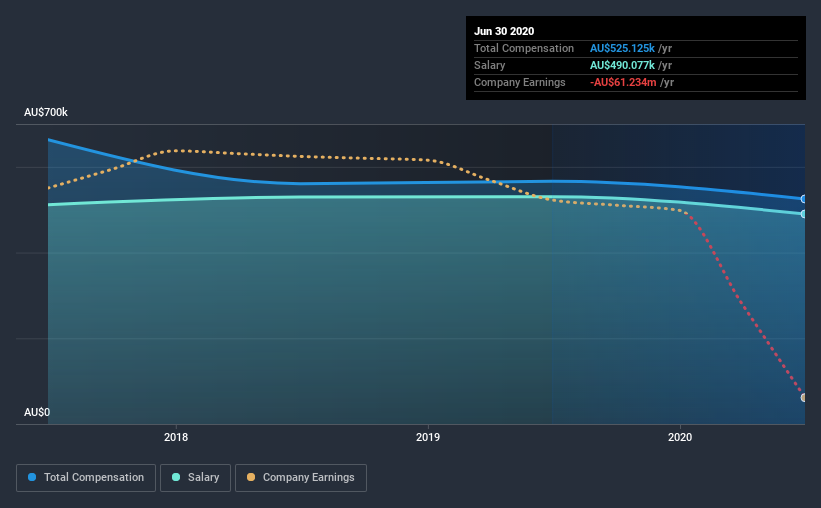

Our data indicates that Apollo Tourism & Leisure Ltd has a market capitalization of AU$62m, and total annual CEO compensation was reported as AU$525k for the year to June 2020. We note that's a small decrease of 7.3% on last year. Notably, the salary which is AU$490.1k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$271m, the reported median total CEO compensation was AU$246k. Accordingly, our analysis reveals that Apollo Tourism & Leisure Ltd pays Luke Trouchet north of the industry median. Moreover, Luke Trouchet also holds AU$308k worth of Apollo Tourism & Leisure stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$490k | AU$530k | 93% |

| Other | AU$35k | AU$36k | 7% |

| Total Compensation | AU$525k | AU$566k | 100% |

On an industry level, roughly 55% of total compensation represents salary and 45% is other remuneration. It's interesting to note that Apollo Tourism & Leisure pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Apollo Tourism & Leisure Ltd's Growth Numbers

Over the last three years, Apollo Tourism & Leisure Ltd has shrunk its earnings per share by 103% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

Overall this is not a very positive result for shareholders. And the flat revenue is seriously uninspiring. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Apollo Tourism & Leisure Ltd Been A Good Investment?

Since shareholders would have lost about 78% over three years, some Apollo Tourism & Leisure Ltd investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Luke is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. To make matters worse, EPS growth has also been negative during this period. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Apollo Tourism & Leisure that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Apollo Tourism & Leisure, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Apollo Tourism & Leisure, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:ATL

Apollo Tourism & Leisure

Apollo Tourism & Leisure Ltd, a tourism leisure company, manufactures, imports, rents, sells, and distributes recreational vehicles (RVs) in Australia, New Zealand, North America, Germany, the United Kingdom, and Ireland.

High growth potential and fair value.

Market Insights

Community Narratives