- Australia

- /

- Auto Components

- /

- ASX:ARB

August Token Unlock Could Be A Game Changer For ARB (ASX:ARB)

Reviewed by Simply Wall St

- Arbitrum has announced an upcoming unlock of 92,650,000 ARB tokens on August 16th, accounting for about 1.80% of its circulating supply.

- This event has drawn significant interest as large token unlocks are closely watched for their potential to increase volatility, depending on market reactions and supply absorption.

- We'll look at how anticipation around this sizable token unlock could influence ARB's investment narrative and future positioning.

ARB Investment Narrative Recap

To be a shareholder in ARB, one typically needs to believe in the company's long-term U.S. expansion, innovation within the 4WD accessories sector, and the value of its growing partnerships, such as with Toyota USA. The recent ARB token unlock announcement is unlikely to materially impact the underlying business catalysts or near-term risks for ARB Corporation Limited, as the event is centered on Arbitrum, not ARB's core automotive operations.

From recent announcements, the full-year earnings report in August 2024 stands out. The company posted higher revenue and net income, along with continued dividend payments, reinforcing confidence in its strategic U.S. retail expansion and partnerships as the most relevant catalysts for future growth.

However, against these positives, investors should be aware that growing employee and acquisition costs could pressure margins if demand softens, especially given...

Read the full narrative on ARB (it's free!)

ARB's outlook projects A$894.3 million in revenue and A$132.5 million in earnings by 2028. This is based on a 7.4% annual revenue growth rate and a A$30.1 million increase in earnings from the current A$102.4 million.

Uncover how ARB's forecasts yield a A$37.99 fair value, a 9% upside to its current price.

Exploring Other Perspectives

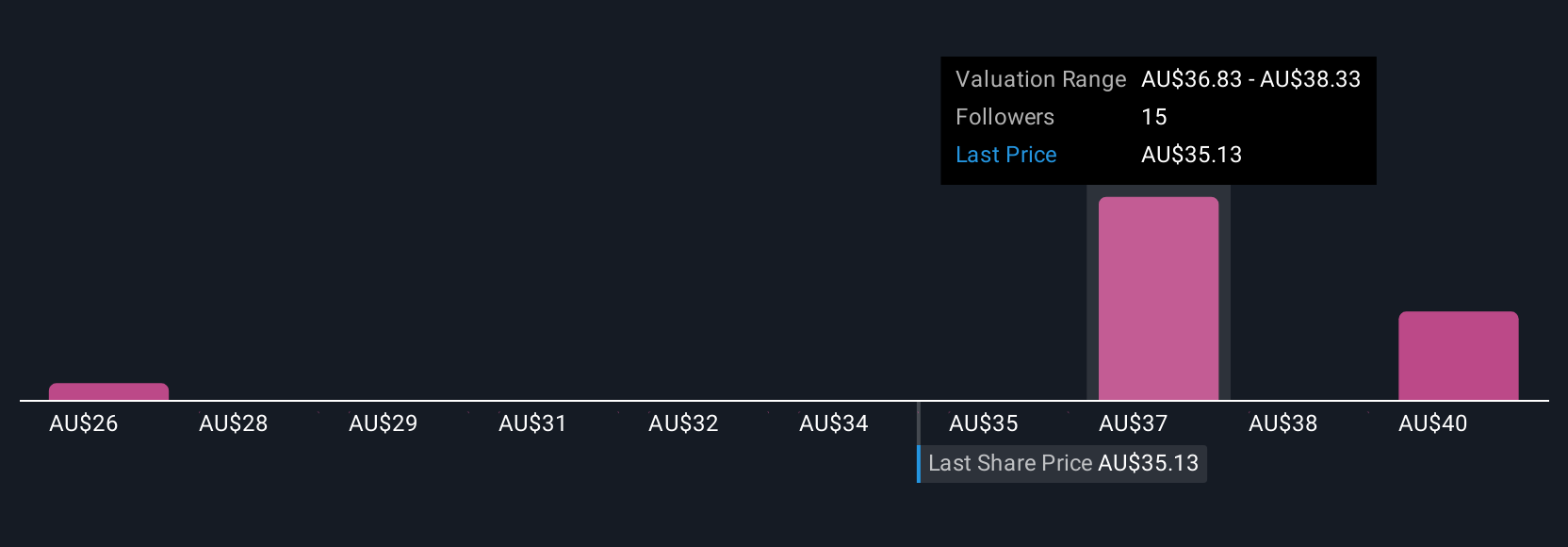

Five individual fair value estimates from the Simply Wall St Community range from A$26.32 to A$37.99 per share. While these perspectives differ, many are closely watching ARB’s cost structure amid ongoing U.S. growth plans, which could play a major role in future profitability.

Build Your Own ARB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARB research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ARB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARB's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARB

ARB

Engages in the design, manufacture, distribution, and sale of motor vehicle accessories and light metal engineering works.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives