Further weakness as Lenzing (VIE:LNZ) drops 3.7% this week, taking three-year losses to 68%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Lenzing Aktiengesellschaft (VIE:LNZ) shareholders. So they might be feeling emotional about the 73% share price collapse, in that time. And over the last year the share price fell 29%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 11% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since Lenzing has shed €46m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Lenzing

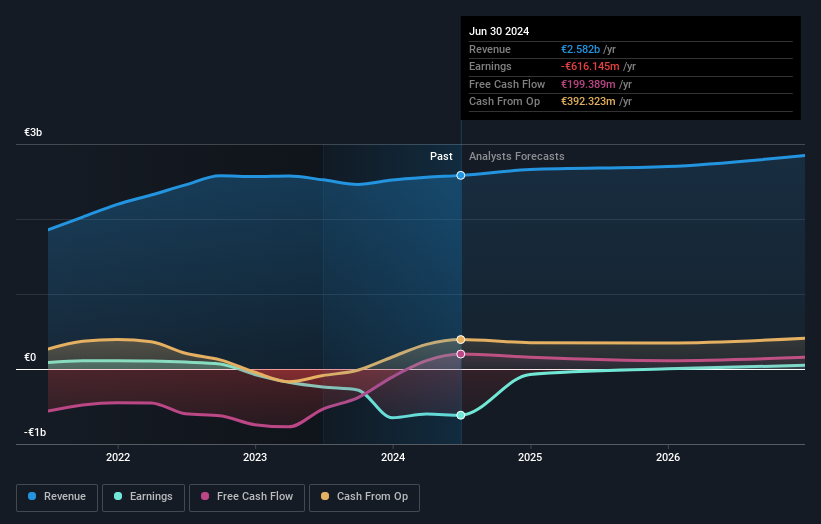

Because Lenzing made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Lenzing saw its revenue grow by 8.1% per year, compound. That's a pretty good rate of top-line growth. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Lenzing stock, you should check out this FREE detailed report on its balance sheet.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Lenzing's TSR over the last 3 years is -68%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Investors in Lenzing had a tough year, with a total loss of 29%, against a market gain of about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Lenzing .

But note: Lenzing may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Austrian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:LNZ

Lenzing

Produces and markets wood-based cellulosic fibers for the textile and nonwoven sectors, and industrial applications.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives