Top Growth Companies With Strong Insider Ownership February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and competitive pressures, particularly in the tech sector, investors are keenly observing how these factors impact corporate earnings and stock performance. In this environment, companies with strong insider ownership can be appealing as they often indicate management's confidence in their long-term growth potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Underneath we present a selection of stocks filtered out by our screen.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A. operates in the media industry both in Spain and internationally through its subsidiaries, with a market capitalization of €356.47 million.

Operations: The company generates revenue from its Education segment, amounting to €456.72 million.

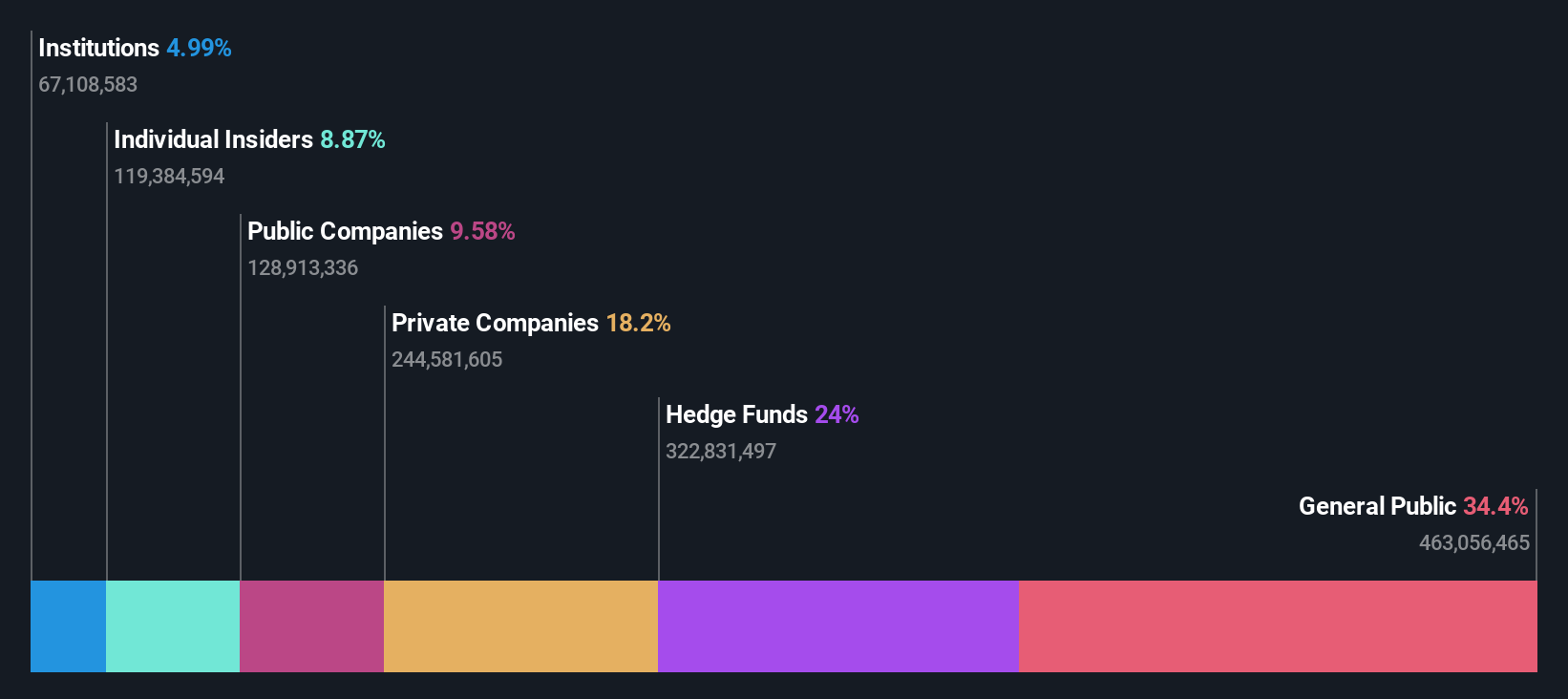

Insider Ownership: 13.3%

Earnings Growth Forecast: 125.9% p.a.

Promotora de Informaciones is trading at a favorable value compared to its peers and industry, with earnings expected to grow significantly at 125.9% annually. The company's revenue is forecasted to increase by 6% per year, outpacing the Spanish market's growth rate of 5.3%. However, shareholders have experienced substantial dilution over the past year, and there's no recent insider trading activity reported for the last three months.

- Get an in-depth perspective on Promotora de Informaciones' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Promotora de Informaciones shares in the market.

