As European markets reach record levels, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are increasingly turning their attention to dividend stocks as a means to enhance portfolio stability. In this environment of rising indices and contained inflation risks, selecting dividend stocks with strong fundamentals can provide a reliable income stream while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.35% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.52% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.08% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.66% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.22% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.60% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.00% | ★★★★★★ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

Banco BPM (BIT:BAMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco BPM S.p.A. offers a range of banking and financial products and services to individual, business, and corporate clients in Italy, with a market cap of €19.42 billion.

Operations: Banco BPM S.p.A.'s revenue is primarily derived from Commercial Management (€3.88 billion), followed by Corporate and Investment Banking (€876.78 million), Finance (€168.84 million), Insurance (€147.19 million), Corporate Center (€151.91 million), and Strategic Partnerships (€126.62 million).

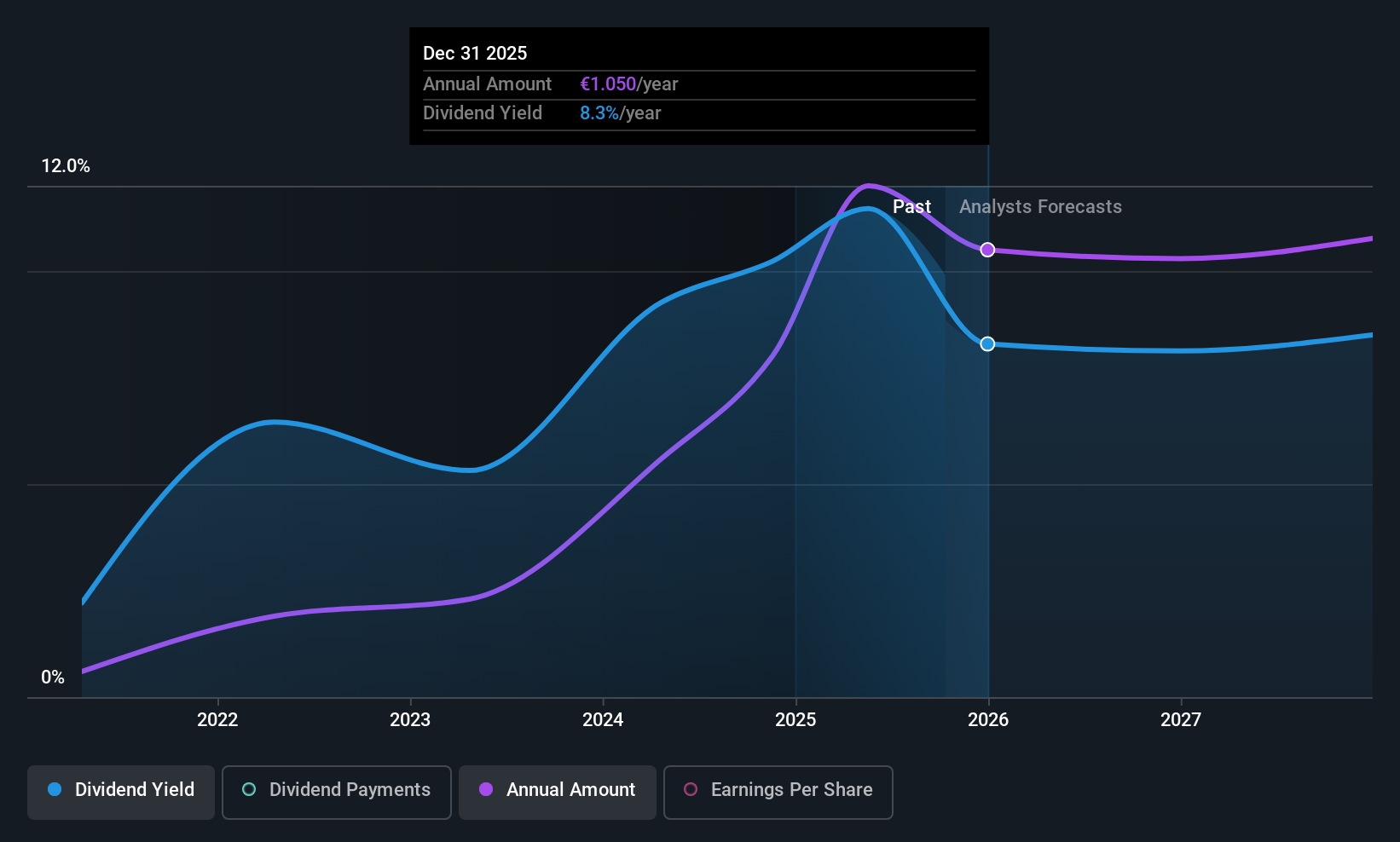

Dividend Yield: 9.3%

Banco BPM's dividend prospects are appealing, with a recent increase to €700 million for 2025, reflecting a 17% rise from the previous year. Despite only five years of dividend history, payments have been stable and reliable. The payout ratio is low at 37.9%, indicating dividends are well covered by earnings. However, the bank faces challenges such as high bad loans and a low allowance for them. Its price-to-earnings ratio of 8.2x suggests good value relative to the Italian market average of 17.1x.

