- Austria

- /

- Telecom Services and Carriers

- /

- WBAG:TKA

Investing in Telekom Austria (VIE:TKA) a year ago would have delivered you a 34% gain

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Telekom Austria AG (VIE:TKA) share price is 28% higher than it was a year ago, much better than the market return of around 7.2% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 15% higher than it was three years ago.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Telekom Austria

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Telekom Austria actually shrank its EPS by 4.8%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

For starters, we suspect the share price has been buoyed by the dividend, which was increased during the year. Income-seeking investors probably helped bid up the stock price.

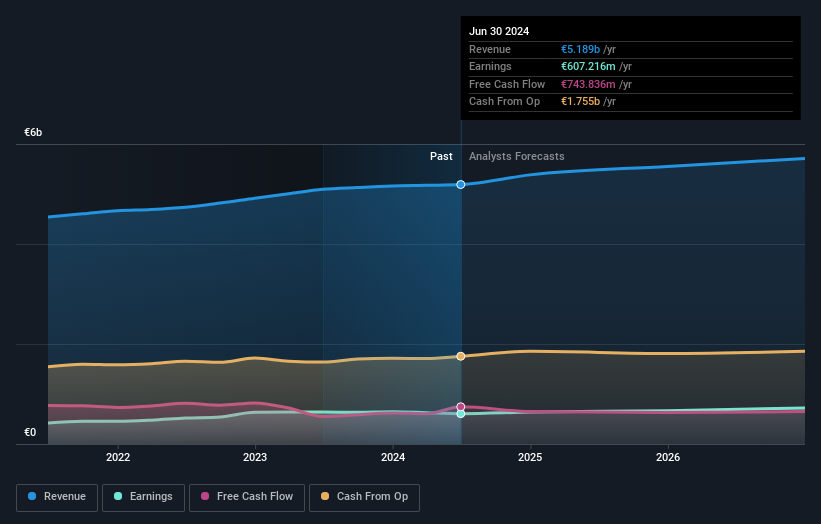

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Telekom Austria's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Telekom Austria's TSR for the last 1 year was 34%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Telekom Austria shareholders have received a total shareholder return of 34% over one year. And that does include the dividend. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Importantly, we haven't analysed Telekom Austria's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Austrian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Telekom Austria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:TKA

Telekom Austria

Provides fixed-line and mobile communications solutions to individuals, commercial and non-commercial organizations, and other national and foreign carriers in Austria, Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Established dividend payer and good value.