Visco Vision (TWSE:6782)

Simply Wall St Growth Rating: ★★★★★☆

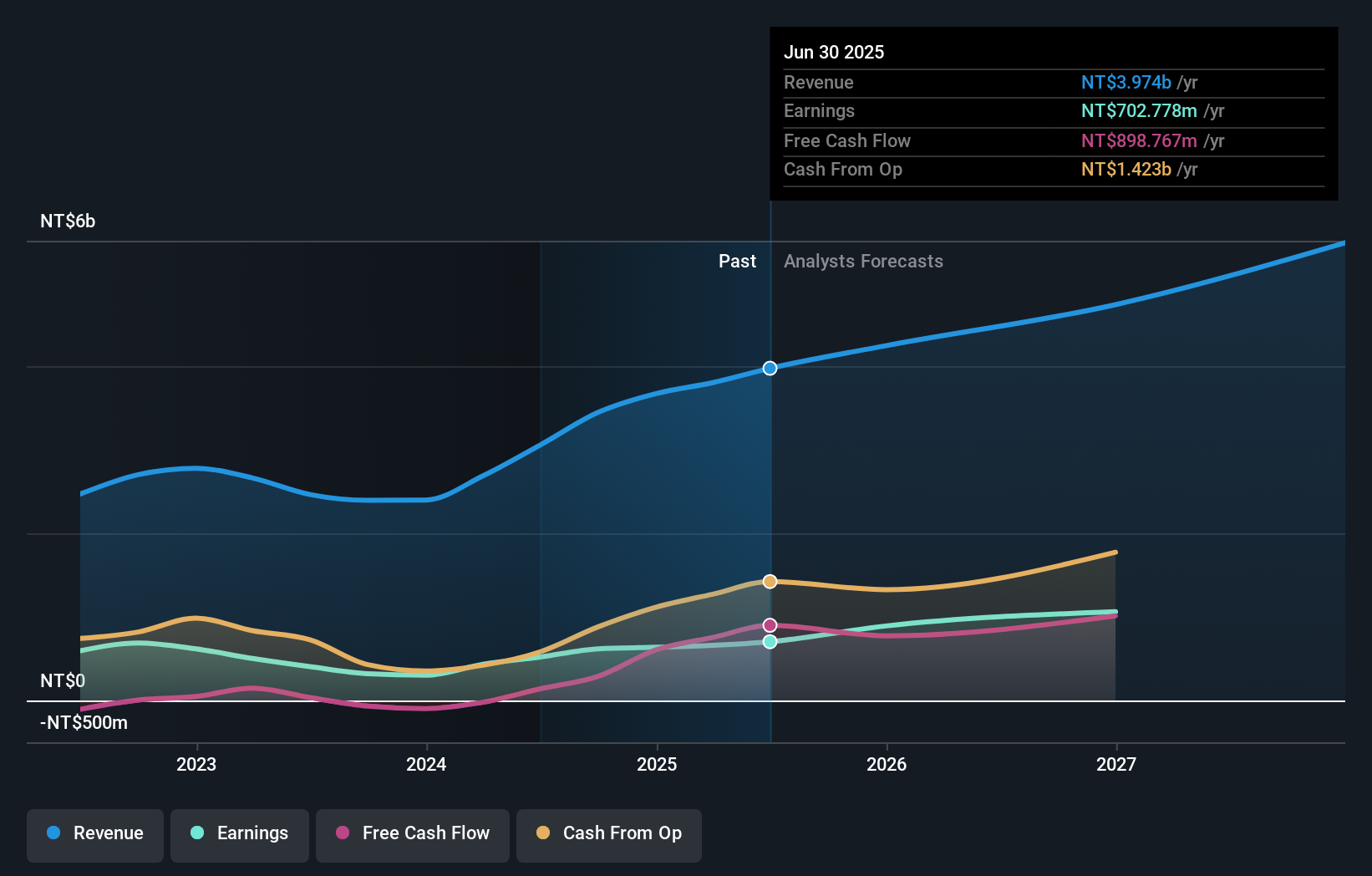

Overview: Visco Vision Inc. manufactures and sells silicone hydrogel contact lenses across Asia, Europe, and the Americas, with a market cap of NT$10.62 billion.

Operations: The company generates revenue from the manufacturing and trading of disposable contact lenses, amounting to NT$3.45 billion.

Insider Ownership: 23.5%

Earnings Growth Forecast: 20.7% p.a.

Visco Vision is trading at a substantial discount to its estimated fair value and is expected to outperform the Taiwan market with earnings growth of 20.7% annually over the next three years. Recent earnings reports show strong performance, with third-quarter sales reaching TWD 1.04 billion, up from TWD 647.57 million a year ago, and net income doubling year-over-year. Analysts anticipate further stock price increases, supported by high forecasted return on equity and revenue growth above market averages.

- Delve into the full analysis future growth report here for a deeper understanding of Visco Vision.