- Get an in-depth perspective on Banco BPM's performance by reading our dividend report here.

- Our expertly prepared valuation report Banco BPM implies its share price may be lower than expected.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €630.45 million, mines, produces, and sells salt in Germany, the European Union, and internationally through its subsidiaries.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily from its Salt segment, which contributes €280.27 million, and its Waste Management segment, which adds €65.48 million.

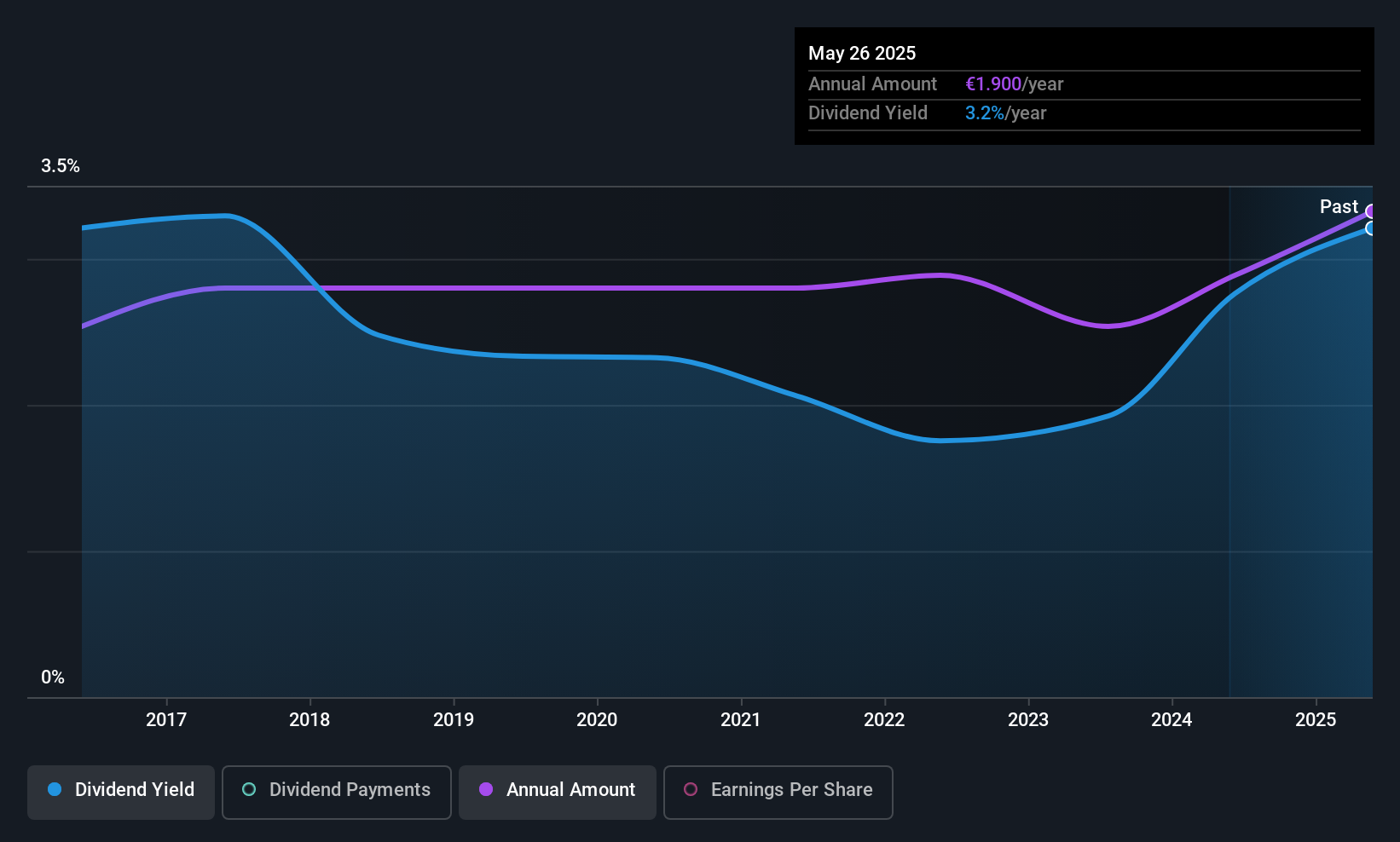

Dividend Yield: 3.1%

Südwestdeutsche Salzwerke AG's dividend payments have been stable and growing over the past decade, supported by a reasonable payout ratio of 66.6%. However, its dividend yield of 3.09% is below the top tier in Germany, and the high cash payout ratio of 125.8% indicates dividends are not well covered by free cash flows. Recent earnings show sales growth to €171.12 million but a decline in net income to €12.84 million, impacting sustainability concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Südwestdeutsche Salzwerke.

- Our expertly prepared valuation report Südwestdeutsche Salzwerke implies its share price may be too high.

EVN (WBAG:EVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EVN AG is an energy and environmental services provider operating in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania with a market cap of €4.24 billion.

Operations: EVN AG's revenue is primarily derived from its Energy (€684.70 million), Networks (€713.90 million), Generation (€356.60 million), Environment (€421.90 million), and South East Europe (€1.50 billion) segments.

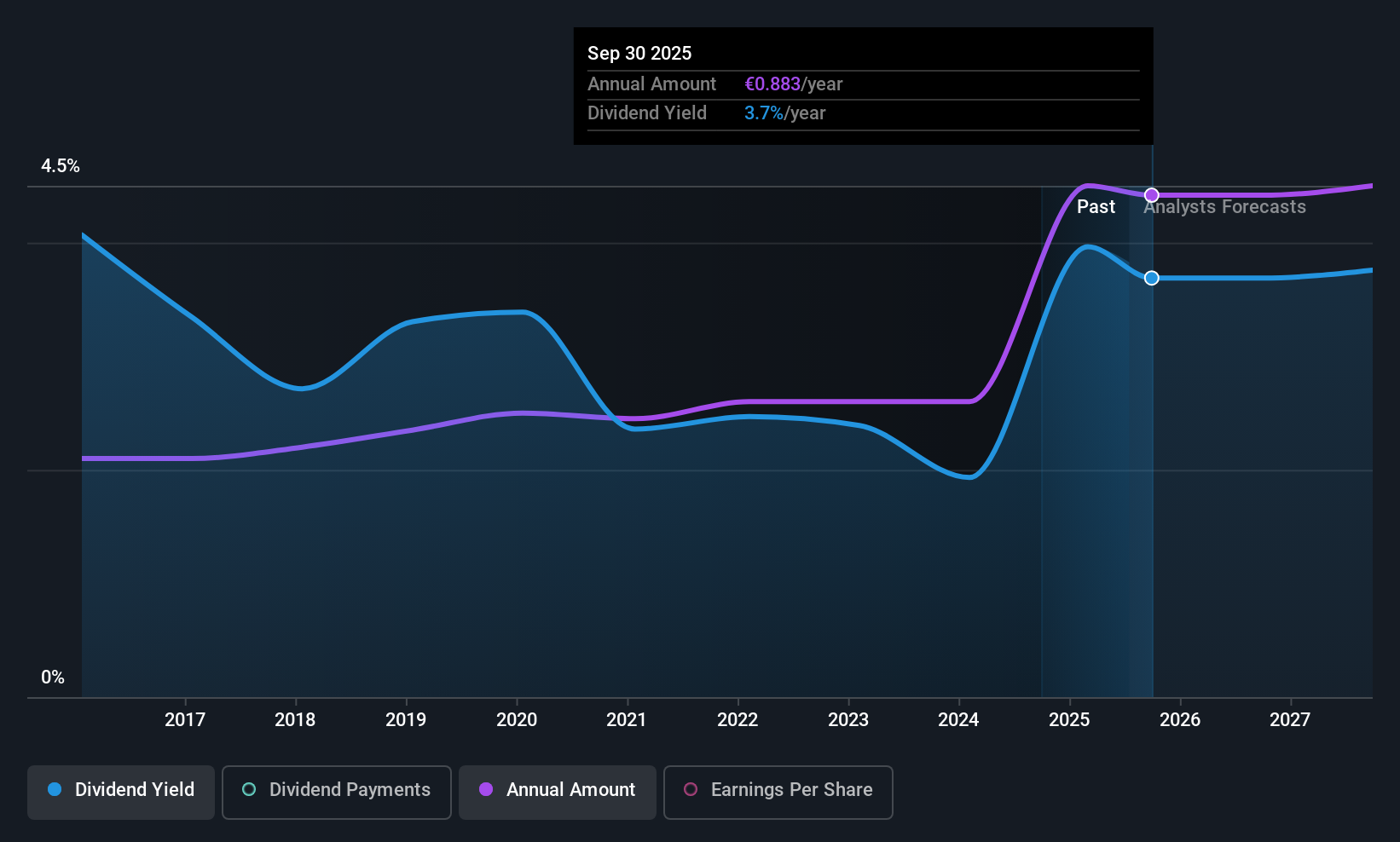

Dividend Yield: 3.8%

EVN AG's dividend payments have been stable and growing over the past decade, with a low payout ratio of 35.4% indicating they are well covered by earnings. However, the dividend yield of 3.78% is below Austria's top tier, and a high cash payout ratio of 112.6% raises concerns about coverage by free cash flows. Recent earnings show sales growth to €2.36 billion for nine months ending June 2025, but net income declined compared to last year.

- Unlock comprehensive insights into our analysis of EVN stock in this dividend report.

- The valuation report we've compiled suggests that EVN's current price could be quite moderate.

Where To Now?

- Explore the 221 names from our Top European Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco BPM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BAMI

Banco BPM

Provides banking and financial products and services to individual, business, and corporate customers in Italy.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives