- Australia

- /

- Auto Components

- /

- ASX:ARB

A Look at ARB (ASX:ARB) Valuation Following Ford Ranger Raptor Desert Pack Partnership Announcement

Reviewed by Kshitija Bhandaru

Ford’s latest announcement featuring ARB (ASX:ARB) accessories in its limited edition Ranger Raptor Desert Pack has placed a spotlight on the company and its potential to attract new customers through this collaboration.

See our latest analysis for ARB.

The spotlight from ARB’s collaboration with Ford seems to have sparked fresh attention, coinciding with a solid 15% share price return over the last 90 days. While the year’s total shareholder return remains negative, longer-term holders have still seen substantial gains, with a 59% total return over three years. Interest is clearly building around ARB as its partnerships open up new commercial avenues and the business continues to refine shareholder offerings, such as its updated Bonus Share and Dividend Reinvestment Plans. Momentum appears to be shifting in the company’s favor as broader investors take note of these positive developments.

If you’re curious where the next opportunity might be, now is a great moment to broaden your investing horizons and discover See the full list for free.

But with shares up 15% in the last three months and trading just shy of the latest analyst price target, the key question is whether ARB shares are now undervalued or if the market is already factoring in renewed growth prospects.

Most Popular Narrative: 2.1% Undervalued

ARB’s narrative fair value stands just above the last close price, which hints at upside potential without stretching into extremes. The consensus sees strength in international expansion and efficiency gains, but with close alignment to where shares already trade, it hints that execution is crucial from here.

Robust export sales growth across all regions (notably 16.4% for FY25, with U.S. up over 21%) and ongoing investments in international retail presence (including store acquisitions, flagship sites and U.S. joint venture integrations) are positioning ARB to capture increased global demand for 4WD/outdoor accessories. This is particularly driven by rising vehicle ownership and middle-class expansion overseas, which are expected to support long-term revenue and earnings growth.

Want to unpack the bold global growth plan behind this modest undervaluation? Find out what future revenue, profit, and margin assumptions power this target. In addition, see which pivotal numbers have analysts split.

Result: Fair Value of $40.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, foreign exchange volatility and sluggish domestic 4x4 sales could threaten ARB’s growth trajectory, particularly if key markets or macro trends worsen unexpectedly.

Find out about the key risks to this ARB narrative.

Another View: Comparable Companies Paint a Cautious Picture

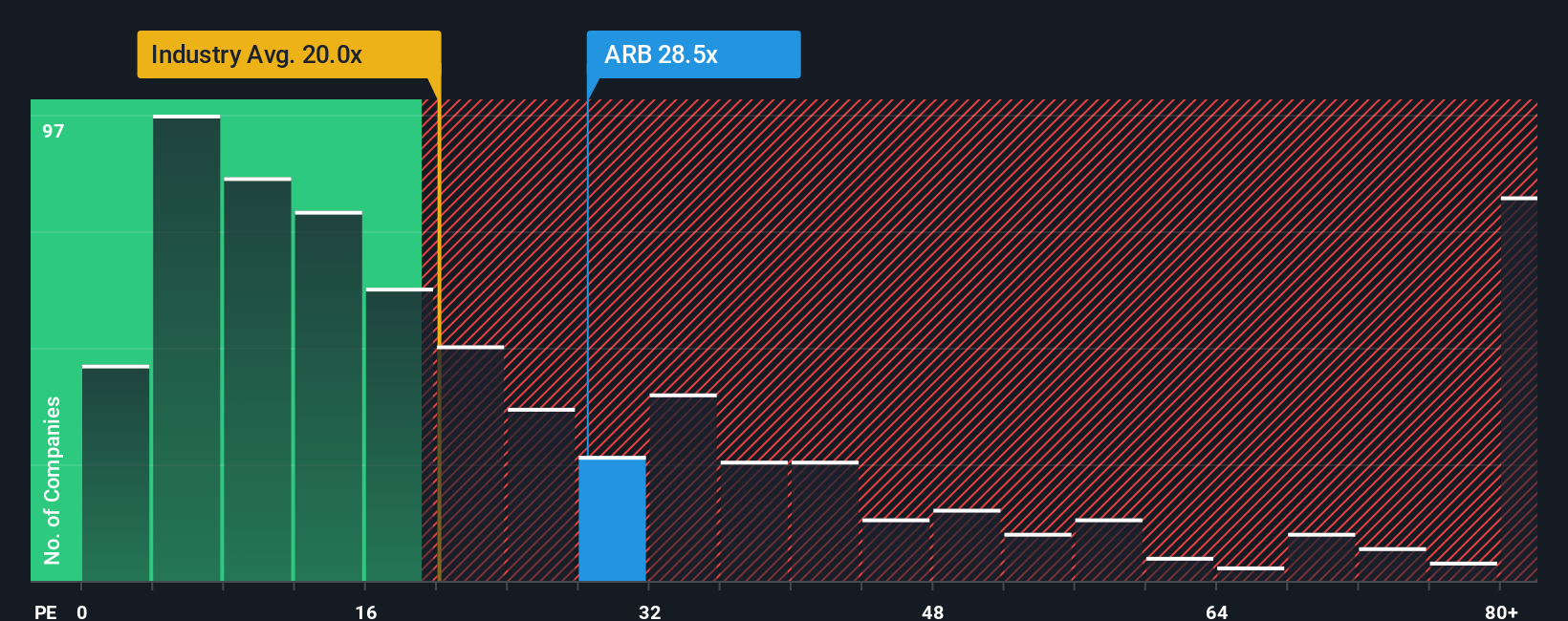

Looking at how ARB is valued against industry yardsticks, its price-to-earnings ratio of 33.9x stands well above both the industry average (21.3x) and its peer group (30x). Even compared to its fair ratio of 23.4x, the gap signals that ARB’s shares may face valuation risk if market sentiment shifts. Will the premium hold if growth does not accelerate?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ARB Narrative

If the consensus view doesn’t quite fit your perspective, or you prefer backing your own research, you can shape your own ARB story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ARB.

Looking for More Investment Ideas?

Confidently seize your edge in the market by tapping into unique strategies other investors overlook. These handpicked opportunities could spark your next big move. Don’t let them slip by.

- Unlock high dividend income potential when you check out these 18 dividend stocks with yields > 3%, packed with reliable payers yielding above 3%.

- Ride the artificial intelligence wave by acting now with these 25 AI penny stocks, transforming industries from healthcare to fintech.

- Capitalize on promising future tech by investigating these 26 quantum computing stocks, quietly advancing breakthroughs in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARB

ARB

Engages in the design, manufacture, distribution, and sale of motor vehicle accessories and light metal engineering works.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.