- Our comprehensive valuation report raises the possibility that Visco Vision is priced lower than what may be justified by its financials.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

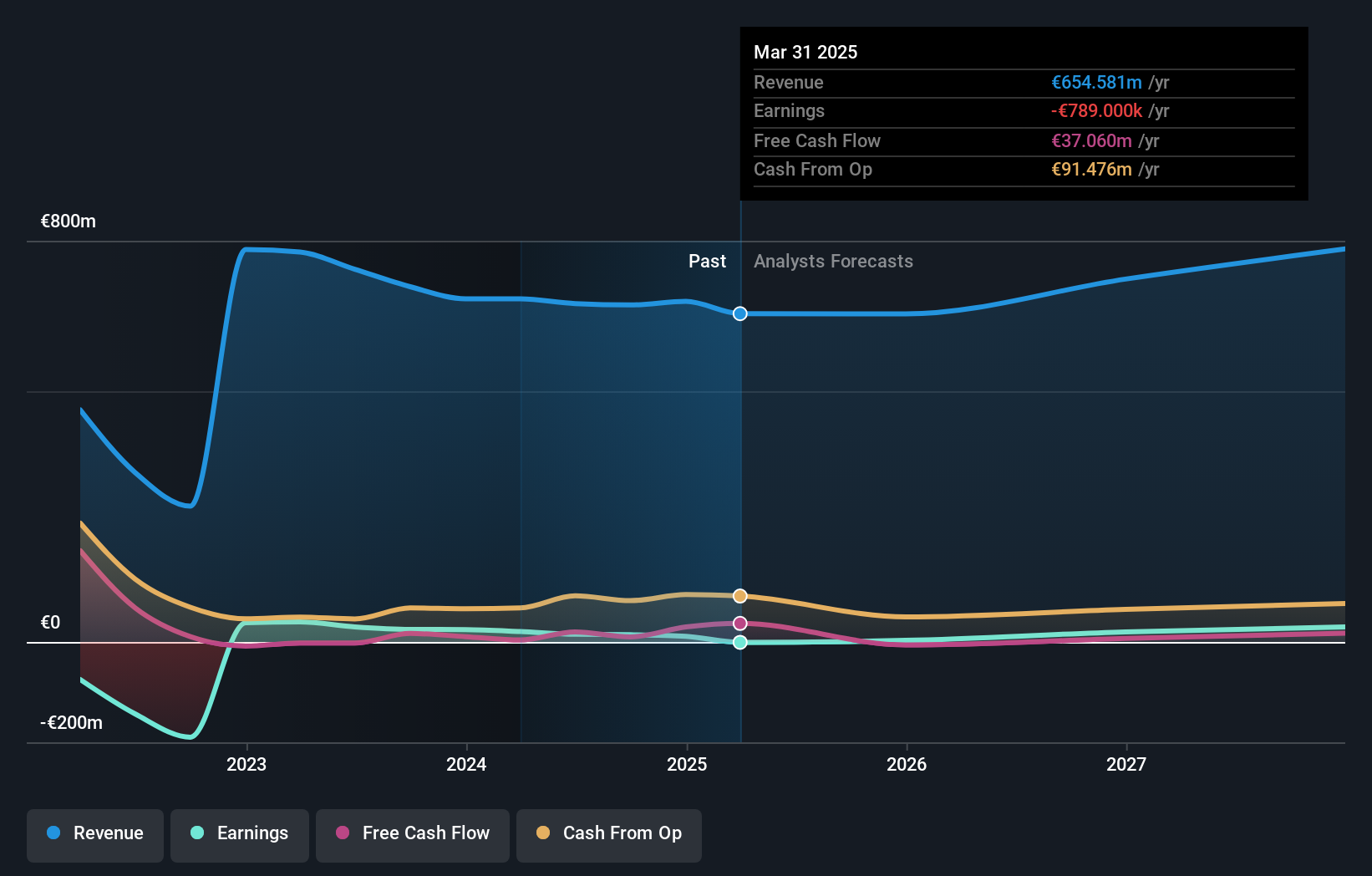

Overview: Semperit Aktiengesellschaft Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €288.03 million.

Operations: The company's revenue segments include €34.32 million from Surgical Operations and €380.82 million from Semperit Engineered Applications, along with €288.16 million generated by Semperit Industrial Applications.

Insider Ownership: 10.1%

Earnings Growth Forecast: 34.7% p.a.

Semperit Holding is trading at a significant discount to its estimated fair value, with earnings projected to grow 34.7% annually over the next three years, outpacing the Austrian market. Despite recent challenges, including a net loss of EUR 2.5 million in Q3 2024 and lower profit margins due to large one-off items, Semperit's revenue growth remains above the market average. However, its dividend sustainability is questionable as it is not well covered by free cash flows.

- Click here to discover the nuances of Semperit Holding with our detailed analytical future growth report.

- The analysis detailed in our Semperit Holding valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1476 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:SEM

Semperit Holding

Develops, produces, and sells rubber products for the medical and industrial sectors worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives